Macy’s, Inc. saw first-quarter sales growth at Bloomingdale’s, and Bluemercury offset by a decline at Macy’s for the 13-week period that ended May 3. Net sales declined 5.1 percent year-over-year (inclusive of store closures) to $4.6 billion, with comparable sales down 2.0 percent on an owned basis and down 1.2 percent on an owned-plus-licensed-plus-marketplace basis.

Macy’s, Inc. go-forward business comparable sales were down 1.8 percent on an owned basis and down 0.9 percent on an owned-plus-licensed-plus-marketplace basis. By nameplate:

- Macy’s net sales were down 6.5 percent, inclusive of store closures, with comparable sales down 2.9 percent on an owned basis and down 2.1 percent on an owned-plus-licensed-plus-marketplace basis.

- Macy’s go-forward business comparable sales were down 2.7 percent on an owned basis and down 1.9 percent on an owned-plus-licensed-plus-marketplace basis.

- Reimagine’s comparable sales at 125 locations were down 1.3 percent on an owned basis and down 0.8 percent on an owned-plus-licensed basis.

- Bloomingdale’s net sales were up 2.6 percent, with comparable sales up 3.0 percent on an owned basis and up 3.8 percent on an owned-plus-licensed-plus-marketplace basis.

- Bluemercury net sales were up 0.8 percent, and comparable sales were up 1.5 percent on an owned basis.

- Other revenue of $194 million increased $40 million, or 26.0 percent. Within Other revenue:

- Credit card net revenues increased $37 million, or 31.6 percent, to $154 million.

- Macy’s Media Network net revenue rose $3 million, or 8.1 percent, to $40 million.

Profitability and Expenses

Gross margin rate was 39.2 percent in the first quarter, flat year-over-year, reflecting improved merchandise margin offset by higher delivery expense as a percent of net sales.

Selling, general and administrative (SG&A) expense of $1.9 billion increased $2 million. The company said it reinvested savings from closed locations and its end-to-end operations efforts into customer-facing initiatives within its go-forward business, including those at Reimagine 125 locations, Bloomingdale’s and Bluemercury. As a percent of total revenue, SG&A expense increased 170 basis points to 39.9 percent, driven by lower net sales.

Asset sale gains of $16 million increased $15 million.

GAAP net income was $38 million, or 0.8 percent of total revenue, and Adjusted net income was $46 million, or 1.0 percent of total revenue. In the first quarter of 2024, GAAP net income was $62 million, or 1.2 percent of total revenue, and Adjusted net income was $77 million, or 1.5 percent of total revenue.

GAAP and Adjusted diluted earnings per share (EPS) were 13 cents and 16 cents, respectively. In the first quarter of 2024, GAAP and Adjusted diluted EPS were $0.22 and $0.27, respectively.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was $324 million, or 6.8 percent of total revenue, and Core Adjusted EBITDA was $308 million, or 6.4 percent of total revenue. In the first quarter of 2024, Adjusted EBITDA was $364 million, or 7.3 percent of total revenue, and Core Adjusted EBITDA was $363 million, or 7.3 percent of total revenue.

Balance Sheet and Liquidity

The company ended the first quarter of 2025 with cash and cash equivalents of $932 million.

Merchandise inventories decreased 0.5 percent year-over-year.

Based on the strength of its balance sheet, the company amended its asset-based credit facility on April 9, 2025. The company extended the maturity date of its facility to April 2030 from March 2027, proactively reducing borrowing capacity to $2.1 billion from $3.0 billion and improving flexibility through revised terms. As of the end of the first quarter of 2025, the company had $2.0 billion of available borrowing capacity under its asset-based credit facility.

As of the end of first quarter of 2025, total debt of $2.8 billion included no material long-term debt maturities until 2027.

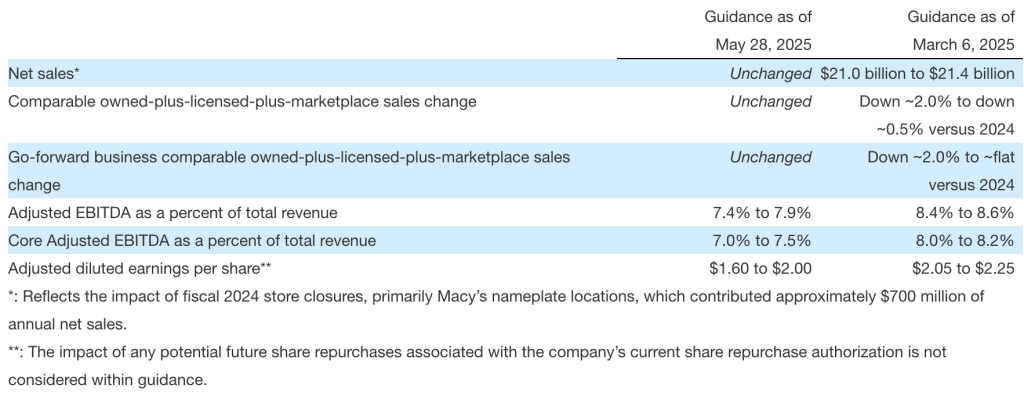

2025 Guidance

The company has revised its annual outlook based on current information to account for several factors, including initial and current tariffs, some moderation in consumer discretionary spending and a heightened competitive promotional landscape.

Despite these challenges, the company said it is confident that its strong financial position, diverse brand and category offerings, and range from off-price to luxury provide flexibility to adapt to these changes.

Revised Guidance

Image and chart courtesy Macy’s, Inc.