Amer Sports reported operating earnings before charges rose 14 percent in the first quarter as higher gross margins and robust profitability gains in the company’s Outdoor segment helped offset currency headwinds.

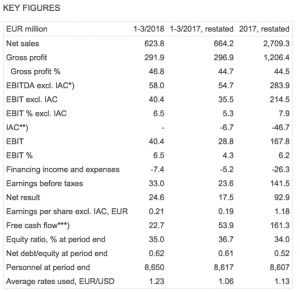

Sales in the quarter were down 6.1 percent to €623.8 million but grew 1 percent on a currency-neutral basis.

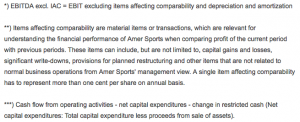

EBIT increased to €40.4 million from €28.8 million. EBIT excluding non-recurring items expanded 13.8 percent to €40.4 million from €35.5 million.

Gross margin grew to 46.8 percent from 44.7 percent, driven by improvement in channel mix and higher share of full-price sales. Net earnings rose 40.5 percent to €24.6 million from €17.5 million a year ago.

Among the company’s major segments, Outdoor sales declined 3 percent to €381.2 million but grew 2 percent on a currency-neutral basis. EBIT in the Outdoor segment grew 26 percent to €33.7 million.

In the Ball Sports segment, sales were down 11 percent to €164.2 million and off 1 percent on a currency-neutral basis. EBIT was down 6 percent to €14.9 million.

Fitness segment revenues were down 7 percent to €78.4 million while expanding 4 percent on a currency-neutral basis. EBIT reached €100,000, down from €700,000 a year ago.

Outlook For 2018

In 2018, Amer Sports’ net sales in local currencies as well as EBIT excl. IAC are expected to increase from 2017. Due to ongoing wholesale market uncertainties, the quarterly growth and improvement are expected to be uneven. The company will prioritize sustainable, profitable growth, focusing on the company’s five strategic priorities (Apparel and Footwear, Direct to Consumer, China, US, and Connected Devices and Services) whilst continuing the company’s consumer-led transformation.

Heikka Takala, president and CEO, said, “In the first quarter, we delivered solid progress across our strategic transformation areas with ongoing acceleration in Direct to Consumer, modern sales channels and China. Following a year of significant transformation and restructuring, our focus in the quarter was on solidifying our margins through more attractive mix, higher quality distribution through sharper segmentation and reduced number of doors and reduction of promotional sales, especially in Footwear. As result, our margins and profit improved, and we can now focus on driving a more sustainable topline with a good pipeline of initiatives.

“The market continues to evolve rapidly, and we are embracing the changes proactively and with encouraging results. Whilst we make good progress and continue to accelerate in most areas, we also have more work to do to address the remaining areas of underperformance. As always, we maintain a long-term view guided by our sustainable growth model.”

The full report is here.

Amer Sports’ brands include Salomon, Wilson, Atomic, Arc’teryx, Mavic, Suunto and Precor.