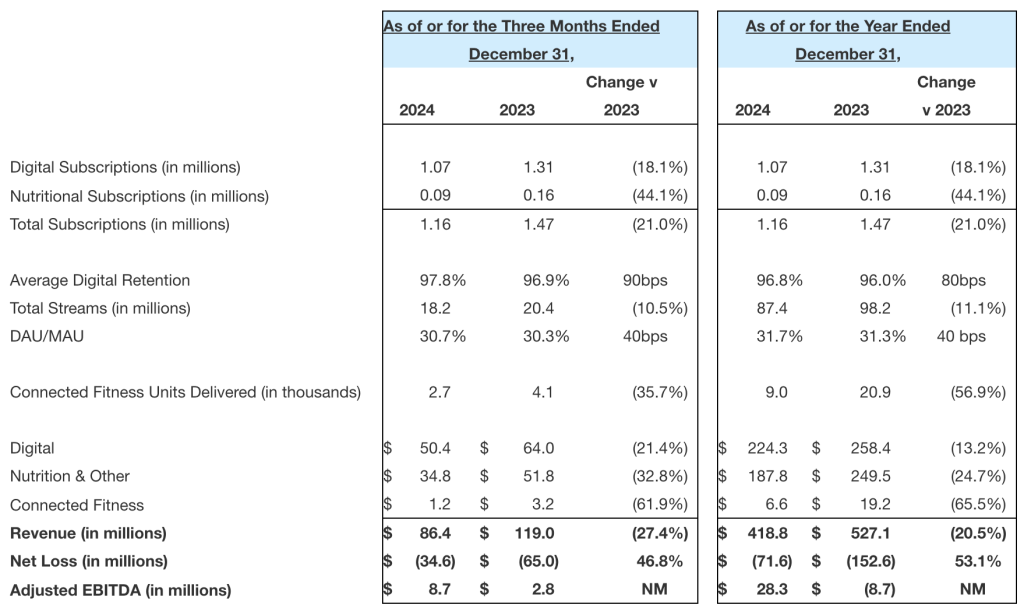

The Beachbody Company, Inc. reported 2024 fourth quarter 2024 total revenue amounted to $86.4 million, compared to $119.0 million in the prior-year Q4 period, and was said to be at the high end of the company’s guidance range.

- Digital revenue was $50.4 million in Q4, compared to $64.0 million in the prior-year Q4 period and digital subscriptions totaled 1.07 million in the fourth quarter.

- Nutrition and Other revenue was $34.8 million in the 2024 fourth quarter, compared to $51.8 million in the prior-year Q4 period. Nutritional subscriptions totaled 0.09 million in the fourth quarter.

- Connected Fitness revenue was $1.2 million in Q4, compared to $3.2 million in the prior-year Q4 period. Approximately 2,700 bikes were delivered in the fourth quarter.

Total operating expenses were $93.8 million in the quarter, which included a $20.0 million impairment of goodwill, compared to $134.3 million in the prior-year Q4 period, which included a $43.1 million impairment of goodwill and intangible assets.

Operating loss decreased by $27.5 million to $32.9 million in Q4, compared to an operating loss of $60.4 million in the prior- fourth quarter.

Net loss for the quarter was $34.6 million, which included a $20.0 million impairment of goodwill, compared to a net loss of $65.0 million in the prior-year Q4 period, which included a $43.1 million impairment of goodwill and intangible assets.

Adjusted EBITDA was $8.7 million in the quarter, compared to $2.8 million in the prior-year Q4 period.

Full Year 2024 Results

(compares full year 2024 to full year 2023)

Total revenue was $418.8 million compared to $527.1 million in 2023.

- Digital revenue was $224.3 million compared to $258.4 million in 2023.

- Nutrition and Other revenue was $187.8 million compared to $249.5 million in 2023.

- Connected Fitness revenue was $6.6 million compared to $19.2 million in 2023. Approximately 9,000 bikes were delivered in 2024.

Total operating expenses were $353.6 million in 2024, which included a $20.0 million impairment of goodwill, compared to $464.1 million in 2023, which included a $43.1 million impairment of goodwill and intangible assets.

Operating loss for the year decreased by $74.8 million to $66.2 million, compared to an operating loss of $141.0 million in 2023.

Net loss was $71.6 million, which included a $20.0 million impairment of goodwill, compared to a net loss of $152.6 million in 2023, which included a $43.1 million impairment of goodwill and intangible assets.

Adjusted EBITDA was $28.3 million compared to a loss of $8.7 million in the prior year.

“2024 was a pivotal year at BODi, as we continued to build upon our strategy to transform the Company. Our turnaround plan successfully streamlined our digital platform, lowering our breakeven point and enhancing our liquidity position,” said Carl Daikeler, co-founder and CEO, The Beachbody Company, Inc. “We generated higher margin revenue streams and achieved positive operating cash flows while successfully rearchitecting the company from a Multi-Level Marketing network to a single level affiliate model. As we move into 2025, we have laid the foundation to execute the next phase of our turnaround which will maximize our market opportunities, and continue to generate positive operating cash flow through our multi-channel strategy and new innovative products.”

Balance Sheet and Cash Management Summary

Cash provided by operating activities for the year ended December 31, 2024 was $2.6 million in 2024, compared to cash used in operating activities of $22.5 million in 2023.

Cash provided by investing activities was $1.1 million in 20024, compared to cash used in investing activities of $10.8 million in 2023.

Free cash flow was negative $2.0 million compared to negative $29.1 million in 2023.

Key Operational and Business Metrics

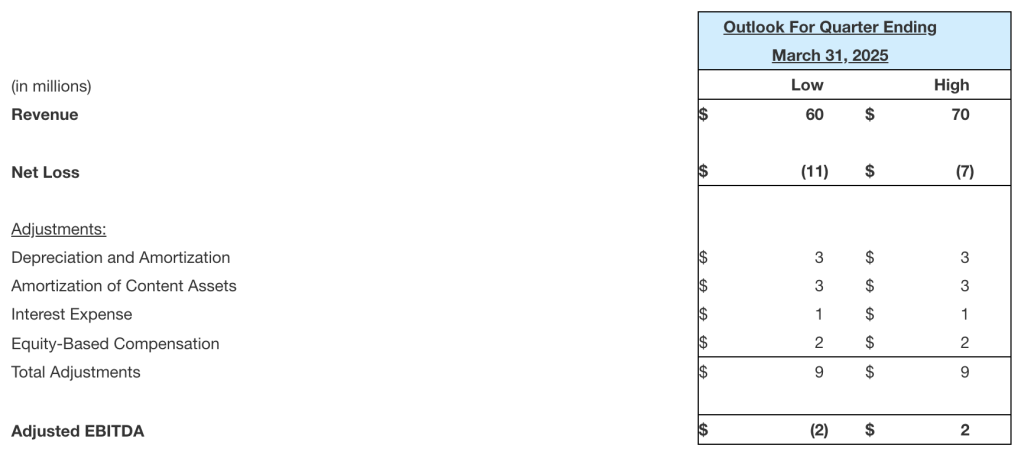

Outlook for the 2025 First Quarter

Image courtesy The Beachbody Company, Inc.