Adidas Group reported a 10 percent gain in third-quarter profit that beat analysts’ estimates, led by sales growth in Western Europe and China. In North America, sales rose 6 percent in the quarter, improving from a flat first half. The results prompted the company to aggressively lift its earnings guidance for the full year. Golf revenues also staged a recovery in the third quarter although plans

were revealed to cut staff at TaylorMade by 14 percent.

Major developments in Q3 2015

- Group sales momentum accelerates, with currency-neutral revenues up 13 percent

- Double-digit growth for Adidas in Western Europe, North America, Greater China, Latin America and MEAA

- Currency-neutral revenues at Reebok and TaylorMade-Adidas Golf up 3 percent and 6 percent, respectively

- Gross margin increases 1.0pp to 48.4 percent

- Operating margin up 0.7pp to 10.6 percent

- Net income from continuing operations grows 20 percent to €337 million

Major developments in the first nine months of 2015

- Group sales increase 9 percent on a currency-neutral basis

- Strong growth at Adidas and Reebok with currency-neutral sales up 11 percent and 6 percent, respectively

- Operating margin excluding goodwill impairment increases 0.2pp to 8.6 percent

- Net income from continuing operations excluding goodwill impairment increases 17 percent to €737 million

Adidas Group currency-neutral sales increase 13 percent in the third quarter of 2015

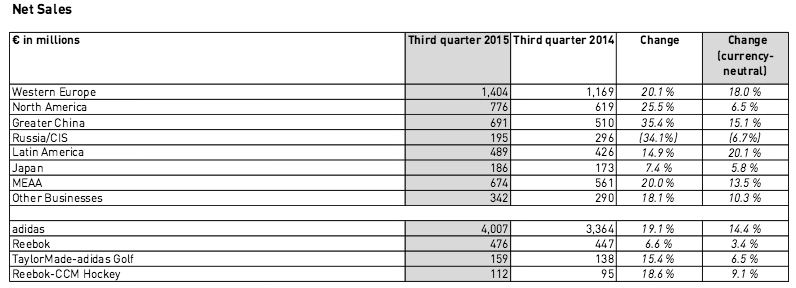

In the third quarter of 2015, the Adidas Group revenues grew 13 percent on a currency-neutral basis, driven by an accelerated momentum at Adidas as well as robust growth at both Reebok and TaylorMade-Adidas Golf. Currency-neutral Adidas revenues grew 14 percent, driven by double-digit sales increases in Western Europe, North America, Greater China, Latin America and MEAA. Currency-neutral Reebok sales were up 3 percent versus the prior year, with revenues more than doubling in Greater China and growing at double-digit rates in Latin America, Japan as well as MEAA. Revenues at TaylorMade-Adidas Golf increased 6 percent currency-neutral, mainly due to double-digit growth in North America. In euro terms, Group revenues grew 18 percent to €4.758 billion in the third quarter of 2015 from €4.044 billion in 2014.

Said Herbert Hainer, Adidas Group CEO, “Our relentless focus on the consumer is clearly paying off: The great momentum that Adidas and Reebok are enjoying across the globe proves that our products and marketing are resonating extremely well with the target audience, both in the lifestyle and the performance arena. The third quarter shows that, in combination with our excellence in execution, this is the game plan to drive brand desirability and generate strong top- and bottom-line growth.”

Double-digit growth in market segments Western Europe, Greater China, Latin America and MEAA

From a segmental perspective, combined currency-neutral sales of the Adidas and Reebok brands in the third quarter of 2015 grew particularly strongly in Western Europe, Greater China, Latin America and MEAA, with revenues up at double-digit rates each. Currency-neutral sales in Western Europe increased 18 percent in the third quarter, due to strong double-digit sales growth at Adidas and a mid-single-digit increase at Reebok. Currency-neutral sales in North America in the third quarter increased 6 percent. Double-digit sales increases at Adidas were partly offset by sales declines at Reebok. Greater China sales in the third quarter increased 15 percent currency-neutral, mainly as a result of continued double-digit sales growth at Adidas. In addition, revenues at Reebok more than doubled. Russia/CIS sales in the third quarter decreased 7 percent currency-neutral, due to sales declines at both Adidas and Reebok. This development was impacted by further store closures in the own-retail network. Currency-neutral sales in Latin America were up 20 percent in the third quarter, as a result of significant double-digit sales growth at both Adidas and Reebok. Japan sales in the third quarter increased 6 percent currency-neutral, due to mid-single-digit sales growth at Adidas and double-digit sales increases at Reebok. Currency-neutral sales in MEAA increased 14 percent in the third quarter, due to double-digit sales growth at both Adidas and Reebok.

