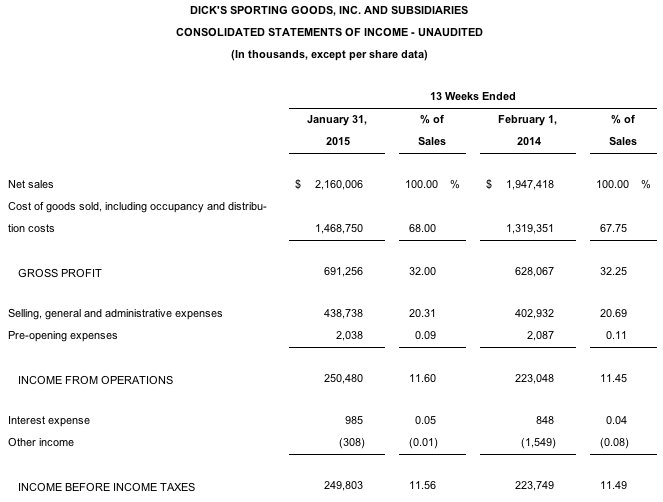

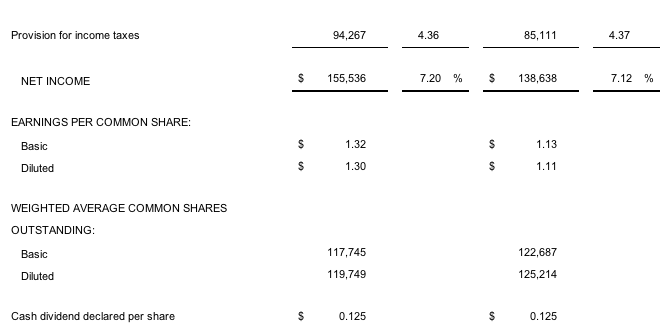

Dick's Sporting Goods Inc. reported consolidated net income for the fourth quarter ended Jan. 31, 2015 of $155.5 million, or $1.30 per diluted share, compared to the company's expectations provided on Nov. 18, 2014 of $1.18 to 1.28 per diluted share. For the fourth quarter ended Feb. 1, 2014, the company reported consolidated net income of $138.6 million, or $1.11 per diluted share.

Net sales for the fourth quarter of 2014 increased 10.9 percent to approximately $2.2 billion. Consolidated same store sales increased 3.4 percent compared to the company's guidance of an approximate 1 to 3 percent increase. Same store sales for Dick's Sporting Goods increased 3.8 percent, while Golf Galaxy decreased 7.1 percent. Fourth quarter 2013 consolidated same store sales increased 7.3 percent, adjusted for the shifted retail calendar due to the 53rd week in 2012.

“We are very pleased with the record results we delivered in the fourth quarter. The 17 percent increase in earnings per diluted share was driven by the continued growth of our omni-channel network, our powerful marketing and merchandising strategies, and the execution of these strategies by our store associates,” said Edward W. Stack, chairman and chief executive officer. “The strong performance validates the merchandising and space allocation strategies that we put into place during this past year. Our team also successfully navigated a heavily promotional environment while exceeding our top line and bottom line targets, and our inventory is well-positioned as we head into 2015.”

Omni-channel Development

E-commerce penetration for the fourth quarter of 2014 was 14.4 percent of total sales, compared to 12.2 percent during the fourth quarter of 2013. E-commerce penetration for the 52 weeks ended Jan. 31, 2015 was 9.2 percent of total sales, compared to 7.9 percent during the 52 weeks ended Feb. 1, 2014.

In the fourth quarter, the company opened six new Dick's Sporting Goods stores and closed two Golf Galaxy stores. As of Jan. 31, 2015, the company operated 603 Dick's Sporting Goods stores in 46 states, with approximately 32.3 million square feet, 78 Golf Galaxy stores in 29 states, with approximately 1.4 million square feet and 10 Field & Stream stores in five states, with approximately 0.5 million square feet.

