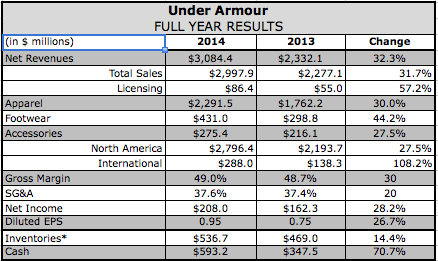

With a robust fourth-quarter led by double-digit gains in apparel and footwear, Under Armour crossed the $3 billion revenue mark in 2014. The bigger surprise was its acquisitions of Endomondo and MyFitnessPal that position the company as the dominant global player in digital health and fitness communities.

With a robust fourth-quarter led by double-digit gains in apparel and footwear, Under Armour crossed the $3 billion revenue mark in 2014. The bigger surprise was its acquisitions of Endomondo and MyFitnessPal that position the company as the dominant global player in digital health and fitness communities.

Highlights:

Acquires MyFitnessPal, a free resource for achieving health and fitness goals with more than 80 million registered users;

Acquires Endomondo, an open fitness tracking platform and social fitness network with 20 million registered users, approximately 80 percent outside of the U.S.;

Fourth-quarter sales were led by a 55.0 percent gain in footwear, with traction gaining in both running and basketball. The brand’s largest campaign starring Stephen Curry launches around the NBA All-Star Game;

Apparel grew 29.7 percent, its 21st consecutive quarter of 20 percent-plus growth in its core apparel business;

Direct-to-consumer Q4 revenues grew 27 percent;

International sales surged 108.2 percent in Q4 to represent 9.3 percent of revenues;

Maintained revenue outlook for 2015 but lowers earnings growth rate due to the two Connected Fitness acquisitions

On a conference call with analysts, Kevin Plank, CEO, said the fourth quarter marked his company’s 19 consecutive quarter of revenue growth over 20 percent with five consecutive quarters of 30 percent-plus growth. Plank added, “Heading into 2015, the confidence we have in our apparel and footwear business has never been higher, our execution never better, and our ambition never stronger.”

But Plank spent much of his allotted time discussing the Endomondo And MyFitnessPal acquisitions and how he sees his company’s evolving Connected Fitness platform becoming a primary differential against competitors in the marketplace.

“Brands that do not evolve, that do not offer their consumer something more than a product, will be hard-pressed to compete in 2015 and beyond,” said Plank. “We fully understand the massive shift in how our consumer will intersect with their favorite brands and these acquisitions firmly position us on the leading edge of that new paradigm.”

In early January, Under Armour acquired Endomondo for $85 million. Based in Copenhagen, Denmark, Endomondo has one of the largest global connected fitness communities with approximately 20 million registered users primarily concentrated in Europe, complementing Under Armour’s existing MapMyFitness platform.

In addition, the company agreed to acquire MyFitnessPal for a purchase price of $475 million. San Francisco-based MyFitnessPal is the leading resource for healthy living and nutrition with over 80 million registered users, expanding the current offerings for Under Armour's Connected Fitness platform to now include nutritional resources such as a calorie counter, nutrition and exercise tracker. The MyFitnessPal acquisition is expected to close in the first quarter.

Combined with MapMyFitness and the recent launch of the UA Record app and website, Under Armour will now be connected with over 120 million unique global consumers, representing the largest digital health and fitness community in the world.

Plank said one out of every five people in the U.S. has downloaded one of the apps in its platform, and it continues to add over 100,000 registered users every day. Geographically, 57 percent of its 120 million registered users are in in North America, providing an avenue to reach global consumers. It has 72 million women registered across its platform.

UA first entered the Connected Fitness space with the launch of its Armour39 measuring device in February 2011. The launch showed the potential of “measuring performance and how our consumers could benefit from it,” according to Plank. But the company soon realized that “the true value for an athletic brand was actually in the community” rather than a hardware tracking device.

That led to the December 2013 acquisition of MayMyFitness and further learnings that led to its launch at the recent Consumer Electronics Show of UA Record as the “daily destination dashboard” to a person’s fitness regimen, its partnership at the same time with HTC to develop product, and the latest two acquisitions.

On the one hand, the Connected Fitness investments will enable Under Armour to connect with active consumers.

“At the end of the day, the math is pretty simple,” added Plank. “The more active someone is, the more likely they are to buy athletic apparel and footwear.”

But Plank said the investments also “enable us to better anticipate our consumers' needs, drive more informed purchase decisions, and authentically build brand loyalty by helping our consumers lead a healthy life.”

And he particularly stressed that the “way consumers digest media and make their purchase decisions is undergoing such dramatic shifts,” and how important such community platforms are becoming for outreach and marketing.

“We built a $3 billion business by making great product and telling great stories, but there's nothing that says we must follow our competitors' playbook, especially when the way consumers digest media and make their purchase decisions is undergoing such dramatic shifts,” said Plank. “The net result of this shift is that our consumer is demanding more from athletic brands than just making shirts and shoes.”

In the fourth quarter, revenues jumped 31.1 percent to $895.2 million. Net income rose 36.7 percent to $87.7 million, or 40 cents a share, exceeding Wall Street’s consensus estimate of 39 cents.

