Shoe Carnival reported third quarter earnings were flat in the third quarter at $10.8 million, or 54 cents a share, exceeding its guidance calling for 45 to 51 cents a share. While store opening costs held back profit gains, the performance was aided by the launch of its first national advertising campaign and robust sales of boots.

Shoe Carnival reported third quarter earnings were flat in the third quarter at $10.8 million, or 54 cents a share, exceeding its guidance calling for 45 to 51 cents a share. While store opening costs held back profit gains, the performance was aided by the launch of its first national advertising campaign and robust sales of boots.

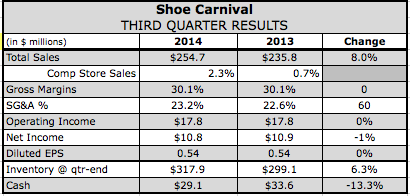

Sales grew 8.0 percent to $254.7 million with comps increasing 2.3 percent. It opened 41 new stores since the third quarter of 2013 and closed seven. Comparable store sales increased 2.3 percent. The firm had expected revenues to range between $247 and $252 million and comps to be in the range of down 1.0 percent to a 1.0 percent gain.

On a conference call with analysts, Cliff Sifford, president, CEO and chief merchandising officer, said the comp gain was primarily driven by the boot category across the family.

Although store traffic was down low single-digits, increases in average unit retail were significant, resulting in mid single-digit increase in our average transaction, said Sifford.

The 2.6 percent comp store increase in October was on top of last year’s October increase of 5.4 percent. Sifford attributed the October gain directly to its national advertising campaign, which particularly focused on its fashion boots lineup.

Strong boot sales at higher margins also lifted merchandise margin by 20 basis points while helping clear the last of its spring and summer merchandise. Sifford added, We believe that our key initiatives including national advertising, better brands in our women’s department, and a reinvigorated e-commerce presence are helping us to bring new customers to our store and our website.

Overall, gross margins were flat at 30.1 percent. SG&A was deleveraged by 60 basis points as a percent of sales due to an increase in expenses for new stores.

Among categories, womens non-athletic sales were up low single-digits on a comp basis. Boot comps were up in the mid-20s.

I believe our boot assortment is the best selection of boots we have ever offered and the strategy is working, said Sifford. Season-to-date, sales in boots for the family are up in the high 20s on a comparable store basis. This strong boot trend continued throughout the month of November as boots for the family produced a comparable store sales increase in the 30s.

Although dress shoes were flat on a comp basis, Shoe Carnival saw sequential improvement in the sales as we progressed through the quarter. Other strong categories were junior flats and vulcanized canvas. A downward trend continued to be seen in boat shoes, athletic sandals and sport sandals.

In men’s non-athletic, comps ended down slightly. Decreases in boat shoes and soccer slides, traditional BTS drivers, were only partly offset by double-digit gains in canvas casuals and fashion boots. Children’s saw a mid single-digit comp increase. Boots and canvas led girls while basketball, running and canvas led boys.

Adult athletics comps were up in the low single-digits for the quarter.

Said Sifford, We experienced a nice quarter in men’s and women’s running, men’s and women’s canvas, along with men’s cross training.

While the company doesnt report e-commerce figures, Sifford said the company was very pleased with the online sales increase in the quarter. On Sept. 16, it transitioned away from its third-party fulfillment arrangement and moved to a ship from store fulfillment model. Said Sifford, Our stores associates have embraced this strategy and are executing at a very high level. Today we have 250 Shoe Carnival stores capable of fulfilling e-commerce orders every day.

Shoe Carnival ended the quarter with inventory down approximately 0.6 percent of a percent on a per store basis, in line with expectations. Said Sifford, I continue to be pleased with our merchants execution of our turn initiative as they lowered inventory levels in our smaller volume stores while maintaining depth of key seasonal items in core basics.

In the quarter, seven stores were opened, including its first in the Philadelphia market, and one closed. As part of an internal review of its store base, it identified five stores for closure in the fourth quarter of 2014 and six stores for closure in 2015. The off-pricer will end the year with 400 stores and will look to open 20 to 25 stores in FY15.

For the fourth quarter, EPS is expected to be in the range of 6 to 10 cents a share, compared to 3 cents a year ago. Fourth-quarter net sales are projected to be in the range of $218 to $222 million with comps ahead in the range of 3 to 5 percent.

Sifford said the company believes its initiatives surrounding women’s better branded merchandise, enhanced marketing, and its upgraded e-commerce site has attracted a new, more affluent consumer.

We see this with the sell through of our better branded shoes and boots and the higher average retails in their respective categories, said Sifford. In addition, we still have the brands, strong promotions and our unique store environment keeping our core customer a loyal Shoe Carnival shopper year after year. Our results in November are evidence of this as we continued our positive comparable store sales trend on top of a record-breaking November last year.