Currency-neutral sales for Other Businesses grew 10 percent in the third quarter with sales increases at TaylorMade-Adidas Golf, Reebok-CCM Hockey as well as Other centrally managed businesses.

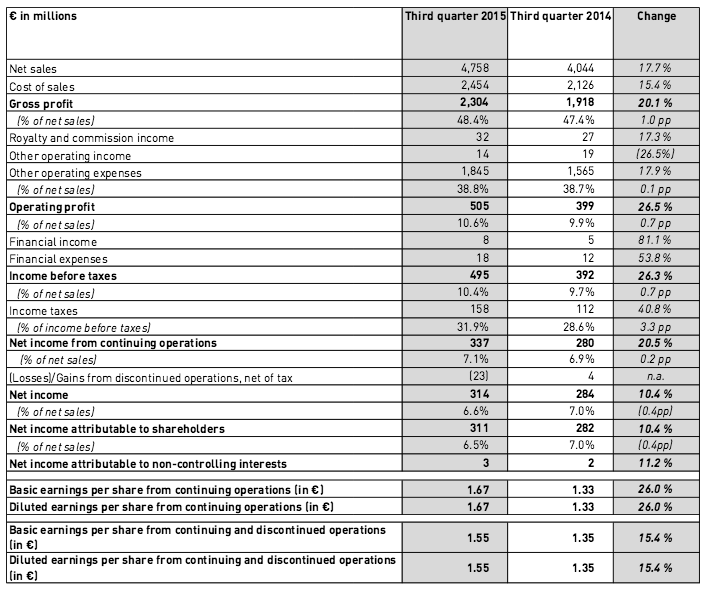

Third quarter operating margin increases 0.7 percentage points

The Group’s gross profit increased 20 percent to €2.304 billion (2014: €1.918 billion) in the third quarter. The Group’s gross margin increased 1.0pp to 48.4 percent from 47.4 percent in the prior year, driven by the positive effects from a more favourable pricing and channel mix, partly offset by higher input costs, negative currency effects as well as a less favourable product mix. Other operating expenses increased 18 percent to €1.845 billion (2014: €1.565 billion), reflecting an increase in sales and marketing investments as well as higher operating overhead costs. As a percentage of sales, other operating expenses increased 0.1pp to 38.8 percent (2014: 38.7 percent). Operating profit increased 26 percent to €505 million in the third quarter of 2015 compared to €399 million in the prior year, representing an operating margin of 10.6 percent, up 0.7 percentage points from the prior year level (2014: 9.9 percent). This development was driven by the increase in gross margin, which more than offset higher operating expenses as a percentage of sales. Net income from continuing operations grew 20 percent to €337 million (2014: €280 million). Net income attributable to shareholders, which in addition to net income from continuing operations includes the losses from discontinued operations, increased 10 percent to €311 million from €282 million in 2014.

Adidas Group currency-neutral sales increase 9 percent in the first nine months of 2015

In the first nine months of 2015, Group revenues increased 9 percent on a currency-neutral basis, due to double-digit growth at Adidas and mid-single-digit increases at Reebok. Currency translation effects had a positive impact on sales in euro terms. Group revenues grew 17 percent to €12.748 billion in the first nine months of 2015 from €10.924 billion in 2014. Currency-neutral Adidas revenues grew 11 percent, driven by double-digit sales increases in Western Europe, Greater China, Latin America and MEAA. Currency-neutral Reebok sales were up 6 percent versus the prior year, reflecting double-digit growth in all regions except North America and Russia/CIS. Revenues at TaylorMade-Adidas Golf decreased 13 percent currency-neutral, mainly due to sales declines in North America and Western Europe.

Currency-neutral sales grow in nearly all market segments

From a segment perspective, combined currency-neutral sales of the Adidas and Reebok brands grew in all market segments except Russia/CIS in the first nine months of 2015. Revenues in Western Europe increased 14 percent on a currency-neutral basis, driven by double-digit sales growth in the UK, Italy, France and Spain. Currency-neutral sales in North America increased 4 percent. Revenues in Greater China grew 18 percent on a currency-neutral basis, while currency-neutral sales in Russia/CIS declined 9 percent. In Latin America, revenues grew 12 percent on a currency-neutral basis, driven by double-digit growth in Argentina, Mexico, Chile, Peru and Colombia. In Japan, sales increased 2 percent on a currency-neutral basis. Revenues in MEAA grew 13 percent on a currency-neutral basis, driven by double-digit growth in South Korea, the United Arab Emirates, Turkey and Australia.

