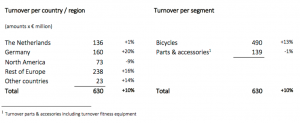

Accell Group N.V. recorded revenues grew 10 percent in the first six months ended June 30, to €629.7 million from €573.8 million a year ago. The rise in turnover was entirely organic. Net profit in the same period rose by 7 percent to €34.0 million (2015: €31.9 million).

René Takens, Chairman of the Board of Directors of Accell Group: “The market conditions for the specialist retail sector were not particularly easy in the first six months of this year, as weather conditions in particular had a negative impact on bicycle sales in many countries. Despite these unfavourable conditions, we have recorded strong organic growth in the first half of 2016, largely driven by higher sales of electric bikes. We are benefitting specifically from our leading position in the field of electric bikes, which currently account for some 43 percent of our total turnover. Turnover from E-performance bikes has doubled in the last six months. Turnover from bicycle parts and accessories was also higher in Europe, but we did see a slight drop in total turnover in this segment due to the sale of our North American operations.

Profit growth came under a certain amount of pressure in the past half year, due to lower margins on the sales of older bike ranges and extra costs incurred in connection with two major bankruptcies of sporting goods chains in North America.

“These bankruptcies are a clear sign of the far- reaching changes in consumer purchasing behavior, changes that we are seeing to a lesser or greater degree in many countries,” said Takens. “We therefore devoted a great deal of attention in the first half of the year to tightening our strategy and we will be giving consumers in many of the countries in which we are active a much more prominent role in this strategy.”

In the first half of the year, Accell sharply reduced working capital compared with year-end 2015. This resulted in a considerable increase in free cash flow, which came in about €40 million higher than in the same period of last year.

For the second half of 2016, Accell expects to record higher turnover and profit, barring unforeseen circumstances.

Bicycles

Thanks to the strong growth in the sales of electric bikes, Accell Group was able to offset the impact of the poor weather conditions in the final months of the period. Sales of electric bikes was up by 39 percent, largely driven by the strong growth in the sales of Accell’s German brands. Sales of traditional bikes fell by 15 percent, while sales of sports bikes was stable.

This likely reflects some cannibalization by e-bikes, as consumers often purchase electric bikes to replace their traditional or sports bike.

Sales in the bicycle segment came in 13 percent higher at €490.3 million in the first half of 2016 (first half of 2015: €432.7 million). Accell Group sold a total of 908,000 bikes in the first half of 2016 (first half of 2015: 985,000 bikes). The average sales price came in 23 percent higher at €541 (first half of 2015: €439) per bike due to the fact that electric bikes and more expensive sports bikes accounted for a greater proportion of turnover. The operating result from the bicycle segment rose by 7 percent to €49.6 million (first half of 2015: €46.3 million).

According to provisional market figures, the total bicycle market in the Netherlands was around the same level as in the first half of 2015. Sales from Accell Group brands in the Netherlands also came in at the same level as the year-earlier period, due to higher sales of E-bikes. The number of city and touring bikes sold was lower than in the year-earlier period.

Many bicycle dealers in the Dutch market are active online, offering consumers low-price deals. There are also new market entrants that sell and deliver bicycles directly to consumers. Sparta was the first bike maker to launch a connected E-bike, the Sparta M8i.

Bicycle sales in Germany was up 26 percent compared with the first half of 2015, largely due to the healthy sales of Haibike and Ghost performance E-bikes. The demand for this relatively new and special category of electric bikes has grown stronger this year. Accell Group is a trendsetter and market leader in this sub-segment in Europe.

The growth in sales of more expensive sports bikes also continued, while sales of non-electric bikes and simpler mountain bikes were down in the first half of this year. In addition to the use of bikes for sporting purposes, there is a growing awareness of the benefits of cycling in Germany. More and more people are using bikes instead of cars.

Outside the Netherlands and Germany, many countries in the Rest of Europe are seeing a growing interest in electric bikes. The Haibike, Ghost and Lapierre brands in particular are responding effectively to this trend and are increasing sales, especially in sports electric bikes. For Accell Group, France, the United Kingdom, Belgium, Spain, Austria and Switzerland remained the largest markets. Sales in the Rest of Europe was up by 24 percent.

