Luxottica Group expects to fold Oakley's back-office functions into its North American operations by October 3, as part of a global integration initiative that is already fueling increased R&D spending and an expansion of the brand's U.S. manufacturing and distribution capacity.

The Italian eyewear company's co-CEOs shared the update in their July 27 earnings call discussing Luxottica's record results for the second quarter ended June 30. LUX reported revenues grew 19.3 percent, or 4.9 percent in currency-neutral terms, to a record €2.46 billion ($2.7 bn) during the quarter.

Wholesale revenues, which include sales of Oakley, Ray Ban and dozens of luxury eyewear brands, increased 14.3 percent (6.1 percent c-n). Retail sales, which include sales by LensCrafters and other prescription eyewear stores, grew 23.4 percent (4.0 percent c-n). At Sunglass Hut currency-neutral sales increased 12.7 percent globally and 7 percent in North America, where comp store sales grew 2.5 percent. LUX's North American e-commerce sales grew 45 percent.

Net income attributable to LUX shareholders rose 25.3 percent to €295 million ($326 mm), although that translated to flat earnings per share of 68 cent in U.S. dollar terms.

The earnings include about €20 million in severance and other pre-tax costs incurred while integrating Oakley during the quarter, when Luxottica:

- Eliminated top management positions, including CEO and senior positions overseeing Oakley's global sales for both the wholesale and retail channels and global product development

- Closed Oakley's European headquarters in Zurich, eliminating 400 positions. Some of that staff has been relocated to Luxottica offices in Milan and Belluno, Italy, London, England, Quebec and other locations

LUX expects to incur the remaining €30 million in expected integration costs in the second half of 2015 as it absorbs Oakley's IT, administration, sales and order cycle management operations in North America. Much of that activity will be folded into Luxottica's wholesale operation in NY, and its Atlanta, GA, distribution center. Luxottica now expects the Oakley integration to yield €50 million in incremental operating income by 2017.

Savings plowed into product development and distribution

Luxottica is simultaneously increasing its investment in R&D, manufacturing product development and distribution operations.

In the U.S., that includes upgrading manufacturing operations at Oakley's CA-based headquarters, and nearly tripling the size of its 183,000-square-foot DC near Hartsfield-Jackson Atlanta International Airport, which already has capacity to process up to 150,000 units per day.

“We are increasing the investment on Foothill Ranch headquarters, creating a revolution on the industrial processes,” said Massimo Vian, co-CEO, Luxottica. “And we are ready for the acceleration of the brand with all the infrastructure– leaner and stronger than ever before.”

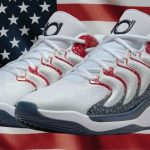

That includes making Oakley “a hit over the Olympics,” according to Adil Kahn, who shares the CEO title with Vian. “It's important for us to underline that, because Oakley is on the 'we want to invest list,' not on the 'we want to extract savings' list.”

Sharpening Pricing for Brazil and China

One of Luxottica's major initiatives in the back half is to lower prices on all its higher-end products in its two fastest growing markets: China and Brazil, which will host the 2016 Summer Olympics.

“I don't want to sound like we are ignoring the fact that Brazil's economy is softening to some extent, but our business continues to be robust and we continue to see double-digit growth there,” said Khan.

Territorial expansion is expected to sustain LUX's 40-to-45-percent growth rate in China, where it owns one of the country's larger domestic sunglasses brands.

“We are still in the coastal areas. We are in the five or six big cities, so we have a lot of China to conquer,” Khan said.