Standard & Poor’s raised the debt ratings of Bass Pro Group LLC. The rating agency said Bass Pro has been resilient through the coronavirus pandemic as it reported positive sales momentum continuing through the third quarter following the initial temporary store closures at the onset of the outbreak.

Standard & Poor’s said it expects the company’s good recent performance to moderate, but anticipates that Bass Pro will use its free operating cash flow to repay debt, which supports its deleveraging expectations.

The issuer credit rating on Bass Pro Group LLC was raised to ‘B+’ from ‘B’. The stable outlook reflects the expectation that Bass Pro’s performance may likely moderate over the next year, amid the uncertain economic climate, and the unclear trends in the sporting industry, which its envisions will lead to reporting adjusted leverage in the low 5x area in 2021.

Rating Analysis

Standard & Poor’s said, “The upgrade reflects Bass Pro’s accelerated deleveraging supported by its good operating performance and expected debt repayment.

“The company saw strong demand for its products amid the COVID-19 pandemic as consumers shifted their purchases toward gear for socially distanced entertainment options and hobbies. Bass Pro’s latest third-quarter and year-to-date 2020 results exceeded our previous expectations as its sales increased by more than 9 percent while its adjusted EBITDA rose by 34 percent on a trailing-12-month basis through the end of September. This performance, in addition to working capital inflows, bolstered the company’s free cash flow, increasing significantly for the first nine months of the year.

“Bass Pro used its cash flow generation, in part, to reduce its leverage. This includes fully redeeming the remaining $284 million of preferred shares that we considered debt in our adjusted credit metrics and paying down the outstanding borrowings under its asset-based lending (ABL) revolver. In addition, the company maintained significant balance sheet cash after the debt redemption, which led to a further improvement in its S&P-adjusted credit protection metrics relative to our prior estimates. Incorporating its improved operations and debt reduction, we project Bass Pro will have adjusted leverage in the mid-4x area in 2020, which compares with the 6.2x area as of year-end 2019.

“We estimate the company’s adjusted leverage metrics will weaken somewhat to the low 5x area due to normalization in its demand trends and operating results in 2021.

“In our opinion, Bass Pro’s recent performance trends not only benefited from its market position as a destination-oriented retailer but also from pull-forward demand in many of its product verticals. This includes higher consumer spending on outdoor products, sporting goods, and firearms this year. However, we expect these product categories to experience lower demand levels in 2021 and project that the company’s sales and profitability may moderate. We believe the normalization in its demand will cause Bass Pro’s sales to decline by the low-single-digit percent area while its adjusted EBIDTA contracts by about 10 percent in 2021 relative to 2020. That said, we expect the company’s leverage to remain in the low-5x area in fiscal year 2021, which is commensurate with our expectations for a ‘B+’ rating. We view these projections as being toward the stronger end of the range for our financial risk profile assessment. The company’s planned deleveraging, in combination with the recent performance trends supported by its leading market position, led us to revise our comparable rating analysis modifier on Bass Pro to neutral from negative.

“Bass Pro Group will maintain its leading market position in the highly competitive sporting goods and outdoor recreation market.

“The company’s profitability has historically benefitted from its good penetration of private-label brands and its fast-growing, vertically integrated recreational boat business. We believe Bass Pro’s large destination store format (which we view as being less concerning for its customers than the smaller locations operated by its peers), compelling in-store experiences, and recently enhanced e-commerce platform will support its results despite the shift in consumer shopping behaviors due to the pandemic. We believe this position provides it with good insulation against online competitors that cannot replicate the same experience without material investments. In addition, the company generates a sizable proportion of its revenue from products and services that are not easily replicable or not typically sold online. These include boats, firearms and ammunition, lodging and outdoor excursions, and personal vehicles, in addition to the company’s private-label brands.”

Stable Outlook

Standard & Poor’s said its stable outlook reflects its expectation that its performance may likely moderate over the next year amid the uncertain economic climate and the unclear trends in the sporting industry, which its envisions will lead to reporting adjusted leverage in the low 5x area in 2021.

“We could raise our rating on Bass Pro if it sustains its good operating performance through 2021 underscored by continued operational improvements in a post-pandemic environment. We believe this could occur if we expect it to sustain positive comparable sales and EBITDA margins in the high-teens percent area over the coming 12 months. Under this scenario, we would also expect Bass Pro to sustain adjusted leverage of less than 5x supported by its financial policy.

“We could lower the rating on Bass Pro if we expect its operating performance to become more volatile in 2021, potentially due to materially reduced demand for sporting goods and increased promotional activity because of heightened competition. This scenario would likely lead to a significant contraction in the company’s sales and adjusted margins such that we expect it to sustain leverage in the 6x area or above. This could also occur if Bass Pro adopts a more aggressive financial policy that leads to a higher outstanding debt balance than we currently assume.”

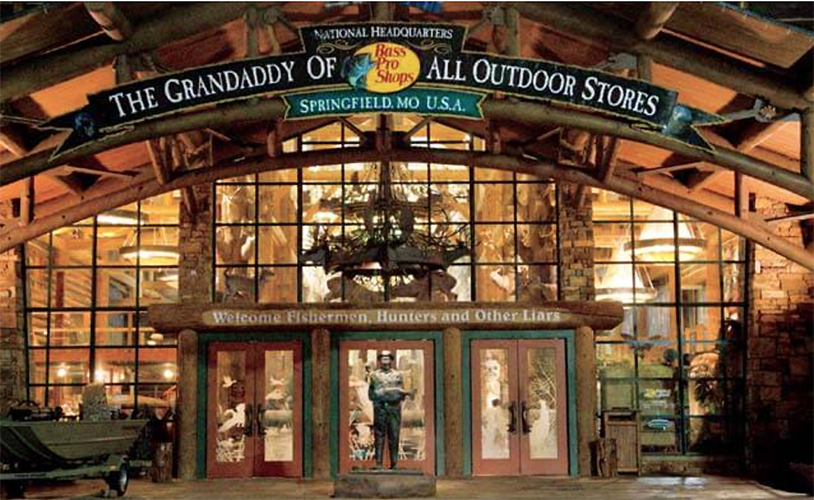

Photo courtesy Bass Pro