Foot Locker Inc. reported first-quarter earnings jumped 13.6 percent to $184 million, or $1.29 a share. Results easily topped Wall Street's consensus estimate of $1.23 a share.

Foot Locker Inc. reported first-quarter earnings jumped 13.6 percent to $184 million, or $1.29 a share. Results easily topped Wall Street's consensus estimate of $1.23 a share.

First Quarter Results

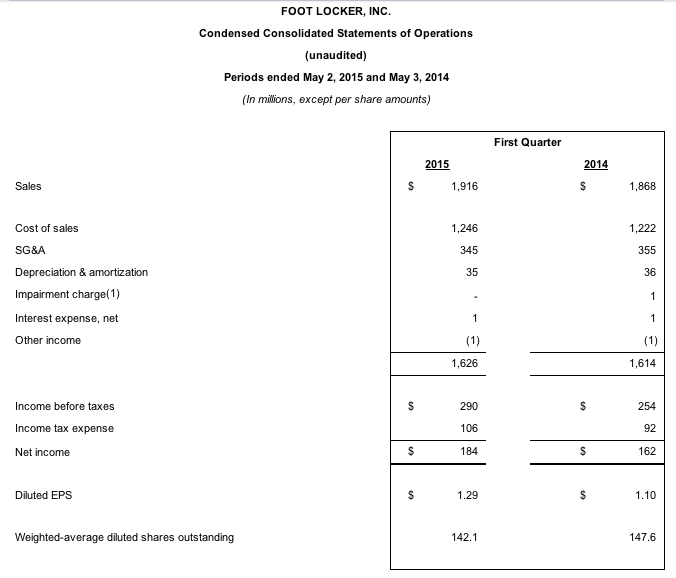

Net income for the company's first quarter ended May 2, 2015 was $184 million, or $1.29 per share, compared with net income of $162 million, or $1.10 per share, last year, a 17 percent increase on a per share basis. First quarter comparable-store sales increased 7.8 percent. Total first quarter sales increased 2.6 percent, to $1,916 million this year, compared with sales of $1,868 million for the corresponding prior-year period. Excluding the effect of foreign currency fluctuations, total sales for the first quarter increased 7.9 percent.

“We have hit the ground running in 2015, producing the most profitable quarter in our history,” said Richard Johnson, President and Chief Executive Officer. “We are focused on executing the updated strategic priorities that we described in our investor meeting in March, and the results in the first quarter demonstrate that we remain on the right track, with strong performances across our channels, geographies, banners, and categories. Our core business improved and we made progress on each of our growth pillars, a team accomplishment of which we are all very proud.”

The company's gross margin rate improved to 35.0 percent of sales from 34.6 percent a year ago, while the selling, general, and administrative expense rate improved to 18.0 percent of sales from 19.0 percent.

“The team at Foot Locker continued to execute efficiently during the quarter, both operationally and financially,” said Lauren Peters, Executive Vice President and Chief Financial Officer. “Driven by solid performance on the top line that flowed effectively to the bottom line, we delivered results which surpassed our guidance at the start of the year. We remain intent on improving the productivity of all of our assets as we strive to attain our recently elevated long-term goals.”

Financial Position

At May 2, 2015, the company's merchandise inventories were $1,234 million, 2.7 percent lower than at the end of the first quarter last year. Using constant currencies, inventory increased 2.4 percent.

The company's cash totaled $986 million, while the debt on its balance sheet was $133 million. The company spent approximately $129 million to repurchase 2.3 million shares during the quarter and paid its quarterly stock dividend of $0.25, spending $35 million.

Store Base Update

During the first quarter, the company opened 37 new stores, remodeled or relocated 55 stores, and closed 41 stores. As of May 2, 2015, the company operated 3,419 stores in 23 countries in North America, Europe, Australia, and New Zealand. In addition, 55 franchised Foot Locker stores were operating in the Middle East and South Korea, as well as 27 franchised Runners Point and Sidestep stores in Germany and Switzerland.