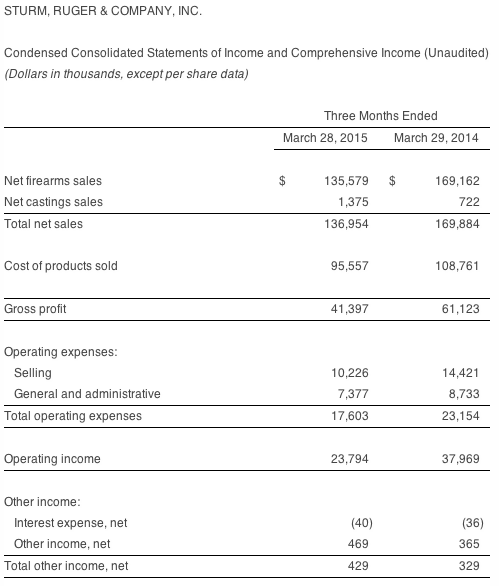

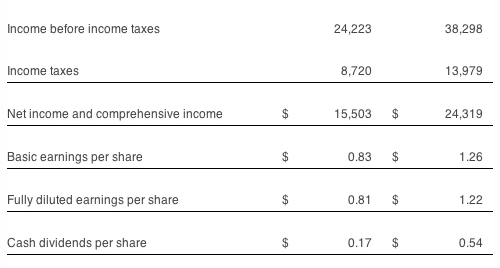

Sturm, Ruger & company, Inc. reported net sales of $137.0 million and fully diluted earnings of 81 cents per share, compared with net sales of $169.9 million and fully diluted earnings of $1.22 per share in the first quarter of 2014.

The company also announced that its board of directors declared a dividend of 32 cents per share for the first quarter for stockholders of record as of May 15, 2015, payable on May 29, 2015. This dividend varies every quarter because the company pays a percent of earnings rather than a fixed amount per share. This dividend is approximately 40 percent of net income.

Chief Executive Officer Michael O. Fifer made the following observations related to the company’s 2015 first quarter performance:

Demand for the company’s firearms in the first quarter of 2015 increased from the fourth quarter of 2014 due to the successful annual sales promotions in effect during the first quarter of 2015, coupled with a reduction in the aggressive price discounting by many of our competitors that was prevalent in the latter half of 2014.

In the first quarter of 2015, net sales and the estimated sell-through of the company’s products from the independent distributors to retailers increased 12 percent and 15 percent, respectively, from the fourth quarter of 2014. The National Instant Criminal Background Check System background checks (as adjusted by the National Shooting Sports Foundation) decreased 15 percent during the same period.

Inventory of the company’s products at the independent distributors decreased by 64,700 units during the first quarter of 2015 and the company’s finished goods inventory decreased by 53,100 units during the same period.

Earnings in the first quarter of 2015 increased 53 percent from the fourth quarter of 2014, excluding the expense related to the termination and settlement of the defined benefit pension plans in 2014.

New products, including the AR-556 modern sporting rifle and the LC9s pistol, represented $22.8 million or 17 percent of firearm sales in the first quarter of 2015. New product sales include only major new products that were introduced in the past two years.

Cash generated from operations during the first quarter of 2015 was $32.8 million. At March 28, 2015, our cash totaled $30.8 million. Our current ratio is 2.1 to 1 and we have no debt.

In the first quarter of 2015, capital expenditures totaled $4.3 million. We expect our 2015 capital expenditures to total approximately $30 million.

In the first quarter of 2015, the company returned $6.0 million to its shareholders through:

- the payment of $3.2 million of dividends, and

- the repurchase of 82,100 shares of our common stock in the open market at an average price of $34.57 per share, for a total of $2.8 million.

At Mar. 28, 2015, stockholders’ equity was $195.4 million, which equates to a book value of $10.46 per share.