The adidas Group saw a fairly healthy improvement in the brand adidas business in the second quarter offset by declines in the Reebok and TaylorMade-adidas Golf businesses. The growth at brand adidas, especially in the Europe region, was particularly important as it came in a period that had to anniversary against strong numbers last year during the FIFA World Cup held in Germany when adidas posted a 13% increase in sales. Still, the business was hampered by a weak mall retail environment in the U.S.. Group management took rather aggressive steps in response to the promotional environment in the mall and will see business decline further there as a result.

The companys full-year guidance for Reebok to produce low-single-digit currency-neutral sales growth “remains unchanged.”

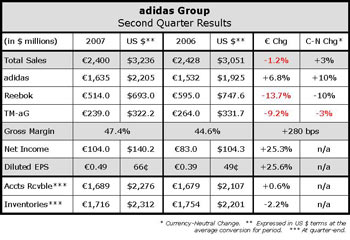

Currency fluctuations had a negative impact on overall Group reported revenues. In Euro terms, Group sales decreased 1.6% to 2.40 billion ($3.2 bn) in Q2 from 2.43 billion ($3.06 bn) in 2006. Currency-neutral sales were up 3% for the period (see chart page 2).

A strong double-digit increase in the bottom line can be traced to growth in the gross margin, which improved 280 basis points to 47.4% of sales, compared to 44.6% of sales in Q2 last year.

Management attributed the improvement to “integration-driven cost synergies” that reduced cost of sales at both adidas and Reebok, as well as underlying improvements in the Reebok segment. The non-recurrence of negative impacts from purchase price allocation in the Reebok segment also positively impacted gross margins for the division.

Operating profit grew 9.1% to 188 million ($254 mm) versus 173 million ($217 mm) in Q2 2006. Net income increased 26.9% to 104 million ($140 mm), or 0.49 (67 cents) per diluted share, compared to 82 million ($103 mm), or 0.39 (49 cents) per diluted share, in the year-ago period.

From a regional standpoint, total second quarter Group sales increased in all regions except North America, which was heavily impacted by a tough retail environment in the mall, as well as a decrease in the golf business.

Group revenues in Europe increased 3.3% to 967 million ($1.30 bn) in Q2 versus 936 million ($1.18 bn) in the year-ago period, with both brand adidas and TM-aG contributing to the gains in the region. Excluding the Reebok decline, EMEA sales, which also include the Middle East and Africa, would have increased 6.0% for the period. North America sales declined 12.5% to 730 million ($984 mm) in the second quarter from 834 million ($1.05 bn) in Q2 last year, and were down 6% when measured in U.S. Dollars. The Group saw Asia/Pacific sales increase 9.2% in Euro terms to 535 million ($721 mm) from 490 million ($616 mm) in Q2 last year. Latin America sales increased 32.2% to 152 million ($205 mm) versus 115 million ($145 mm) in the year-ago period.

For the second quarter, brand adidas sales increased 6.7% to 1.64 billion from 1.53 billion in Q2 2006. Brand adidas sales in Europe increased 5.6% to 786 million ($1.06 bn) from 744 million ($935 mm) in the year-ago period. Sales in North America were down 3.2% to 306 million ($413 mm) from 316 million ($397 mm) in Q2 2006, and increased approximately 3.9% when measured in U.S. dollars. Asia/Pacific sales grew 9.8% to 405 million ($546 mm) from 369 million ($464 mm) in Q2 last year. Latin America sales were up 36.7% for the quarter to 134 million ($181 mm) from 98 million ($123 mm) in the year-ago period.

The Sport Performance business continues to carry the torch for the adidas brand, growing 12.2% in Q2 to 1.31 billion ($1.78 bn) from to 1.17 billion ($1.47 bn) in the year-ago period.

Management said that first half growth for the adidas Sport Performance business was driven by all major categories except football (soccer), with “particularly strong” increases in running and training. Hainer said running was up 30% for the quarter.

