Callaway Golf Company reported a 6.5 percent increase in net sales and a 140 percent increase in earnings per share compared to the same period in 2015.

The company said the results reflect their continued brand strength, additional hard goods market share gains, increased gross margins and an $0.18 per share gain from the sale of a portion of the company’s investment in Topgolf International, Inc. The company also reaffirmed its full year financial outlook for 2016 and provided financial guidance for the third quarter of 2016.

“We are pleased with our performance in the second quarter of 2016,” commented Chip Brewer, President and Chief Executive Officer at Callaway Golf company. “Despite softer-than-expected market conditions, we grew our net sales by 6.5 percent in the second quarter, which was led by increased sales in all product categories and in every major region. We also continued to realize benefits from the many initiatives we undertook during the last three years with gross margins improving 90 basis points and our realizing over $23 million in proceeds from the sale of a small portion of our Topgolf investment.”

Brewer continued, “Overall, I believe we are performing well in the current environment as evidenced in part by our continued increase in U.S. hard goods dollar market share for the first half of this year. I also believe that we are on track to create long-term shareholder value through our improved core business as well as future growth from areas tangential to the golf equipment business such as our recently formed joint venture in Japan. For the balance of this year, however, there could be some additional market risk related to Brexit, the softer-than-expected market conditions and the impact of those factors on the golf specialty retail channel. Despite this potential short-term market risk, we believe our business is strong and we remain cautiously optimistic about the second half of the year and are therefore reaffirming our full year guidance.”

Summary of Second Quarter 2016 Financial Results

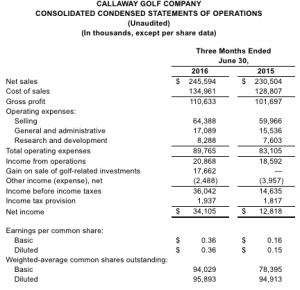

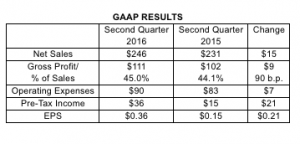

For the second quarter of 2016, Callaway announced the following GAAP financial results, as compared to the same period in 2015 (in millions, except eps):

Despite softer-than-expected market conditions, the company’s 2016 second quarter net sales increased $15 million to $246 million, as compared to $231 million in the second quarter of 2015. The higher sales were led by increases in all major product categories, including woods, irons, putters and balls. The company’s sales also increased in every major region, including the United States, Europe and Japan, as well as in the rest of Asia. This sales performance resulted in increased market shares, including an increase in total U.S. hard goods dollar share for the first half of 2016. This is Callaway’s highest first half share in over 10 years.

Despite softer-than-expected market conditions, the company’s 2016 second quarter net sales increased $15 million to $246 million, as compared to $231 million in the second quarter of 2015. The higher sales were led by increases in all major product categories, including woods, irons, putters and balls. The company’s sales also increased in every major region, including the United States, Europe and Japan, as well as in the rest of Asia. This sales performance resulted in increased market shares, including an increase in total U.S. hard goods dollar share for the first half of 2016. This is Callaway’s highest first half share in over 10 years.

The company’s 2016 second quarter financial results also include improvements in gross margin and profitability. For the second quarter of 2016, the company’s gross margin increased 90 basis points to 45.0 percent, primarily as a result of improved operational efficiencies and higher average selling prices. The increase in sales and gross margin offset a $7 million increase in operating expenses related primarily to a planned shift in marketing expenses to the second and third quarters of 2016. As a result, operating income increased by 12 percent to $21 million for the second quarter of 2016 compared to $19 million in the same period in 2015.

The company’s diluted earnings per share increased to $0.36 for the second quarter of 2016 compared to $0.15 for the same period in 2015. The company’s earnings include an $18 million gain, or earnings per share of $0.18, on the second quarter sale of approximately 10 percent of the company’s investment in Topgolf. The company continues to hold an approximate 15 percent ownership interest in Topgolf.

Third Quarter 2016

Net sales for the third quarter of 2016 will benefit from the commencement of the joint venture in Japan in July 2016 and will be negatively impacted by a change in product launch timing in Japan as compared to 2015. The anticipated increase in loss per share in the third quarter of 2016 as compared to 2015 reflects the addition of operating expenses in 2016 related to the Japan joint venture, as well as a shift in marketing expense to the third quarter of 2016 and unusually low compensation expense in the third quarter of 2015. Given the seasonality of the company’s business, the company is always in a loss position in the second half of the year. In 2016, the timing of the second half loss is such that a greater proportion of the loss will occur in the third quarter as compared to 2015 when a substantial majority of the loss occurred in the fourth quarter.