Apparel sales climbed 29.7 percent to $707.7 million, supported by expanded platform innovations in ColdGear Infrared, Storm, and Charged Cotton. New innovation like Magzip, an open-ended magnetic zipper that aligns and locks into place without the use of both hands, “showcased our ongoing ability to bring value to the consumer,” said Brad Dickerson, CFO.

Particular areas of strength in apparel were training, golf, outdoor, and studio.

Footwear sales jumped 55.0 percent to $85.8 million, led by running and basketball. Running is benefiting from success across a broader price range, including the $100 Speedform Apollo, and is seeing market share gains within its core sporting goods distribution. Basketball also continues to gain momentum. Said Dickerson, “These categories, along with our ongoing strength in areas such as cleated and slides, position Under Armour as the number two overall footwear brand in some of our top wholesale accounts in 2014.”

Accessories advanced 22.2 percent to $79.0 million, primarily driven by headwear and gloves.

Direct-to-consumer revenues grew 27 and represented 38 percent of total revenues. Within North America, its factory house square footage grew 17 percent year-over-year to end with a 7 percent increase in store count and expansion at 14 existing locations during the year. It closed the year with 124 factory stores in the U.S.

On the full price side, UA closed the year with five brand house stores in North America. E-commerce traffic continued to migrate from desktop to mobile devices and UA saw conversion improvements from a new mobile site launched in September. A local e-commerce site was launched in the quarter in Singapore, its first site in Southeast Asia, following the launch of such sites in the U.K., Germany, and France in the third quarter.

Overall North America sales grew 25.3 percent to $808.2 million while international sales vaulted 131.1 percent to $87.0 million. In the EMEA region, continued strength was seen in the U.K., Germany, and France. It also commenced a new distributor agreement covering the Middle East. In Asia Pacific, store openings throughout Greater China and Southeast Asia supported growth. Latin America benefited from the early 2014 conversion of its Mexico distributor to an Under Armour subsidiary and expansions into Brazil and Chile. Its first South American brand house store opened in Santiago, Chile in the quarter.

Gross margin contracted 140 basis points in the quarter to 49.9 percent. As warned in its third-quarter conference call, about 90 basis points of the decline stemmed from a higher mix of international revenues, including the introduction of new lower margin distributor businesses. The strengthening of the U.S. dollar and higher freight costs to meet consumer demand each reduced gross margins by approximately 20 basis points.

SG&A expenses were reduced to 33.6 percent of sales from 36.9 percent, primarily reflecting higher incentive compensation expenses in the prior year's period. Operating income jumped 48.6 percent to $146.3 million.

Discussing 2014’s results, Plank said the 30 percent growth in apparel was aided by its the success of large platforms like ColdGear Infrared, Charged Cotton, and Storm and key categories like training, outdoor, golf, and women's studio. He also pointed to a strong reception to its “I Will What I Want” women’s campaign.

“We are focused on gaining additional floor space in these categories with our key wholesale sporting goods partners through improved merchandising and key initiatives like reinvigorating our core performance training apparel with the introduction of Armour, our reengineered base layer, featuring enhanced ventilation,” said Plank. “In addition, we see growth with our partners in the department store channel as we build out broader businesses there in women's and kids.”

Direct-to-Consumer grew 32 percent to just under $1 billion for the year with a strong factory house growth helped by increased footwear assortments. The opening of stores in in Tyson's Corner and SoHo in New York will be followed in the first quarter by its largest brand house yet at 30,000-square foot on Michigan Avenue in Chicago. Said Plank, “We know from our experience in the existing brand house stores, especially in Soho, that we are better positioned to tell great footwear stories and we'll expand on that as we build out new doors in 2015 and beyond.”

Footwear’s 44.2 percent gain in 2014 benefited from significant investments in talent, according to Plank. These include hiring Fritz Taylor, who formerly ran Mizuno’s run category, as VP Run last year. In January, ex-Nike exec Peter Ruppe was appointed SVP of Footwear.

The success of its athletes, including Tom Brady and Stephen Curry, are also supporting the footwear category. Its largest campaign starring Curry, who is the leading vote-getter for the NBA All-Star game, is being launched to support his signature $120 Curry One shoe with a second installment supporting the $130 Speedform Gemini.

Regarding footwear, Plank said Under Armour will likely “look back on 2014 as a pivotal year in the development of what may become our biggest engine for growth.”

International sales surged 108.2 percent in the year to $288.0 million, expanding its wholesale base and ending the year with 68 brand house stores outside the U.S., up from 18 doors in 2013. It expects to add more than 100 stores this year. The recent signing of Andy Murray, the number four-ranked tennis player, is also expected to support international growth.

Regarding 2015, Under Armour is maintaining its prior guidance of approximately 22 percent revenue growth. The strengthening dollar is expected to impact revenues by approximately 1 percentage point versus its prior guidance but the Connected Fitness acquisitions are expected to largely offset the currency impact.

Operating is expected to expand 12 percent to 15 percent down from expectations of 22 percent previously also due to the acquisitions. It estimates 90 basis points of operating margin dilution from these acquisitions, mostly within SG&A, offset with a slight gross margin benefit.