Nordstrom, Inc. reported earnings per diluted share of 42 cents per share for the third quarter ended Oct. 31, 2015. This included a reduction in earnings per diluted share of 15 cents, which primarily represented transaction costs associated with the closing of its credit card portfolio sale.

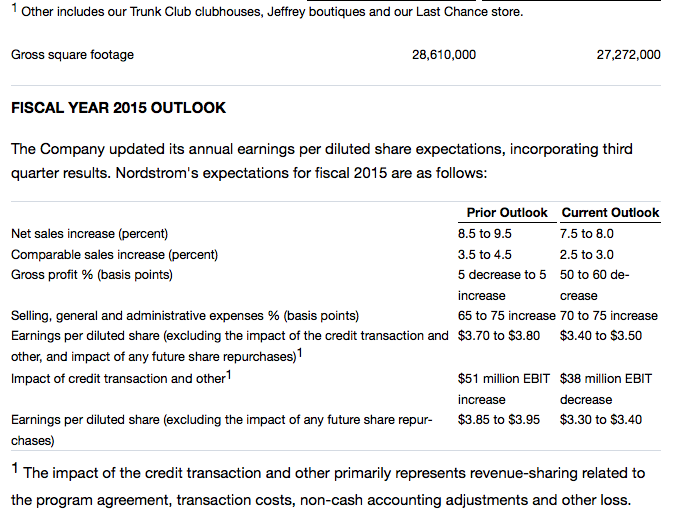

The company's third quarter performance was below company expectations, reflecting softer sales trends that were generally consistent across channels and merchandise categories. Total company net sales increased 6.6 percent and comparable sales increased 0.9 percent, compared with the same period last year. On a year-to-date basis, total company net sales increased 8.5 percent and comparable sales increased 3.5 percent.

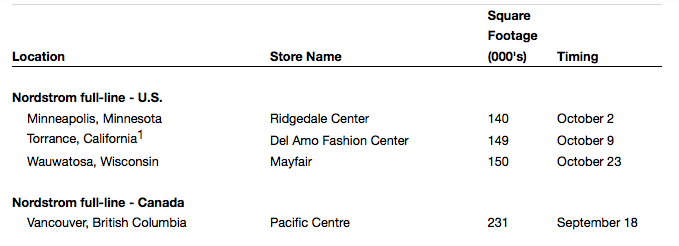

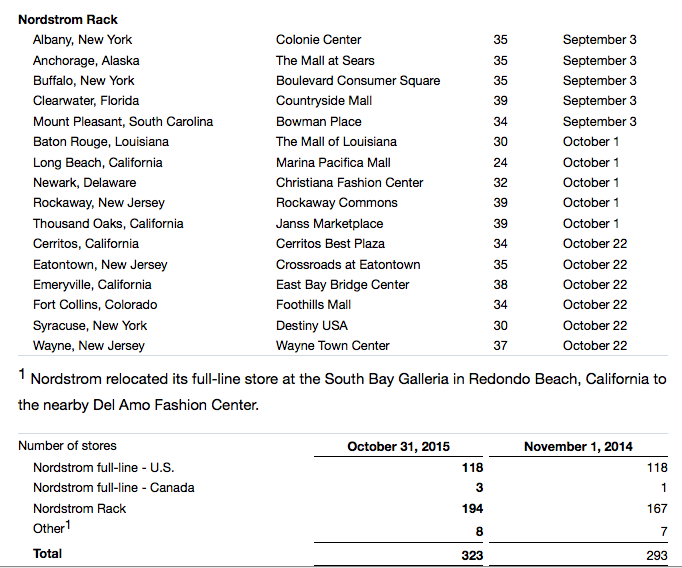

The company is executing its customer strategy through multiple growth initiatives to enhance the customer experience and reach more customers. During the third quarter, the company opened three new full-line stores, including its first international flagship store in Vancouver, B.C., relocated a full-line store and opened 16 new Rack stores.