Bankruptcies hurt Diamondback in North America

Sales in North America fell by 3 percent. The Diamondback brand was confronted by two major bankruptcies of multi-sports chains, which led to $2 million in direct costs. On top of this, the company also faced indirect costs as a result of the loss of sales to those two chains and the price pressure in the market resulting from the liquidation sales of the inventories.

The Ghost brand, which was launched exclusively by REI in North America last year, recorded an increase in bike sales. Sales from Raleigh bikes sold to independent bicycle dealers (IDBs) was down, due in part to competitive pressures and difficult conditions in the North American IDB channel, where wholesale inventory levels remain far above their idea range. Accell Group has taken the first steps towards omni-channel sales at the Raleigh brand, which has traditionally only delivered to bike dealers.

This is a translation, in case of any inconsistencies the Dutch version of this press release is leading. 2

This will enable consumers to order bikes directly from the Raleigh website. The bikes will be delivered via bike dealers, who will receive a fee for the service. Sales in the electric bikes launched this year have increased, but the North American market is still small, in terms of both volumes and turnover.

Sales in Other countries outside Europe rose by 8 percent and accounted for 4 percent of total turnover. Around half of this sales were realized in Turkey, where sales increased in the first half of this year. The remainder of the sales came largely from Asian countries and Australia.

Parts & accessories

Sales in the bicycle parts & accessories segment came in at €139.4 million, slightly lower than in the year-earlier period (first half of 2015: €141.1 million). Revenue was higher when adjusted for the sale of Accell Group’s North American bicycle parts and accessories activities. The segment operating result fell to €8.3 million (first half of 2015: €10.3 million). This drop was due to margin pressure in Europe and the transfer of the North American operations.

The positioning of Accell group’s own brands, with XLC the most important of these, is becoming ever more important. Also important in this positioning context is having exclusive licenses for parts (these are items for which Accell Group has exclusive sales rights in one or more countries). Having our own brands and exclusive licenses for brands makes us less dependent on other (sometimes less well known) brands, which can be sold by multiple suppliers.

In the Netherlands, sales came in higher due to solid sales of our own brand XLC, as a well as higher demand for accessories and replacement parts for electric bikes. Revenue was stable in Germany, where Accell Group has a strong market position via Wiener Bike Parts. Exports from the Netherlands and Germany to other European countries were higher than in the year-earlier period. In North America, Accell group sold its parts & accessories operations effective 1 April, following which the North American business only offers a limited range of replacement parts and accessories for the Raleigh and Diamondback bike brands. Sales were higher in the Rest of Europe, in which the United Kingdom, Spain and France are Accell Group’s most important markets. Sales of parts and accessories in Other countries outside Europe remain limited.

Organisation

As of last year Accell Group made a number of radical changes in the field of supply chain management to improve performance in terms of meeting customer needs, logistics and purchasing. The company has since started to strengthen the group organisation and started to make changes in the management of purchasing and planning. The impact of these organisational changes is already clearly visible in several aspects of the supply chain, including a reduction in working capital.

To enable the company to compete more effectively in the fight to win the favour of consumers in the future, Accell Group is currently tightening its strategy on the marketing and distribution fronts. To make sure Accell Group can continue to serve consumers effectively, omni-channel strategies will be necessary in many counties. Part of this plan is to make it easier for consumers to order bikes directly (online), often in cooperation with specialist retailers.

Accell group also plans to stimulate the brand experience for consumers, with the ‘De Fietser’ (the cyclist) experience center in the Netherlands as a trend-setting example of how to combine digital and physical brand experience. Bicycle sales via this channel will also continue to be in cooperation with specialist bike dealers.

Group turnover and profit

Net sales rose by 10 percent to €629.7 million in the first half of 2016 (first half of 2015: €573.8 million). This increase in turnover was entirely organic.

The absolute added value increased by 7 percent to €192.3 million (first half of 2015: €180.0 million). Added value (net turnover less material costs and inbound transport costs) as a percentage of sales came in at 30.5 percent (first half of 2015: 31.4 percent). In the first half of this year, added value was negatively impacted by lower underlying margins compared with the year-earlier period and more discounts, largely due to the slightly higher sales of older models in relative terms.