Revenues in Other Businesses were down 3 percent on a currency-neutral basis. Double-digit sales increases at Reebok-CCM Hockey and in Other centrally managed businesses were more than offset by sales declines at TaylorMade-Adidas Golf.

Group gross margin increases 0.1 percentage points

In the first nine months of 2015, gross profit for the Adidas Group increased 17 percent to €6.202 billion versus €5.303 billion in the prior year. Gross margin of the Adidas Group increased 0.1 percentage points to 48.6 percent (2014: 48.5 percent), driven by a more favorable pricing and channel mix at Adidas and Reebok, which more than offset higher input costs, negative currency effects as well as lower product margins at TaylorMade-Adidas Golf.

Goodwill impairment in an amount of €18 million

As a result of the change in the composition of the Group’s operating segments and associated cash-generating units, respectively, the Group determined in the first quarter of 2015 that goodwill impairment was required. As a result, goodwill impairment losses for the first nine months ending September 30, 2015 amounted to €18 million. This charge was related to the Latin America (€15 million) and Russia/CIS (€3 million) operating segments. Goodwill for these groups of cash-generating units is now completely impaired. The impairment losses were non-cash in nature and do not affect the Adidas Group’s liquidity.

Operating margin excluding goodwill impairment increases 0.2 percentage points to 8.6 percent

In the first nine months of 2015, other operating expenses increased 15 percent to €5.265 billion (2014: €4.561 billion), reflecting an increase in sales and marketing investments as well as higher sales expenditure. As a percentage of sales, other operating expenses decreased 0.4 percentage points to 41.3 percent (2014: 41.8 percent). Sales and marketing investments amounted to €1.704 billion, which represents an increase of 19 percent versus the prior year level (2014: €1.435 billion). Group operating profit increased 17 percent to €1.083 billion in the first nine months of 2015 versus €923 million in 2014. The operating margin of the Adidas Group remained stable at 8.5 percent (2014: 8.5 percent). Excluding the goodwill impairment losses, operating profit grew 19 percent to €1.101 billion from €923 million in the first nine months of 2014, representing an operating margin of 8.6 percent, up 0.2 percentage points from the prior year level (2014: 8.5 percent). This development was due to an increase in gross margin as well as lower other operating expenses as a percentage of sales.

Net income from continuing operations excluding goodwill impairment increases 17 percent

The Group’s tax rate increased 3.6 percentage points to 32.4 percent in the first nine months of 2015 (2014: 28.8 percent). Excluding the goodwill impairment losses, the effective tax rate grew 3.1 percentage points to 31.9 percent from 28.8 percent in 2014, mainly due to the non-recognition of deferred tax assets. The Group’s net income from continuing operations increased 14 percent to €719 million in the first nine months of 2015 from €632 million in 2014. Basic and diluted EPS from continuing operations increased 18 percent to €3.54 in the first nine months of 2015 (2014: €3.00). Excluding the goodwill impairment losses, net income from continuing operations was up 17 percent to €737 million (2014: €632 million). Basic and diluted EPS from continuing operations excluding goodwill impairment increased 21 percent to €3.62 from €3.00 in 2014. The weighted average number of shares used in the calculation was 201,987,657 (2014: 209,216,186).

Losses from discontinued operations total €36 million

In the first nine months of 2015, the Group incurred losses from discontinued operations of €36 million, net of tax, related to the Rockport operating segment (2014: gains of €3 million). Losses from discontinued operations were due to a loss from the sale of discontinued operations in the amount of €27 million as well as a loss from Rockport’s operating activities of €9 million.

Net income attributable to shareholders excluding goodwill impairment increases 10 percent

The Group’s net income attributable to shareholders, which in addition to net income from continuing operations includes the losses from discontinued operations, grew 8 percent to €678 million in the first nine months of 2015 from €630 million in 2014. Excluding the goodwill impairment losses, net income attributable to shareholders was up 10 percent to €696 million (2014: €630 million).

