Adidas, Vans, Supreme, Champion and Lululemon all saw a strong uptick in mindshare among teens in Piper Jaffray’s 35th semi-annual Taking Stock With Teens survey. Nike, Converse and Under Armour all lost ground.

The findings, based on a survey of approximately 6,000 teens at an average age of 16.4 years, found that overall teen spending grew 6 percent in spring 2018 from its fall survey and was up 2 percent from spring 2017.

The athletic category was still found to hold wide appeal with teens. Among upper-income teens (plus $100,000 household income), 35 percent prefer apparel brands that are athletic, down from 41 percent last spring but up from 33 percent in the fall survey. In footwear, 66 percent of upper-income female teens preferred an athletic brand, up from 63 percent last year and down from 67 percent last fall. Among upper-income males, 84 percent prefer an athletic brand of footwear, down from 86 percent both last spring and fall.

But some shifts are being seen among brands.

Among the big three traditional athletic brands:

• Nike posted dominant share across the board as a preferred apparel and footwear brand (both genders). But the overall mindshare share loss continued, despite the ongoing athletic strength. Nike/Jordan, for instance, declined as “top-fashion trend for males” from 18 percent to 12 percent. As a performance athletic brand, Nike lost mid single-digit percentage mindshare year-over-year among both genders

• Adidas stood out as the single largest gainer in the survey, showing significant year-over-year share across every segment of the data. Adidas ranked as the No. 1 “new” brand that males are wearing (highest share ever for No. 1 in the category) and the number two for females. As a performance athletic brand, Adidas gained mid-single digit percentage mindshare year-over-year among both genders and categories

• Under Armour had lost ground in teen mindshare in recent years and its status showed little recovery. Piper Jaffray’s analysts described the brand as “being boxed out by resurgent adidas & retro-category.” As a preferred apparel brand, Under Armour was ranked 13 this year, the same as the prior year. As a preferred footwear brand, Under Armour dropped to 24 from 14 last year. Under Armour was still cited as the No. 1 “old” brand that males are no longer wearing for the third straight survey and debuted at No. 10 among females (tied w/Nike).

Meanwhile, a healthy streetwear cycle is seen benefiting Vans and Supreme while the 90s logo revival has been a boon for Champion as well as Tommy Hilfiger.

Vans hit the highest mindshare level for favorite footwear among upper-income teens in the survey’s history, at 16 percent. Women’s drove the most significant piece of this increase (22 percent vs. 9 percent last year). Vans was listed as a top-ten fashion trend for males and females, as well as up and coming brand for both genders.

Converse saw sequential and year-over-year mindshare declines in nearly all categories, with most pronounced pressure in female fashion trends. Piper Jaffray said Vans appears to be taking mindshare from Nike’s Converse brand in canvas.

Supreme improved its rank and mindshare sequentially after debuting on the top-ten list for apparel preference last fall. The brand also moved up to number five “up and coming male brand” from seven last fall.

Champion moved from No. 44 favorite upper-income male apparel brand last fall to ten in a tie with Vineyard Vines. Among average income males, the company moved up to 25 from 40.

Among other active brands, Patagonia pushed its mindshare lead over The North Face among upper-income teens to a new peak. The North Face still saw stable mindshare versus Fall. Among non-athletic brands, Tommy Hilfiger’s appeal grew with teens while Ralph Lauren took a step back.

Among favorite apparel brands, standout gainers in mindshare among upper-income teens included Adidas and Urban Outfitters, which both grew 300 basis points year-over-year. Supreme ranked seven with 3 percent mindshare and Gucci made a debut at the top-ten list of apparel favorites at 10.

Among preferred apparel brands (upper-income, all teens), Nike saw a steep year-over-year drop to 23 percent from 31 percent. Under Armour slid from 3 percent to 2 percent. Adidas grew to third ranking, at 6 percent, up from 3 percent in spring 2017.

Among males (upper-income), Nike’s status as a preferred clothing brand fell to 38 percent from 47 percent in spring 2017. Adidas grew among upper-income males to 9 percent from 4 percent and Supreme increased to 5 percent from 2 percent. Champion debuted in the top-ten list of preferred clothing brands among upper-income males at 2 percent.

Among upper-income females, the most popular brands were American Eagle, 17 percent; Forever 11 percent; Urban Outfitters, 10 percent, Nike 6 percent and Pacific Sunwear, 5 percent. Nike’s preference among upper-income female declined from 8 percent.

Among preferred athletic clothing brands, (upper-income), Nike fell among males to 67 percent from 71 percent and eroded among females to 54 percent from 65 percent. Adidas grew to 13 percent from 6 percent year-over-year among males and expanded to 11 percent from 9 percent with females. Under Armour slid to 7 percent with males from 10 percent a year ago. Lululemon jumped to 21 percent among females from 14 percent in spring 2017.

Among favorite footwear brands (upper-income teens), Vans grew 700 basis points year-over-year while Adidas gained 600 basis points. Nike slid to 42 percent from 52 percent and Converse lost 200 basis points.

Among preferred footwear brands (upper-income), Nike’s mindshare among males slid to 53 percent from 67 percent year-over year and eroded in females to 27 percent from 33 percent. Adidas grew to 17 percent from 8 percent among males year-over-year and to 9 percent from 7 percent among females. Vans climbed to 11 percent from 9 percent among males and leaped to 22 percent from 9 percent with female teens.

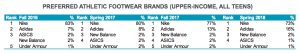

Among preferred athletic footwear brands (upper-income), Nike was preferred by 70 percent of males, down from 78 percent in spring 2017. Adidas’ preference among males (upper income) improved to 17 percent from 8 percent. Among females (upper income), Nike eased to 77 percent down from 82 percent. Adidas preference in athletic footwear with females grew to 14 percent from 8 percent.

Among other categories:

- Top-five top fashion trends (upper-income males): Nike/Jordan, 12 percent; athletic wear, 10 percent; Adidas, 9 percent; jogger pants, 7 percent; and Supreme, 7 percent.

- Top-five top fashion trends (upper-income females): Leggings/Lululemon, 29 percent; ripped jeans, 8 percent; jeans, 5 percent; Victoria’s Secret, 4 percent; and Vans, 4 percent.

- Top five brands they’re starting to wear (upper-income males): Adidas, 19 percent; Nike, 9 percent; American Eagle, 5 percent; Vans, 4 percent; and Champion, 4 percent;

- Top five brands they’re brands starting to wear (upper-income females): Lululemon, 8 percent; Adidas, 6 percent; Urban Outfitters, 6 percent; Vans, 5 percent; and American Eagle, 5 percent.

- Top five downtrending brands (upper-income males): Under Armour, 12 percent; Adidas, 9 percent; Nike 9 percent; Gap, 8 percent; and Reebok, 8 percent.

- Top five downtrending brands (upper-income females): Justice, 16 percent; Aeropostale, 8 percent; Hollister, 11 percent; Abercrombie & Fitch, 8 percent; and Forever 21, 3 percent.

Photo courtesy Vans