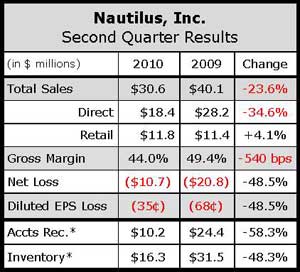

For the second consecutive quarter, Nautilus, Inc. saw sales for its Direct segment plummet more than 30% on tight consumer credit, easily offsetting moderate strength from the Retail segment and effectively crippling the company’s top line.

Net sales for the Vancouver, WA-based fitness company sank 23.6% for the second quarter ended June 30 as management continues to struggle–dealing with decreasing credit approval rates from HSBC, its third-party financing provider. Operating loss for the quarter was $6.8 million compared to a loss of $14.9 million a year ago.

Operating results from Q209 included a restructuring charge of $11.8 million that was related to a non-cash write-off of leasehold improvements in connection with the reduction of leased office space in the company’s corporate headquarters.

In a conference call with analysts, Nautilus CFO Ken Fish said a 40% year-over-year decrease in approval ratings dropped Direct sales 34.6% for the quarter, more than offsetting moderate growth from the company’s Retail segment. Gross margins for the direct segment fell 54.1%, down 440 basis points from the year-ago period due primarily to changes in product mix and increased customer discounts from sales promotions. Operating loss for the segment was $5.0 million as compared to a profit of $577,000 a year ago.

Despite the disappointing results from the Direct segment, however, Fish maintained that management does not believe the credit quality of consumers applying for credit in its direct business has declined in proportion to the rate of declining credit approvals from HSBC. Moreover, the company confirmed it has entered into a new agreement as of June 15 with GE Money Bank to become Nautilus’ new Tier 1 provider. The company said it began offering customers consumer credit financing programs from GE on August 9 and will fully complete the implementation in September.

Among other results, Fish said the company’s Retail business improved 4.1%. Gross margins in the Retail business were 26.4%, down 90 basis points from the year-ago period on “adjustments to certain previously recognized reserves for warranty costs.” Operating profit for the segment was $1.3 million, up 11.9% from $1.2 million a year ago.