After the U.S. and China last week agreed to take a break from the tit-for-tat tariff oneupmanship game they have conducted since U.S. President Donald Trump fired the first salvo of the tariff battle, the U.S. confirmed it was maintaining the elimination of the “de minimis” exemption, which allows a company to avoid U.S. tariffs for shipments under $800.

According to a recent congressional report, the rule elimination mainly affects direct-to-consumer e-commerce sites like ultra-discount Chinese retailers Shein and Temu, which account for around 30 percent of the de minimis affected shipments. However, it also affects U.S. retailers positively, as Consumer Edge found in its late April consumer survey.

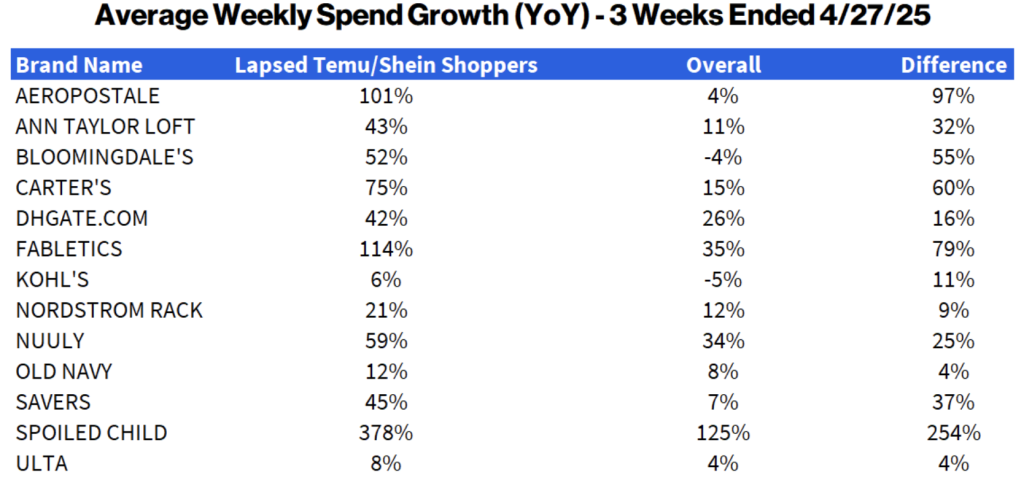

“In the three weeks leading up to April 27, American brands including Old Navy, Ulta Beauty, Nordstrom Rack, and Savers Value Village picked up a significant amount of redirected consumer dollars from former Temu and Shein shoppers,” the firm stated in the survey report.

According to its Consumer Edge data, U.S. spending growth has dramatically slowed for Temu and Shein amid increasing U.S./China trade tensions and eliminating the de minimis loophole supporting both companies’ low-price models. Consumer Edge U.S. transaction data showed that Temu’s year-over-year spend growth decelerated from up ~50 percent on April 9 to nearly flat at the end of the month, as its advertising pullback pressured sales. Shein’s growth slowed from up ~30 percent to up ~20 percent.

“This dramatic slowdown coincides with rising U.S.-China trade tensions, the elimination of the duty-free de minimis treatment for low-value imports and a reduction in advertising spend that had previously fueled both platforms’ rapid growth,” Consumer Edge suggested.

To identify where consumers spent their money, Consumer Edge analyzed shoppers who made at least two purchases at Temu or Shein in January or February 2025 but no purchases in March or April.

As U.S./China trade tensions pressure ultra-discount growth, brands like Old Navy, Ulta and Nordstrom Rack are winning share from value-driven consumers seeking affordable alternatives, but even Bloomingdales is picking up share.

- Legacy department stores reclaim value shoppers: Bloomingdale’s, Kohl’s and Nordstrom Rack are pulling in significant dollars from ex-Temu and Shein shoppers, benefiting from their wide selections across categories.

- Old Navy regains market share: Long known for its affordability, Old Navy is reclaiming cost-conscious shoppers and capturing spending from those moving away from ultra-discount platforms. Its broad assortment of clothing for all ages and genders continues to resonate.

- Resale gains ground: Savers Value Village also sees momentum as resale becomes the new value frontier.

- Beauty shoppers shift: Ulta Beauty and SpoiledChild benefit from consumers looking to make personal care swaps.

“The data isn’t just showing a slight dip; we’re seeing a rapid reallocation of spend from these popular Chinese discount platforms, and we’re able to isolate exactly who’s driving it,“ said Michael Gunther, VP, head of Insights at Consumer Edge.

“Our cohort analysis gives us the ability to track what former Temu and Shein shoppers are doing now, not just in general, but down to the specific brands seeing surges in growth among this group.

“The current political and economic climate, including policy shifts and pricing pressures, is causing U.S. consumers to alter their spending behavior drastically. Our near-real-time data shows where this significant shift in spend is landing,” concluded Gunther.

Image courtesy Nordstrom Rack