Operating costs rose by 7 percent to €139.9 million. As a percentage of sales, costs came in at 22.2 percent (first half of 2015: 22.8 percent). The higher costs were partly related to the higher sales and partly to higher expenditures for marketing and consultancy. The increase in consultancy costs was primarily related to the above-mentioned organisational changes in the supply chain and the tightening of the group strategy. These costs also include the one-off write-down of debts as a result of the bankruptcies of the two multi-sports chains in North America.

The operating result was 7 percent higher on the back of organic turnover growth. The operating result came in at €52.4 million (first half of 2015: €49.1 million), which translates into an operating margin of 8.3 percent (first half of 2015: 8.6 percent).

Financial expenses came in lower due to less currency exchange differences for positions held in foreign currencies. The average credit use was higher and average interest rates were slightly lower in the first half of 2016 than in the first half of 2015.

Taxes increased to €14.4 million (first half of 2015: €11.7 million) due to the sharply higher results in Germany and the limiting of capitalised tax losses in North America. This led to an increase in the average tax rate to 29.8 percent (first half of 2015: 26.8 percent).

Net profit rose by 7 percent to €34.0 million in the first half of 2016. Net earnings per share came in at €1.34 in the first half of 2016 (first half of 2015: €1.28).

Financial position

In the first half of the year to 30 June 2016, Accell Group’s fixed assets fell to €203.1 million (30 June 2015: €208.6 million). The movement in tangible fixed assets was limited; the impact of depreciations was offset by both replacement investments and new investments (including the experience centre ‘De Fietser’ in Ede). The movements in financial fixed assets were largely driven by the valuation and currency conversion of the pension claim of the UK pension fund.

This is a translation, in case of any inconsistencies the Dutch version of this press release is leading. 4

On the working capital front, the movement in inventories is particularly notable. The reduction of inventories compared to the level of year-end 2015 was more rapid than in previous years, particularly when the difficult seasonal circumstances are taken into account.

Inventories have declined to €295.2 million as at 30 June, compared with €338.7 million at the end of December 2015. When compared to the end of June 2015, inventories are still higher, largely due to higher average cost prices for components and bicycles and lower sales in June. Accounts receivable remained at a comparable level totalling €199.6 million at 30 June 2016 (30 June 2015: €199.8 million) despite the increase in turnover in the first half of the year.

As of 30 June 2016, other short-term debt stood at €185.5 million, which is an increase of €26.9 million compared to 30 June 2015. The increase was largely due to the item accounts payable, which increased by €18.8 million. Renegotiations of payment terms and the introduction of a Supplier Finance programme contributed to this improvement in working capital.

Total net debt, comprising interest-bearing loans, bank credit and cash positions, stood at €158.7 million on 30 June 2016, in line with a year earlier (30 June 2015: €159.6 million).

Net cash flow from operating activities increased to €56.1 million (first half of 2015: €15.5 million), mainly on the back of the reduction of inventories compared to year-end 2015. Free cash flow increased to €49.4 million (first half of 2015: €9.7 million).

Shareholders’ equity currently stands at €327.2 million, which translates into a solvency rate of 45.1 percent (30 June 2015: 45.3 percent). The movement of €21.3 million in shareholders’ equity seen in the first half of the year can among others be divided into the profit for the period (+ €34.0 million), dividend payments (-/- €8.8 million) and currency exchange rate differences (-/- €3.7 million).

There were no material changes in the risks and uncertainties described in the 2015 annual report.

Outlook

Accell Group believes it will be able to realise continued growth in turnover in the second half of 2016 on the back of a strong range of innovative bicycles and Accell Group’s leading position in electric bicycles. The full year result could be affected by discounts that may be necessary if inventories are still higher than average in September due to continued bad summer weather. Macro-economic developments, consumer confidence and the weather all impact the financial results of Accell Group. The underlying market trends remain positive. Based on the aforementioned and barring unforeseen circumstances, Accell Group expects to record an increase in turnover and profit in the second half of 2016 compared to the same period of 2015.