Adidas Group had a solid first quarter at its adidas and TalyorMade-adidas Group divisions, but experienced continued declines in the Reebok business. Both the adidas and Reebok segments got a boost from an increase in the owned-retail business and the company appears to be relying on expanding growth in that area for gross margin improvements and revenue gains for the balance of the year and into 2009.

and TalyorMade-adidas Group divisions, but experienced continued declines in the Reebok business. Both the adidas and Reebok segments got a boost from an increase in the owned-retail business and the company appears to be relying on expanding growth in that area for gross margin improvements and revenue gains for the balance of the year and into 2009.

That plan, accompanied with the expectation that most of the growth will come out emerging markets in Europe, Asia and

One area of the current business that is expected to show some gains this year is in the

Owned-retail again played a big role in the increase, growing 22.0% (+31% currency-neutral) for the period to 310 million, or 16% of adidas brand revenues, from 254 million, or 14% of brand revenues, in the year-ago period. The owned-retail increase was again driven by double-digit comparable store sales increases as well as the addition of new stores. Brand adidas revenues would have increased 5.9% in euro terms excluding the owned-retail business, which would be compared to the 0.8% dip in the first quarter last year.

Sport Performance category sales more than  doubled from the year-ago high-single-digit growth rate, posting a 19% increase in currency-neutral terms, driven by double-digit growth in footwear, apparel and equipment, with particular strength in football (soccer), running and training. In euro terms, Sport Performance sales were up 13% to 1.57 billion ($2.35 bn) in the quarter, compared to 1.39 billion ($1.82 bn) in the year-ago period. adidas Sport Style revenues were down 9% for the quarter to 385 million ($577 mm) from 421 million ($552 mm) in Q1 last year. Originals sales declined, but Fashion sales increased for the quarter. Currency-neutral sales were down roughly 4% for the period.

doubled from the year-ago high-single-digit growth rate, posting a 19% increase in currency-neutral terms, driven by double-digit growth in footwear, apparel and equipment, with particular strength in football (soccer), running and training. In euro terms, Sport Performance sales were up 13% to 1.57 billion ($2.35 bn) in the quarter, compared to 1.39 billion ($1.82 bn) in the year-ago period. adidas Sport Style revenues were down 9% for the quarter to 385 million ($577 mm) from 421 million ($552 mm) in Q1 last year. Originals sales declined, but Fashion sales increased for the quarter. Currency-neutral sales were down roughly 4% for the period.

On a regional basis, brand adidas currency-neutral sales increased “strongly” in all regions except

The European football championship had an impact on backlog, but it was only three percentage points in

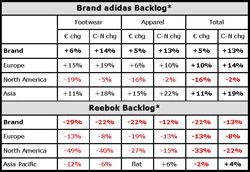

Based on current backlog figures (see chart below), and continued growth with owned-retail, brand adidas expects to see currency-neutral sales increase in the high-single-digits for the full year. Reebok segment revenues decreased 6% on a currency-neutral basis, driven by double-digit declines in the

Sales in Europe declined 7% on a currency-neutral basis, due to declines in the

Owned-retail revenues partly offset the sharper declines in the wholesale business, with retail posting a 16% increase for the quarter on a currency-neutral basis. In U.S. dollar terms, owned-retail grew 19% to $106 million, reflecting an increase in store openings, and represented 16% of Reebok segment sales in the first quarter, compared to 13% in the year-ago period. Excluding owned-retail, Reebok segment sales were down 4% in U.S. dollar terms to $574 million (383 mm). Reebok brand sales were $562 million (375 mm) for the quarter, representing a 4% decrease on a currency-neutral basis, or a 0.4% increase when measured in U.S. dollars. Rockport brand revenues decreased 6% to $85 million (57 mm) for the quarter versus $90 million (57 mm) in the year-ago period, representing an 8% decline in currency-neutral terms. The decline reflects a tough business in department stores and the mall, as well as a weaker

Reebok-CCM Hockey, which includes the Reebok Hockey, CCM, JOFA, and KOHO brands, tumbled 10% in U.S. dollar terms to $22 million (206 mm) in Q1 from $37 million (28 mm) in Q1 last year, reflecting a 20% decrease on a currency-neutral basis. Management said that sales decreased here for the quarter due to a shift in product launch and delivery schedules. Reebok segment gross margins were up 30 basis points for the period to 37.1% of sales, due primarily to double-digit growth at the owned-retail business and an “improving product mix” and retail mix during the quarter. Based on the Reebok brand backlog (see below), Reebok segment sales are forecast to grow in the mid- to high-single-digits for the full year, up from previous estimates, due to a new joint venture in Brazil and Paraguay. Sales are expected to increase at Reebok, Reebok-CCM Hockey and Rockport.

The rosier picture for Reebok was based on what management described as “positive retailer and trade show feedback, especially in emerging markets.” In