Balance Sheet

The company ended fiscal 2014 with approximately $222 million in cash and cash equivalents as compared to $182 million at the end of fiscal 2013, with no outstanding borrowings under its $500 million revolving credit facility at the end of each fiscal year. In fiscal 2014, the company utilized capital to invest in omni-channel growth, and returned over $260 million to shareholders through share repurchases and quarterly dividends.

Total inventory was 12.9 percent higher at the end of the fourth quarter of 2014 as compared to the end of the fourth quarter of 2013.

Full Year Results

The company reported consolidated non-GAAP net income for the 52 weeks ended Jan. 31, 2015 of $347.8 million, or $2.87 per diluted share. On a GAAP basis, the company reported consolidated net income for the 52 weeks ended Jan. 31, 2015 of $344.2 million, or $2.84 per diluted share. For the 52 weeks ended Feb. 1, 2014, the company reported consolidated net income of $337.6 million, or $2.69 per diluted share. The GAAP to non-GAAP reconciliations are included in a table later in the release under the heading “Non-GAAP Net Income and Earnings Per Share Reconciliations.”

Net sales for the 52 weeks ended Jan. 31, 2015 increased 9.7 percent from last year's period to $6.8 billion due to the consolidated same store sales increase of 2.4 percent coupled with the opening of new stores.

Capital Allocation

On Feb. 18, 2015, the company's Board of Directors authorized and declared a quarterly dividend in the amount of $0.1375 per share on the company's Common Stock and Class B Common Stock. The dividend is payable in cash on Mar. 31, 2015 to stockholders of record at the close of business on Mar. 13, 2015. This dividend represents a 10 percent increase over the company's previous quarterly per share amount and is equivalent to an annualized rate of $0.55 per share.

In total for fiscal 2014, the company repurchased approximately 4.3 million shares of its common stock at an average price of $46.20 per share, for a total cost of $200 million. Since starting its $1 billion share repurchase authorization at the beginning of fiscal 2013, the company has repurchased over $455 million of common stock, and has approximately $545 million remaining under the authorization.

Current 2015 Outlook

The company's current outlook for 2015 is based on current expectations and includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as described later in this release. Although the company believes that the expectations and other comments reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations or comments will prove to be correct.

Full Year 2015

Based on an estimated 119 to 120 million diluted shares outstanding, the company anticipates reporting consolidated earnings per diluted share of approximately $3.10 to 3.20. The company's earnings per share guidance includes the expectation of approximately $100 to $200 million of share repurchases in 2015. For the 52 weeks ended Jan. 31, 2015, the company reported non-GAAP consolidated earnings per diluted share of $2.87 excluding a gain on the sale of an asset and golf restructuring charges. On a GAAP basis, the company reported consolidated earnings per diluted share of $2.84 for the 52 weeks ended Jan. 31, 2015.

Consolidated same store sales are currently expected to increase 1 to 3 percent, compared to a 2.4 percent increase in fiscal 2014.

The company expects to open approximately 45 Dick's Sporting Goods stores and relocate nine Dick's Sporting Goods stores in 2015. The company also expects to open approximately nine Field & Stream stores and relocate one Golf Galaxy store in 2015.

First Quarter 2015

Based on an estimated 120 million diluted shares outstanding, the company currently anticipates reporting consolidated earnings per diluted share of approximately 49 to 53 cents a share in the first quarter of 2015, compared to non-GAAP consolidated earnings per diluted share of 50 cents in the first quarter of 2014 excluding a gain on the sale of an asset. On a GAAP basis, the company reported consolidated earnings per diluted share of 57 cents in the first quarter of 2014.

Consolidated same store sales are currently expected to be approximately flat to an increase of 2 percent in the first quarter of 2015, compared to a 1.5 percent increase in the first quarter of 2014.

The company expects to open approximately nine Dick's Sporting Goods stores, open one Field & Stream store, relocate one Dick's Sporting Goods store and relocate one Golf Galaxy store in the first quarter of 2015.

Capital Expenditures

In 2015, the company anticipates capital expenditures to be approximately $245 million on a net basis and approximately $365 million on a gross basis. In 2014, capital expenditures were approximately $247 million on a net basis and approximately $349 million on a gross basis.