Group inventories from continuing operations increased 10 percent currency neutral

Group inventories increased 2 percent to €2.698 billion at the end of September 2015 versus €2.647 billion in 2014. On a currency-neutral basis, inventories grew 6 percent. Inventories from continuing operations increased 6 percent (+10 percent currency-neutral), reflecting the Group’s growth expectations. The Group’s accounts receivable increased 8 percent to €2.502 billion at the end of September 2015 (2014: €2.322 billion). On a currency-neutral basis, receivables increased 7 percent. Receivables from continuing operations rose 10 percent (+9 percent currency-neutral), reflecting the sales increase in the third quarter of 2015.

Net borrowings increase to €903 million

Net borrowings at September 30, 2015 amounted to €903 million, compared to net borrowings of €543 million in 2014, representing an increase of €359 million. This development is mainly a result of the utilization of cash for the share buyback programme in an amount of €601 million. The Group’s ratio of net borrowings over EBITDA amounted to 0.6 at the end of September 2015 (2014: 0.5).

Supervisory Board extends the contract of Roland Auschel

At its meeting yesterday, the Adidas AG Supervisory Board extended the mandate of Executive Board member Roland Auschel, responsible for Global Sales, by another three years beyond 2016 until 2019. Roland Auschel, a German citizen, has been a member of Adidas AG’s Executive Board since October 2013.

Adidas Group raises top- and bottom-line guidance for the full year 2015

Due to the strong momentum at both Adidas and Reebok, the Adidas Group now expects currency-neutral sales to increase at a high-single-digit rate (previously: mid-single-digit rate) in 2015. Group sales development will be driven by double-digit increases in Western Europe, Greater China and MEAA. Additionally, higher sales expectations in Latin America and North America are expected to further support the Group’s revenue growth. While in Latin America currency-neutral sales are now projected to increase at a high-single-digit rate (previously: mid-single-digit rate), currency-neutral sales in North America are now expected to grow at a mid-single-digit rate (previously: low- to mid-single-digit rate). Sales at Reebok-CCM Hockey are now projected to grow at a high-single-digit rate (previously: mid-single-digit rate) on a currency-neutral basis. This, as well as the further expansion and improvement of controlled space initiatives, will more than offset the non-recurrence of sales related to the 2014 FIFA World Cup as well as the expected sales decline at TaylorMade-Adidas Golf.

The Adidas Group gross margin is forecasted to increase to a level between 48.0 percent and 48.5 percent (previously: between 47.5 percent and 48.5 percent) compared to the prior year level of 47.6 percent. The more favourable pricing and product mix at both Adidas and Reebok together with a better channel mix as a result of the further expansion and improvement of controlled space initiatives are expected to positively influence the Group’s gross margin development. However, adverse currency movements in emerging markets, in particular in Russia/CIS, higher input costs as well as lower product margins at TaylorMade-Adidas Golf are projected to negatively impact the Group’s gross margin development.

Given the strong financial performance during the first nine months of the year, the Group decided to further increase the planned marketing and point-of-sale investments in the fourth quarter to leverage the current momentum and drive long-term brand desirability. In addition, TaylorMade-Adidas Golf will continue to work on the redesign of the organization through the streamlining of its global business and processes. As part of this, TaylorMade-Adidas Golf will reduce its global workforce by 14 percent by the end of the year. While this will negatively impact the Group’s profitability by a low-double-digit million euro amount in the fourth quarter, the result will be a more nimble organization which will have a positive impact on the Group’s profitability from 2016 onwards. As a result, the Group’s other operating expenses as a percentage of sales are now expected to increase moderately in 2015 compared to the prior year level of 42.7 percent (previously: around the prior year level). The Group’s operating margin excluding goodwill impairment is forecasted to be at a level between 6.5 percent and 7.0 percent (2014 excluding goodwill impairment losses: 6.6 percent). The Group’s tax rate is expected to be at a level of around 32.0 percent (previously: at a level of around 30.0 percent) and thus above the prior year level of 29.7 percent.

Despite the increased marketing investments and the one-time restructuring costs at TaylorMade-Adidas Golf, the Group is raising its bottom-line expectations for the full year 2015. Net income from continuing operations excluding goodwill impairment is now projected to increase at a rate of around 10 percent (previously: to increase at a rate of between 7 percent and 10 percent) compared to net income from continuing operations excluding goodwill impairment losses of €642 million in 2014.

Hainer stated: “Thanks to our outstanding performance during the first nine months we are reaching the 2015 goal line much faster than we had anticipated. Like true champions we will not rest on our laurels, but will continue to build on our current strength to prepare ourselves for the next stage. The investments into our brands and a leaner golf organisation will directly fuel next year’s top- and bottom-line performance and set us up for sustainable profitability improvements from 2016 onwards.”