Boosted by strong momentum in both basketball and running footwear, Foot Locker Inc. churned out a comp gain of 10.2 percent in the fourth quarter. Excluding currency fluctuations, comps were still up a healthy 6.7 percent.

Boosted by strong momentum in both basketball and running footwear, Foot Locker Inc. churned out a comp gain of 10.2 percent in the fourth quarter. Excluding currency fluctuations, comps were still up a healthy 6.7 percent.

Earnings rose 18.0 percent to $146 million, or $1.01 a share. Adjusted for non-recurring gains, EPS came to $1.00 per share, beating Wall Street's consensus estimate of 90 cents.

On a conference call with analysts, Dick Johnson, in his first investor call since succeeding Ken Hicks as president and CEO, noted that the company has now reached 20 consecutive quarters of “significant sales and profit growth.”

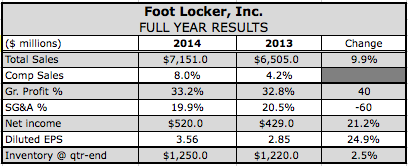

With a successful close, 2014 marked Foot Locker’s fifth consecutive year with double-digit EPS increases. Its net income margin was 7.3 percent in 2014, reaching the third of its long-range goals it has surpassed, along with EBIT margin and return on invested capital.

“We have made good progress towards our other key objectives – sales, sales per square foot, and inventory turns,” added Johnson.

One unique challenge was managing the West Coast port slowdown. On a c-n basis, inventories were up 6.6 percent at the close of the quarter as the company intentionally brought in extra merchandise to avoid any major port delay issues and support NBA All Star week. The effort would up supporting a mid single-digit comp gain in February.

“Yes, there was some impact and it will take some time to get fully back on schedule,” said Johnson of the port slowdown. “But we do not expect the backlog to have a material impact on our business, either in Q1 or the full year.”

By segment, direct-to-customer led the way, with a 21.9 percent sales gain for the quarter. Eastbay was up low double digits, while its U.S. store banner dot-com businesses were collectively up over 30 percent, said Lauren Peters, EVP and CFO, on the call. For the year, direct business had a comp gain of 17.8 percent, with Eastbay up mid-single digits and store banner dot-com sales up almost 40 percent.

The store segment saw an 8.5 percent comp gain for the quarter. Several U.S. banners produced double-digit gains, led by Footaction and Foot Locker with increases in the teens, followed by low double-digit gains in Kids Foot Locker and Lady Foot Locker. The gain at Lady Foot Locker was its third consecutive quarterly increase and its first double-digit gain in several years. Champs Sports was up mid-single digits as was its European businesses. Foot Locker Asia Pacific was up low double digits, while Foot Locker Canada grew high single digits.

By month, comps jumped low double-digits in November, supported by its Week of Greatness marketing campaign that now extends more than a week and has been exported to other Foot Locker banners globally. A high-single digit gain was seen in December and a low-double-digit gain in January.

By product category, footwear again led the way with comp gains in the teens, while apparel was down low single digits. Basketball and running footwear were both up double digits, with strong gains in both categories in all major regions

Johnson said the Jordan brand was again “very strong across all of our banners and geographies. The retro business continued to build momentum, the sportswear collection performed very well, and the Jordan player shoes also saw increases.”

Signature basketball “was also very strong,” with Kyrie Irving from Nike emerging as a strong seller. Established models from Lebron, Kobe and KD “also continued to perform at a high level.”

ClutchFit from Under Armour “had solid results” in the quarter, and “we're excited about the early performance” of the Seth Curry signature shoe so far from UA in Q1, said Johnson. Adidas’ styles from Lillard, Rose and Wall also contributed to the gains.

Running “was even stronger” than basketball, driven by lifestyle running silhouettes including the Roshe, Huarache, and various elements of the Max Air platform from Nike. Adidas, led by its ZX Flux shoe, as well as Puma, New Balance and Asics “are also developing encouraging lifestyle running footwear offerings.” The shift towards boots as a fashion item, led by Timberland and Nike, “contributed significantly to strong Q4 results in casual footwear,” Johnson added.

In apparel, Foot Locker was up high single-digits while Footaction gained in the teens. Banner differentiation efforts are helping both concepts with Foot Locker focused on a performance look and Footaction emphasizing lifestyle. Johnson still said apparel margins continue to trail footwear “so we have a lot of opportunity to get even stronger in this part of our business.”

Also encouraging was Lady Foot Locker, which saw an apparel gain in the double digits at a higher margin rate. The banner is successfully transitioning to a more premium positioning with partners such as Nike, Under Armour and Adidas. Said Johnson, “It is still a work in progress but we feel very well aligned with our vendors on the shared strategy of emphasizing and growing the women's athletic apparel business.”

On the downside, apparel decreased double digits in Foot Locker Europe with branded lifestyle programs, as well as private label, facing challenges. Apparel sales were down mid single digits at Champs Sports as a decline in licensed apparel and some of the same lifestyle programs impacting Foot Locker Europe wasn’t offset by gains in fleece tops and bottoms. Said Johnson, “We continue to work with our vendor partners to develop new or updated styles that we believe will begin to rebuild the apparel businesses at both Champs Sports and Foot Locker Europe in 2015.”

Gross margins improved 40 basis points to 32.9 percent. Lowering its markdown rate helped offset ongoing initial markup pressure and produced a slight improvement in merchandise margin on a c-n basis. SG&A expenses decreased to 19.6 percent of sales from 20.4 percent last year with the gains attributed to improve labor efficiencies.

The company’s banners continue to benefit from remodeling efforts. While store count was reduced by 50 units last year to 3,423 last year, square footage increased slightly because the stores being opened tend to be larger to support successful vendor shop-in-shops in remodeled stores.

The remodelings “continue to produce positive results” with more expected as part of Foot Locker’s plan first announced last month for $220 million in capital spending in 2015.

“Between these exciting, fresh store environments and powerful marketing programs, we were successful in driving an increase in traffic during the quarter,” said Johnson. “We continue to see higher average selling prices with footwear units increasing, as well.”

For the current year, Peters said the stronger dollar is “expected to be a significant headwind” to reported 2015 results. For instance, she noted that if exchange rates stay around where they are now, its 2015 EPS results will be 16 to 18 cents lower than at 2014 exchange rates.

The company expects to deliver a mid single-digit comp gain and a double-digit percentage earnings per share increase this year. However, it expects a low single-digit total sales increase due to the currency challenges.

Gross margin is expected to be flat to up slightly, particularly impacted by currency impacts on its international divisions, which have a higher gross margin rate than its domestic divisions. On the other hand, the SG&A rate is expected to improve 50 to 60 basis points, partly because the international divisions have higher SG&A expenses.

“Looking ahead,” Johnson concluded, “we intend to stay focused on our strategic priorities and seize opportunities to raise the bar again and achieve our next set of financial milestones, the details of which we look forward to sharing on March 16th at our New York headquarters.”