Vail Resorts, Inc. reported fiscal 2025 third quarter net revenues amounted to $1.30 billion for the three-month period ended April 30, 2025, a 1.0 percent increase compared to net revenue of $1.28 billion in the prior-year fiscal Q3 period.

Mountain Segment

Total lift revenue increased 3.3 percent year-over-year (y/y) to $770.3 million in the third quarter, primarily due to an increase in pass product revenue of 5.5 percent that benefitted from an increase in pass pricing for the 2024/2025 North American ski season. Non-pass product lift revenue was said to be flat compared to the prior-year period and saw benefit from incremental non-pass revenue from Crans-Montana of $7.9 million and an increase in non-pass effective ticket price (ETP) – excluding Crans-Montana – of 6.6 percent. That upside was offset by decreased non-pass visitation at the company’s North American resorts. Total non-pass ETP, including the impact of Crans-Montana, increased 1.3 percent compared to the prior year.

Ski school revenue decreased 0.6 percent year-over-year (y/y), driven by decreased skier visitation, partially offset by increased lesson pricing and incremental revenue from Crans-Montana.

Dining revenue increased 1.4 percent y/y in fiscal Q3, driven by incremental revenue from Crans-Montana, partially offset by decreased skier visitation.

Retail & Rental revenue decreased $9.6 million, or 7.8 percent y/y.

- Retail revenues decreased $6.1 million, or 10.1 percent, reportedly driven by lower sales at on-mountain retail locations and decreased skier visitation.

- Rental revenues decreased $3.5 million, or 5.5 percent, also driven by decreased skier visitation.

Segment operating expense increased $19.2 million, or 3.4 percent, which was primarily attributable to incremental operating expenses from Crans-Montana and an increase in general and administrative expenses, partially offset by decreased variable expenses associated with decreased revenue upon which those expenses are based.

Mountain segment reported EBITDA decreased $3.2 million, or 0.5 percent, for the third quarter compared to the prior-year Q3 period, which includes $6.1 million of stock-based compensation expense for the fiscal 2025 Q3 period compared to $5.4 million in the prior-year Q3 period. Mountain segment results also include one-time operating expenses attributable to the Resource Efficiency Transformation plan of $3.9 million for the fiscal 2025 Q3 period, as well as acquisition and integration related expenses of $0.1 million and $1.3 million for the fiscal 2025 Q3 period and 2024, respectively.

Lodging Segment

Lodging segment net revenue (excluding payroll cost reimbursements) decreased $3.6 million, or 4.3 percent, to $78.7 million for the fiscal 2025 Q3 period as compared to the prior-year Q3 period, primarily due to a decrease in revenue from managed condominium rooms as a result of a net reduction in inventory of available managed condominium rooms proximate to the company’s mountain resorts, as well as decreased demand, which was impacted by decreased destination skier visitation.

Lodging Reported EBITDA decreased $3.5 million, or 22.1 percent, for the third quarter compared to the prior-year Q3 period, which includes $0.8 million of stock-based compensation expense for the fiscal 2025 Q3 period compared to $0.7 million in the prior-year Q3 period. Lodging segment results also include one-time operating expenses attributable to the company’s Resource Efficiency Transformation plan of $0.3 million for the fiscal 2025 Q3 period.

Resort EBITDA

Resort Reported EBITDA was $647.7 million for the fiscal 2025 Q3 period, a decrease of $6.6 million, or 1.0 percent, compared to the prior-year Q3 period, which includes one-time operating expenses attributable to the Resource Efficiency Transformation plan of $4.2 million for the fiscal 2025 Q3 period, as well as $0.1 million of acquisition related expenses for the third quarter of fiscal 2025 compared to $1.3 million of acquisition related expenses for the third quarter of the prior year.

Consolidated Net Income

Net income attributable to Vail Resorts, Inc. was $392.8 million, or $10.54 per diluted share, for the third quarter of fiscal 2025 compared to net income attributable to Vail Resorts, Inc. of $362.0 million, or $9.54 per diluted share, in the third quarter of the prior year.

