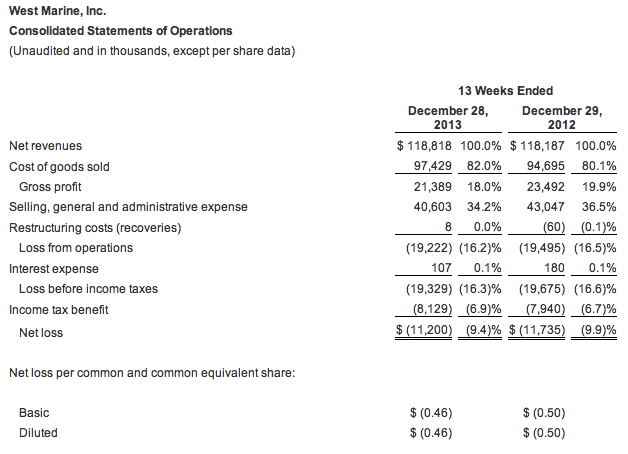

West Marine, Inc. slightly reduced its net loss in the fourth quarter to $11.2 million from $11.7 million a year ago. Net revenues increased 0.5 percent, to $118.8 million compared to $118.2 million for the fourth quarter of 2012. Comparable store sales also increased by 0.5 percent.

Net revenues for the fiscal year ended December 28, 2013 were $663.2 million, a decrease of 1.8 percent compared to net revenues of $675.3 million for fiscal year 2012. Comparable store sales for 2013 decreased by 1.8 percent when compared to the same period last year. For 2012, comparable store sales increased 3.1 percent.

Net income for fiscal year 2013 was $7.8 million, or 32 cents per diluted share, compared to fiscal year 2012 net income of $14.7 million, or $0.62 per diluted share. Excluding the impact of the $1.7 million valuation allowance recorded during the second half of this year, which resulted from a California tax law change, net income for full-year 2013 would have been $9.5 million, or 39 cents per diluted share.

“I would characterize 2013 as a challenging year due to the unusually cold, rainy and windy weather in many of our markets during the first half of the year,” said Matt Hyde, West Marine's CEO. “We were disappointed in the results, but we have continued to make great progress with our three key growth strategies: eCommerce development; merchandise expansion; and store optimization. Our growth strategies continue to evolve West Marine into a waterlife outfitter by offering broader product selections, a more appealing in-store experience and ease of shopping options.”

Total inventory as of Dec. 28, 2013 was $203.0 million, a $13.7 million, or 7.2 percent, increase compared to the balance at December 29, 2012, and a 6.4 percent increase on an inventory per square foot basis. Inventory turns for 2013 decreased by 1.1 percent versus last year.

The accompanying financial statements have been revised, primarily to reflect immaterial corrections of certain cash consideration received from our vendors that were previously recorded as a reduction of advertising in selling, general and administrative expense and are now reflected as a reduction to cost of goods sold. The revision included a decrease of $9.4 million to cost of goods sold and an increase of $9.3 million to selling, general and administrative expense which resulted in a $0.1 million increase to pre-tax income for fiscal 2012.

Fiscal 2014 Guidance

Our key financial projections for full-year 2014 are in the following ranges (note that fiscal 2014 is a 53-week fiscal year for West Marine):

- Net revenues of approximately $695 million to $710 million, an increase of 4.8 percent to 7.1 percent over 2013

- Comparable store sales growth of 3.5 percent to 6.0 percent

- EBITDA of $35.0 million to $37.5 million

- Pre-tax income of $16.0 million to $18.5 million

- Earnings per share of $0.39 to $0.45

Share Repurchase Program

Under our previously-announced share repurchase program, we repurchased 608,530 shares of our common stock in open-market transactions for $8.1 million during the fourth quarter of 2013 and the first seven weeks of fiscal 2014 at an average price of $13.37 per share. As of February 14, 2014, we had $1.3 million remaining under our current share repurchase authorization.

Founded in 1968 by a sailor, West Marine, Inc. has 287 stores located in 38 states, Puerto Rico and Canada.