The 2024 Spring U.S. Footwear Consumer Survey, a collaborative effort by AlixPartners and the Footwear Distributors & Retailers of America (FDRA), showed significant trends in the U.S. footwear consumer market. The survey highlighted that athletic footwear is set to lead in purchasing growth this spring and summer, with consumers most often making purchases during promotional events when their preferred brand is available at a discounted price. However, the study also found that inflation and economic pressures are beginning to impact consumer behavior.

“While consumers report buying shoes more frequently, they want them at a lower price-point; 42 percent of respondents are more likely this year to search for coupons or wait for a sale over last year,” the company wrote in a release regarding the study.

“We expect flat growth in the footwear segment heading into spring and summer 2024,” said Bryan Eshelman, partner and managing director at AlixPartners. “It’s clear from the footwear consumer—specifically in the athletic/athleisure segment—that brands matter more than ever. The challenge for companies in those categories is scaling their direct-to-consumer operations profitably.”

Matt Priest, president and CEO of FDRA, said the report offers a crucial real-time consumer snapshot that shows inflation continues to impact behavior.

“I speak daily with shoe executives who are working to transform their merchandising strategies to address rapidly changing consumer demand,” Priest said in the release. “We are seeing tighter margins across the industry than we have in some time—this is my main concern for our members coming out of this report. Furthermore, the footwear industry has worked to reduce inventory in the market and reduce new stock across categories, but have we reduced it enough? This report will certainly provide some excellent insights to strengthen sales strategies and inventory management.”

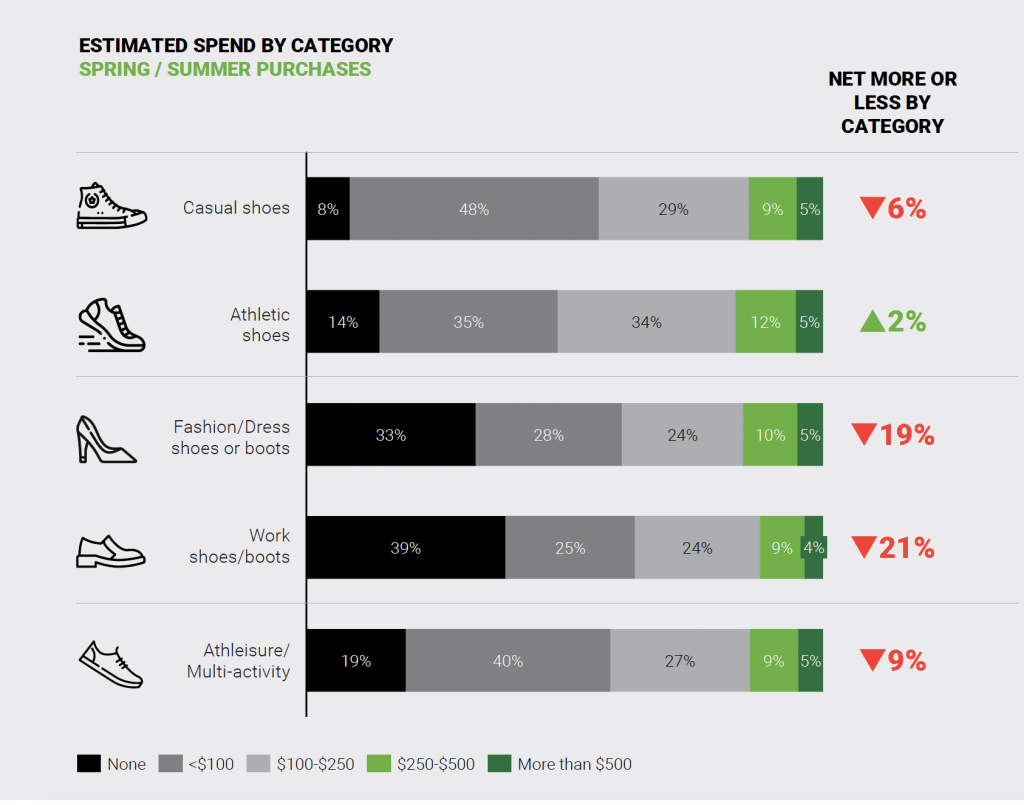

The report said that athletic shoes were the bright spot, with respondents expecting to spend two percent more on the segment than last year; fashion and work shoes saw projected declines of 19 percent and 21 percent, respectively. Brand preference stands out in the athletic segment, with 61 percent of respondents planning to shop for athletic shoes this spring and summer in branded online stores and 57 percent in branded brick-and-mortar, against 49 percent and 40 percent for nonathletic shoes in the same respective venues.

Retailers Miss Opportunities

Brand is the third most important driver of purchases, and it showed salience, especially for athletic footwear purchases, according to the survey. At the same time, the second top reason for purchase abandonment is size out of stocks.

The report indicated that more than one-quarter of respondents said they were more likely to buy less expensive brands in 2024 compared to purchasing preferences last year; however, when asked whether seeing a similar model or dupe on sale would drive a purchase, only 7 percent agreed. The report said that customer wallets are constrained, but shoppers still want the real thing.

“Even though cost and availability are barriers to purchases, we are not seeing consumers trade down to cheaper options,” said Raj Konanahalli, partner and managing director at AlixPartners. “Rather, we see signs that they would rather find ways to purchase the brand they want—whether through sales or coupons.”

Room for AI to Optimize Inventory

According to the study, being able to try on the right size and shoe type in-store is a driver for 76 percent of respondents, and 65 percent shop in-store to purchase an item that they want immediately. More than 70 percent of respondents indicated they intend to buy additional items simultaneously with their footwear purchase. According to the study data, both these trends are undercut by the prevalence of sizes being out of stock, the second-top reason respondents abandon purchases.

“New AI capabilities can help companies optimize inventory levels at individual stores as well as across stores and in the e-commerce portal. Smart use of AI can reduce out-of-stock moments and limit excess inventory across sizes. Investments to improve forecasting, planning, and allocation processes will pay off more than ever through direct demand capture,” the company said in its release.

“The importance of having the right size, in the right store, in stock is old news, but with customers making store trips less frequently with larger baskets, the impacts of not being in stock have increased,” added Ryan Poole, partner at AlixPartners. “Also, AI advancements in the last year have changed the game for planning and allocation, making it an investment worth scrutinizing.”

Packaging A Waster Expense

Over one-half of consumers think that a box, dust jacket, or extra laces are not important items, with little to no impact on purchasing decisions. According to the survey, most consumers don’t look for sustainability when purchasing shoes, but a growing number are willing to pay more for sustainability; 22 percent of respondents said they would not consider a brand or retailer that ignores sustainability.

“Reassessing packaging could be coupled with sustainability initiatives to both reduce costs and create goodwill with consumers,” advised Mitchell Collens, director at AlixPartners.

The online survey of over 1,000 people aged 15 and up assessed the purchasing decisions of consumers this Spring into Summer. The

The FDRA represents 95 percent of the footwear industry, working from footwear design to retail to help the industry evolve and advocate for policies that grow the sector. AlixPartners advises footwear manufacturers and retailers on digital-first retail strategies across the value chain.

Go here to read the full 2024 Spring U.S. Footwear Consumer Survey.

Image courtesy Foot Locker, Data and charts AlixPartners and the FDRA