Guidance Updated

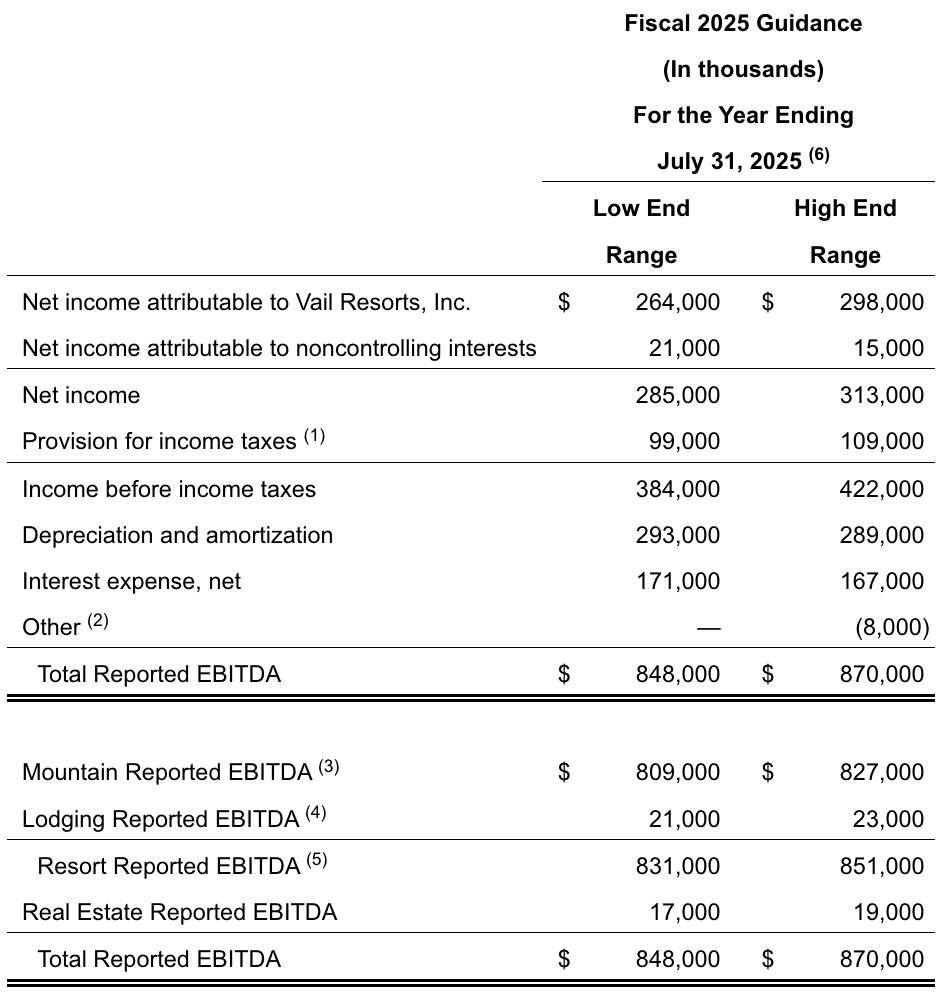

As a result of the lower than expected lift ticket visitation during the spring period announced on April 24, 2025, and one-time costs related to the CEO transition announced on May 27, 2025, the company is updating its guidance for fiscal 2025.

The company now expects net income attributable to Vail Resorts, Inc. to be between $264 million and $298 million, and Resort Reported EBITDA for fiscal 2025 to be between $831 million and $851 million. The guidance is said to reflect the lower-than-expected lift ticket visitation in the spring period that was partially mitigated by the company’s focus on its Resource Efficiency Transformation plan and strong cost discipline.

The updated guidance now includes an estimated $9 million in one-time costs related to the CEO transition, in addition to the estimated $15 million in one-time costs related to the multi-year Resource Efficiency Transformation plan, and the estimated $1 million of acquisition- and integration-related expenses specific to Crans-Montana. Compared to the original fiscal 2025 guidance, the updated guidance includes an estimated $7 million impact from foreign exchange rates. At the midpoint, the guidance implies an estimated Resort EBITDA Margin for fiscal 2025 to be approximately 28.4 percent or 29.2 percent before one-time costs from the Resource Efficiency Transformation plan and CEO transition.

The updated guidance also assumes a continuation of the current economic environment and normal weather conditions and operations throughout the Australian ski season and North America summer season. In addition, the updated guidance also reflects foreign currency exchange rate volatility as compared to the assumptions included in the original guidance provided on September 26, 2024. The updated guidance assumes foreign currency exchange rates as of June 4, 2025, including an exchange rate of 73 cents between the Canadian dollar and U.S. dollar related to the operations of Whistler Blackcomb in Canada, an exchange rate of 65 cents between the Australian dollar and U.S. dollar related to the operations of Perisher, Falls Creek and Hotham in Australia, and an exchange rate of $1.21 between the Swiss franc and U.S. dollar related to the operations of Andermatt-Sedrun and Crans Montana in Switzerland, and does not include any potential impacts related to future fluctuations in foreign currency exchange rates, which may be impacted by tariffs, trade disputes, or other factors.