FINANCIAL IMPACT OF CREDIT CARD TRANSACTION

On October 1, 2015, the company sold its credit card portfolio to TD Bank U.S.A., N.A. (TD) for $2.2 billion. The company is deploying net proceeds of $1.8 billion, after $325 million in debt reduction and transaction costs, directly to shareholders consistent with its balanced capital allocation approach. On October 27, 2015, the company paid a special cash dividend of $900 million, or $4.85 per share of outstanding common stock. In addition, the company expects to initiate share repurchase for the remaining net proceeds beginning in the fourth quarter.

For fiscal 2015, the company estimates a reduction in earnings before interest and taxes of approximately $28 million, or earnings per diluted share of approximately $0.08, related to the credit card transaction. For fiscal 2016, the company estimates the net financial impact, including the share repurchase impact, to be approximately neutral to earnings per diluted share.

THIRD QUARTER SUMMARY

- Third quarter net earnings were $81 million and earnings before interest and taxes were $155 million, or 4.8 percent of net sales, compared with net earnings of $142 million and earnings before interest and taxes of $262 million, or 8.6 percent of net sales, during the same period in fiscal 2014.

- This included a reduction in earnings before interest and taxes of approximately $46 million, related to the credit card transaction.

- In addition, the impact of the Trunk Club acquisition and the ongoing entry into Canada represented an incremental reduction to earnings before interest and taxes of $20 million relative to last year.

- Total company net sales of $3.2 billion for the third quarter increased 6.6 percent compared with net sales of $3.0 billion during the same period in fiscal 2014. Total company comparable sales for the third quarter increased 0.9 percent.

- Nordstrom comparable sales, which consist of full-line stores and Nordstrom.com, increased 0.3 percent. The top-performing merchandise category was Cosmetics. In addition, coats, younger customer-focused departments and dresses continued to reflect strength in Women's Apparel.

- Full-line net sales of $1.6 billion decreased 1.9 percent and comparable sales decreased 2.2 percent compared with the same period last year. The Northwest and Southern California were the top-performing geographic regions.

- Nordstrom.com net sales increased 11 percent, reflecting continued expansion of merchandise selection.

- Net sales in the off-price business increased 12 percent compared with the same period last year.

- Nordstrom Rack net sales of $0.9 billion increased 8.4 percent while comparable sales decreased 2.2 percent, compared with the same period in fiscal 2014.

- Nordstromrack.com/HauteLook net sales increased 39 percent, continuing to outperform expectations.

- Gross profit of $1.1 billion, or 33.9 percent of net sales, decreased 163 basis points compared with the same period in fiscal 2014, primarily due to higher markdowns in addition to the planned impact of higher occupancy costs related to store growth and the increased mix of Nordstrom Rack.

- Ending inventory increase of 8.0 percent was in-line with the increase in net sales of 6.6 percent.

- Selling, general and administrative expenses of $1.0 billion, or 30.8 percent of net sales, increased 68 basis points compared with the same period in fiscal 2014. The increase was in-line with expectations, reflecting growth initiatives related to Trunk Club and Canada in addition to higher fulfillment costs associated with online growth.

- The Nordstrom Rewards loyalty program continues to contribute to overall results, with members shopping more frequently and spending more on average than non-members. The company opened approximately 260,000 new accounts in the third quarter. With 4.6 million active members, sales from members increased 8 percent in the third quarter and represented 38 percent of sales.

- On October 1, 2015, Nordstrom's board of directors authorized an additional $1.0 billion share repurchase program. During the third quarter, the company repurchased 3.5 million shares of its common stock for $250 million. A total of $1,486 million remains available under its existing share repurchase board authorizations. The actual number, price, manner and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities and Exchange Commission (“Commission”) rules.

- Return on invested capital (ROIC) for the 12 months ended October 31, 2015 was 11.4 percent compared with 13.1 percent in the prior 12-month period. This decrease reflected ongoing store expansion and increased technology investments in addition to the acquisition of Trunk Club.

EXPANSION UPDATE

To date in fiscal 2015, the company opened five full-line stores, relocated one full-line store and opened 27 Nordstrom Rack stores. The company opened the following stores in the third quarter of 2015: