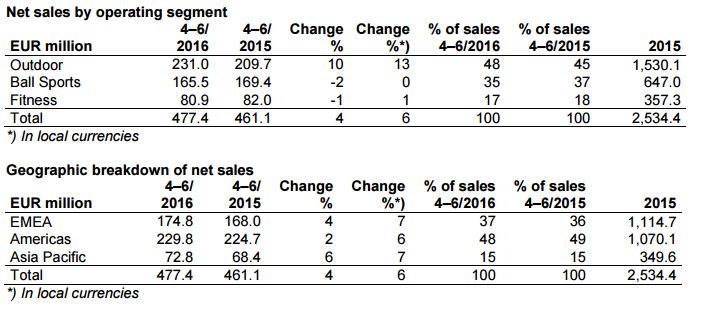

Double-digit growth at Amer Sports flagship Outdoor segment easily offset low-single-digit declines at its Ball Sports and Fitness segments in the second quarter.

The Finnish company reported net sales reached €477.4 million in the second quarter ended June 30, up 4 percent from the year earlier quarter, or 6 percent in currency-neutral (c-n) terms. Organic growth was 5 percent, led by footwear and apparel sales.

Gross margin increased 60 basis points to 44.7 percent compared with the second quarter of 2015.

Loss before income taxes increased to -€12.1 million, or -€9.0 excluding “items affecting comparability”, or IAC, which can include, but are not limited to, capital gains and losses, significant write-downs, provisions for planned restructuring and other items that are not related to normal business operations from Amer Sports’ management view. A single item affecting comparability has to represent more than one cent per share on annual basis. Earnings per share -€0.13 (-€0.11 excluding IAC).

The company’s free cash flow deteriorated to -€54.3 million from -€11.5 million due to seasonal fluctuation.

Amer Sports affirmed its outlook for 2016. Despite challenging market conditions, including the liquidation of several U.S. sporting goods chains, the company still expects net sales to increase and for EBIT margin, excluding IAC, to improve from 2015 in currency-neutral terms.

Amer Sports will focus on growing the core business and accelerating in five prioritized areas: Apparel and Footwear, US, China, Business to Consumer, and digitally connected devices and services.

“The second quarter is traditionally our smallest; however we delivered a solid 6% growth despite short-term adverse business impact due to US customer disruptions, which especially impacted Ball Sports,” noted Amer Sports President and CEO Heikki Takala. “During the quarter we executed a significant distribution center expansion in both the U.S. and EMEA, and moved Arc’teryx into a larger production facility in Canada. These changes added short-term CAPEX and OPEX; however they support our mid/long-term growth.

“Our outlook for the year remains positive, supported by robust pre-orders in most businesses, with the exception of Winter Sports Equipment where we expect a modest decline following the challenging previous winters,” Takala stated. “Our initiative pipeline for the Fall/Winter season is stronger than ever with strong joint business plans with our retail partners, continuous B2C expansion and a robust innovation rollout across the brands.”