The Sport Style business, which now also includes the former Sport Heritage business, posted a 10.2% decrease in sales to 318 million ($429 mm) from 354 million ($445 mm) in the year-ago period. The decline is somewhat surprising given the strength of the lifestyle fashion athletic business in the U.S. and elsewhere. Management said a decrease in the Originals business could not be offset by “strong increases” in Y-3 sales.

Owned-Retail sales for brand adidas were up 18.8% in Euro terms to 257 million ($410 mm) from 257 million ($323 mm) in the year-ago period. Excluding Owned-Retail, brand adidas sales increased 4.4% to 1.33 billion ($1.79 bn) in the second quarter.

Brand adidas operating profit jumped 41.5% for the period to 191 million ($258 mm), compared to 135 million ($166 mm) in the year-ago period. Gross margin dipped 20 basis points to 46.1% of sales.

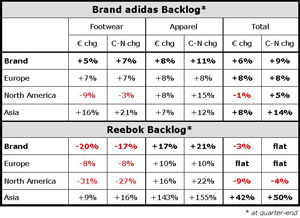

Based on the 9% currency-neutral increase in brand adidas backlogs at quarter-end, management expects the brand to post a mid-single-digit increase in revenues for the year on a currency-neutral basis.

Reebok division revenues were down approximately 7.3% to $693 million from $748 million in the year-ago period when measured in U.S. Dollar terms. In Euros, the division declined 13.6% in the second quarter to 514 million from 595 million in Q2 last year.

A double-digit decline in Reebok brand sales and a small decline in the Reebok/CCM Hockey business offset good growth at Rockport in the second quarter. Reebok brand sales were down 10.5% in U.S. Dollar terms for the period to $537 million from $599 million in the year-ago period. The numbers include both footwear and apparel, which was supported by a sharp increase in revenues from the licensed apparel group. The gains in licensed apparel were apparently driven by stronger NFL and NHL sales. The Rockport business was up 8.9% in U.S. Dollar terms to $94 million for the quarter, compared to $87 million in Q2 last year.

For the Rbk/CCM business, which also includes Koho and JOFA, sales dipped roughly 1% to $62 million, a decline management attributed to the lack of new product launches in the first half.

Gross margins for the Reebok business jumped 710 basis points to 39.1% of sales, thanks in part to sourcing and production savings, but also primarily due to the non-recurrence of the purchase price allocation included in last years numbers.

Management suggested that the Foot Locker pull-back on forward orders represents roughly half of the 27% currency-neutral backlog decline for Reebok footwear. They also cited a reduction in entry-level product being sold into the family footwear channel and a tough market overall for the sharp backlog decline.

Reebok pared its second quarter operating loss by more than 73% to $1.3 million, compared to $5.0 million last year.

TaylorMade-adidas Golf revenues declined 2.9% in U.S. Dollar terms to $322 million (239 mm) in the second quarter, compared to $332 million (264 mm) in the 2006 second quarter. Currency-neutral sales growth was pegged at negative 3% for the period. The first half was impacted by the divesture of the Greg Norman Collection business. Management indicated that currency-neutral sales would have been up 5% for the first half, compared to the reported 3% decrease. Strong double-digit gains at adidas Golf footwear and apparel were cited as the drivers for the gains.

Due in large part to the GNC impact, TM-aG sales in the North America region declined 16% for the second quarter to $185 million from $220 million in Q2 last year, and saw a 22% decrease when measured in Euros. Asia/Pacific sales increased 25% in U.S. dollar terms to $96 million from $77 million in the year-ago period. In Europe, TM-aG sales jumped 19.2% in U.S dollar terms to roughly $40 million (30 mm) from $34 million (27 mm) in the year-ago period.

Gross margins for TM-aG in the second quarter were down 40 basis points to 44.7% of sales due primarily to the divesture of the GNC business. Operating profit for the quarter was down roughly 12% to $36 million (27 mm) from $42 million (33 mm) in Q2 last year.