Authentic Brands Group Inc., officially withdrew its plans for an initial public offering, according to a regulatory filing with the Securities & Exchange Commission. The cancellation of the IPO was expected given its move in November to sell significant equity stakes in the company to private equity firms CVC Capital Partners and HPS Investment Partners.

The transaction values the company at $12.7 billion in enterprise value. At the time, Authentic Brands CEO Jamie Salter said the company would target an IPO date in 2023 or 2024.

The company had filed for an IPO in early July and was reportedly seeking a valuation of about $10 billion.

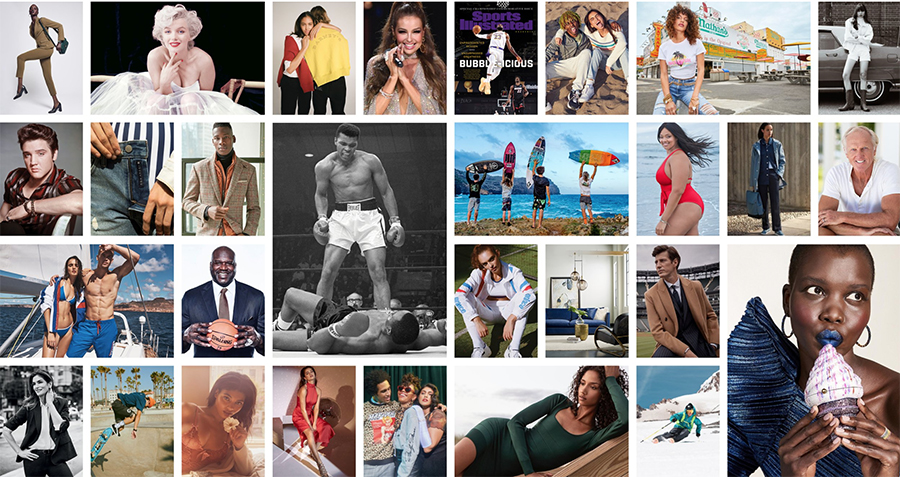

Founded in 2010, ABG’s portfolio has grown to more than 30 brands that are diversified across the fashion, luxury, outdoor, home, entertainment, events, media and fine arts sectors. In the active lifestyle space, brands include Eddie Bauer, Izod, Greg Norman, Spyder, Tretorn, Tapout, Prince, Volcom, Airwalk, and Vision Street Wear. It expects to close on its acquisition of Reebok in early 2022. Other high-profile properties include Brooks Brothers, Barneys New York, Juicy Couture, Vince Camuto, Van Heusen, Sports Illustrated, and Forever 21.

Photo courtesy Authentic Brands Group