The following table reflects the forecasted guidance range for the company’s fiscal year ending July 31, 2025 for Total Reported EBITDA (after stock-based compensation expense) and reconciles net income attributable to Vail Resorts, Inc. guidance to such Total Reported EBITDA guidance.

Capital Structure and Allocation Update

The company’s total liquidity as measured by total cash plus revolver availability and delayed draw term loan availability was approximately $1.6 billion at quarter-end. This includes $467 million of cash on hand, $508 million of U.S. revolver availability and $450 million of U.S. delayed draw term loan availability under the Vail Holdings Credit Agreement, and $215 million of revolver availability under the Whistler Credit Agreement. As of April 30, 2025, the company’s Net Debt was 2.6 times its trailing twelve months Total Reported EBITDA.

Regarding the return of capital to shareholders, the company declared a quarterly cash dividend on Vail Resorts’ common stock of $2.22 per share. The dividend will be payable on July 9, 2025 to shareholders of record as of June 24, 2025. In addition, the company repurchased approximately 0.2 million shares during the quarter at an average price of approximately $161 per share for a total of $30 million. This amount brings the company’s total fiscal year-to-date repurchases to $70 million for a total of 0.4 million shares. Additionally, the Board of Directors increased the company’s authorization for share repurchases by 1.5 million shares to approximately 2.8 million shares.

Regarding calendar year 2025 capital expenditures, as previously announced, the company expects its capital plan for calendar year 2025 to be approximately $198 million to $203 million in core capital, before $46 million of growth capital investments at its European resorts, comprised of $42 million at Andermatt-Sedrun and $4 million at Crans-Montana, and $6 million of real estate related capital projects to complete multi-year transformational investments at the key base area portals of Breckenridge Peak 8 and Keystone River Run, and planning investments to support the development of the West Lionshead area into a fourth base village at Vail Mountain. Including European growth capital investments and real estate related capital, the company plans to invest approximately $249 million to $254 million in calendar year 2025. Key capital investments include the multi-year transformational investment plans at Park City Mountain, which includes the new Sunrise gondola out of the Canyons base area, along with beginner terrain improvements and restaurant upgrades, in addition to the investments at Andermatt-Sedrun and a six-pack lift at Perisher, new functionality for the My Epic App, more advanced AI capabilities for My Epic Assistant, and technology investments across the company’s ancillary businesses.

Commenting on capital allocation, Katz said, “We remain committed to a disciplined and balanced approach as stewards of our shareholders’ capital. We continue to prioritize investments that enhance our guest and employee experience, provide high-return capital projects, and enable strategic acquisition opportunities. After these priorities, we focus on returning excess capital to shareholders. In the current environment, the company looks to balance its approach between share repurchases and dividends. The current dividend level reflects the strong cash flow generation of the business with any future growth in the dividend dependent on a material increase in future cash flows and the company also maintains an opportunistic approach to share repurchases based on the value of the shares.”

Season Pass Sales

Commenting on the company’s season pass sales for the upcoming North American ski season, Katz said, “Pass product sales through May 27, 2025 for the upcoming North American ski season decreased approximately 1 percent in units and increased approximately 2 percent in sales dollars as compared to the period in the prior year through May 28, 2024. Given elevated levels of macro-economic volatility that occurred throughout the spring selling period, it is currently unknown what, if any, impact that had on early pass decision making. Pass sales dollars are benefiting from the 7 percent price increase relative to the 2024/2025 season, partially offset by the mix impact from the growth of Epic Day Pass products. Pass product sales are adjusted to eliminate the impact of foreign currency by applying an exchange rate of $0.73 between the Canadian dollar and U.S. dollar in both periods for Whistler Blackcomb pass sales.

Katz continued, “The slight decline in units relative to the prior year season to date period was primarily driven by new pass holders and lower tenured renewing pass holders, which may reflect delayed decision making due to the macro-economic environment. Epic Day Pass products experienced strong unit growth driven by the strength in renewing pass holders. Overall renewing pass holder product net migration was relatively consistent with the prior three years.

“The majority of our pass selling season is ahead of us, and we believe the full year pass unit and sales dollar trends will be relatively stable with the spring results. We will provide more information about our pass sales results in our September 2025 earnings release.”

Regarding Epic Australia Pass sales, Katz commented, “Epic Australia Pass sales through May 28, 2025 increased approximately 20 percent in units and approximately 8 percent in sales dollars as compared to the period in the prior year through May 29, 2024. Epic Australia Pass sales are benefitting from the successful introduction of the Epic Australia 4-Day Pass, which is resonating with lower frequency skiers and riders in Australia.”

Image courtesy Vail Resorts, Inc.