Escalade, Incorporated announced that its board of directors has unanimously approved a plan to focus the company on the Sporting Goods segment. The company conducted a careful evaluation of each business unit with the objective of increasing shareholder value and redeploying capital where possible. The resulting plan includes the company's intent to sell the Information Security business.

The decision to divest the Information Security business, coupled with the previously announced sale of its Print Finishing business on June 30, 2014, will represent the company's complete exit from the Information Security and Print Finishing segment. Timing for the divesture of the Information Security business will be determined by market conditions, but is expected to be completed within one year. Escalade believes its focus on the Sporting Goods segment will facilitate better deployment of company resources, increased market leadership and greater returns for shareholders.

Following this decision, Escalade's Board of Directors increased the quarterly dividend on the company's common stock from $0.09 per share to $0.10, to be paid to all shareholders of record on September 14, 2014 and disbursed on September 21, 2014. Escalade's Board of Directors will evaluate its dividend policy on an ongoing basis, giving careful consideration to the company's financial condition, outlook, and potential cash flow requirements.

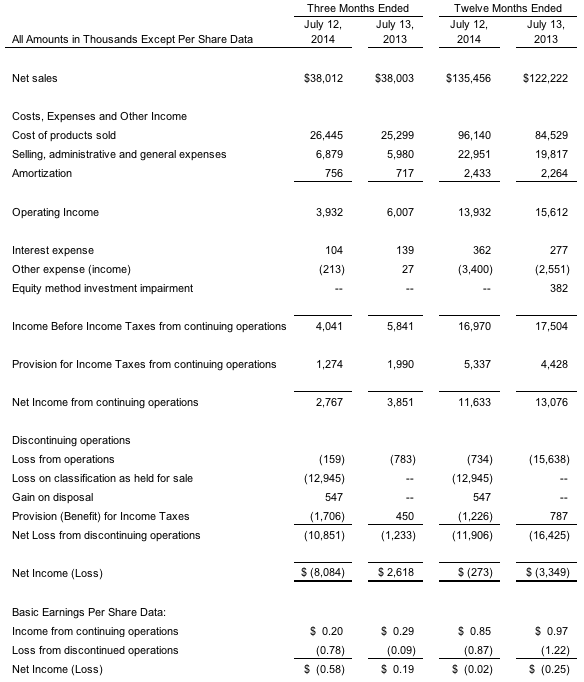

As a result of the decision to exit the Information Security business, effective as of the quarter ended July 12, 2014, the company incurred an impairment of certain assets totaling $12.9 million. Net loss for the second quarter of 2014 was $8.1 million, or 57 cents a share,compared to net income of $2.6 million or 19 cents for the same quarter in 2013. Operating income from Continuing Operations for the quarter was $3.9 million compared with $6.0 million for the same quarter in 2013, a 35 percent decline. The decline in operating profits is primarily driven by a lower sales volume and an unfavorable product mix in certain Sporting Goods categories, coupled with increased product research and development investments for which the benefit will be realized in future quarters.

Revenue from the Sporting Goods business was flat for the second quarter of 2014 and up 4 percent for the first half of 2014, compared with the same periods in 2013. During the first half of 2013, the company realized exceptional sales growth in certain categories that was not matched during the first half of 2014. The company expects improved sales growth for the remainder of the year.

Escalade Sports' brands include STIGA and Ping-Pong Table Tennis, Accudart and Unicorn darting, Goalrilla, Goaliath and Silverback sports training equipment and basketball goal systems, and Bear Archery, Trophy Ridge, and Cajun Bowfishing hunting products. In November 2013, it acquired DMI Sports, marketers of Arachnid, Nodor and Winmau darting, Prince and Head table tennis, and Minnesota Fats billiards.

The Sporting Goods gross margin ratio for the first half of 2014 was 31.3 percent compared to 33.6 percent for the same period in 2013. Decreased gross margin resulted from lower sales in certain higher margin categories and increased product research and development investments.

“We are excited to announce Escalade's clear strategic vision for the Sporting Goods segment,” stated Robert J. Keller, President and Chief Executive Officer of Escalade, Inc. “We are a team of sports and outdoor enthusiasts with a passion for innovation and a close connection to our brands and the active lifestyles they inspire. We look forward to building Escalade into a premier Sports and Outdoors company that will play an important leadership role in the $27 billion Sporting Goods equipment industry. Strong cash flow from profits in the Sporting Goods segment and proceeds from the sale of the Print Finishing business allowed the company to reduce its debt by more than 50% thus far in 2014. As a result, the company is pleased to increase its quarterly dividend.”