Callaway President and CEO Chip Brewer said the company was pleased with its first quarter results as it reportedly met or beat plan in all business segments. However, given that all three company segments were down year-over-year in the first quarter, the spin-off of the Topgolf business and the sale of Jack Wolfskin cannot come soon enough for this once iconic company.

“We are particularly pleased with the performance of our Golf Equipment business, where the Elyte Driver received numerous awards, and we started to benefit from the cost reduction and margin improvement initiatives we began implementing in 2024,” Brewer said. “We are also pleased we entered into an agreement to sell the Jack Wolfskin business, as this will allow us to focus and optimize our resources on our core business and will further enhance our balance sheet and liquidity ahead of our planned separation of Topgolf.”

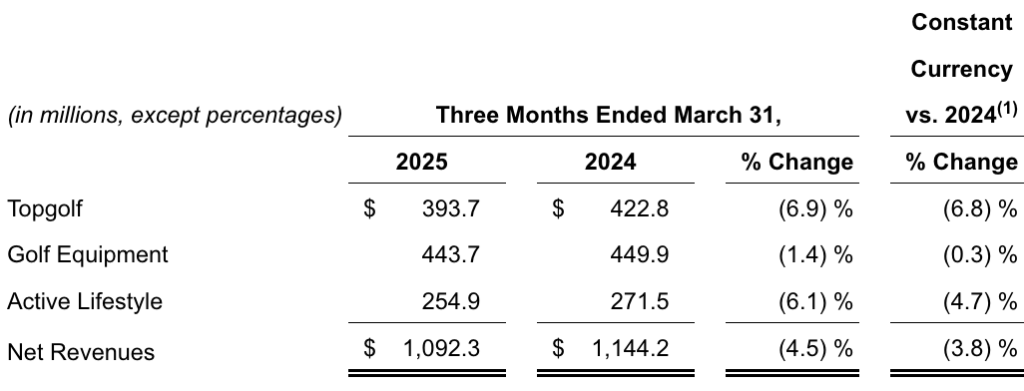

The company posted net revenue of $1.09 billion in the first quarter, a 4.5 percent year-over-year decrease. Brewer said the result was better than expected and was primarily due to the reduction of Topgolf same-venue sales, the rightsizing of the Jack Wolfskin business and unfavorable changes in foreign currency rates.

On a GAAP basis, operating income was approximately flat at $66.5 million. On a non-GAAP basis, income from operations increased $15.2 million to $87.8 million, driven by a $10.6 million increase in segment operating income, led by increases in its Golf Equipment and Active Lifestyle segments.

Adjusted EBITDA of $167.3 million increased 4.0 percent versus the prior year, primarily driven by increased profitability in the Golf Equipment and Active Lifestyle segments.

Segment Net Revenues

First quarter Net Revenues by segment:

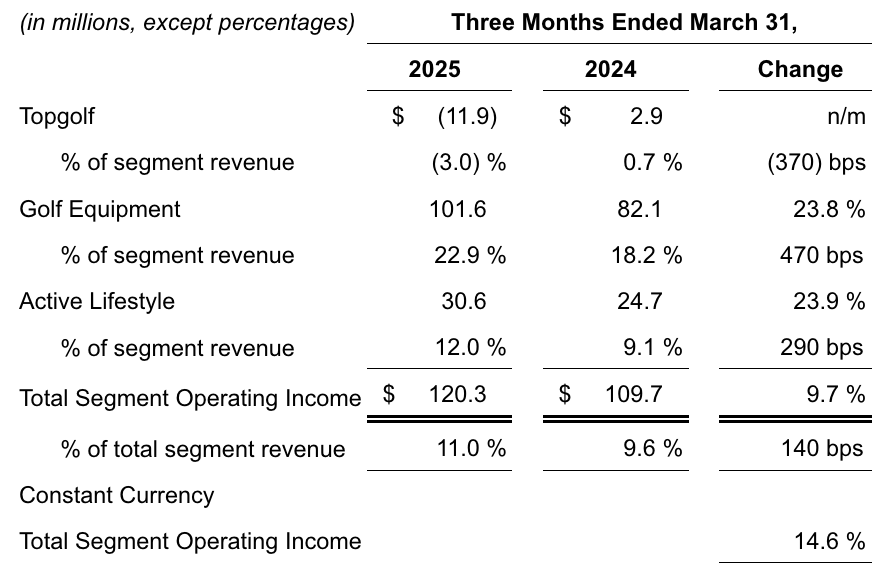

Segment Operating Income

First quarter Operating Income by segment:

Segment Summary

(nnless otherwise noted, comparisons to prior periods are calculated year-over-year.)

Golf Equipment

Revenue decreased $6.2 million to $443.7 million, primarily due to unfavorable foreign currency rates and a more competitive launch environment as all four OEM’s launched full new wood lineups in the first quarter, as expected.

Segment operating income increased $19.5 million to $101.6 million, primarily driven by improved gross margin performance, the favorable impact of cost savings initiatives and a lease termination incentive for our Japan subsidiary.

Topgolf

Segment revenue decreased $29.1 million to $393.7 million, with a decline in same-venue sales offsetting revenue from

new venues. Same-venue sales declined 12 percent, which is in line with expectations.

The segment posted an operating loss of $11.9 million in Q1 2025, compared to segment operating income of $2.9 million in the year-ago Q1 period, a decrease of $14.8 million year-over-year.

Adjusted EBITDA decreased by $15.9 million to $43.9 million, reportedly due primarily to the decline in same-venue sales, partially offset by ongoing cost reduction efforts.

Active Lifestyle

Revenue decreased $16.6 million year-over-year to $254.9 million, reportedly due to the planned rightsizing of the Jack Wolfskin business in Europe, partially offset by continued growth in China.

Operating income increased by $5.9 million in Q1, primarily driven by cost savings initiatives at Jack Wolfskin, which resulted from the rightsizing of that business and improved gross margins.

Balance Sheet Summary

Available liquidity, comprised of cash on-hand plus availability under the company’s credit facilities, increased $85.3 million to $805.0 million compared to March 31, 2024.

Inventory decreased $49.0 million year-over-year to $653.9 million, due to the $75.3 million reclassification of Jack Wolfskin inventory to Current Assets Held for Sale.

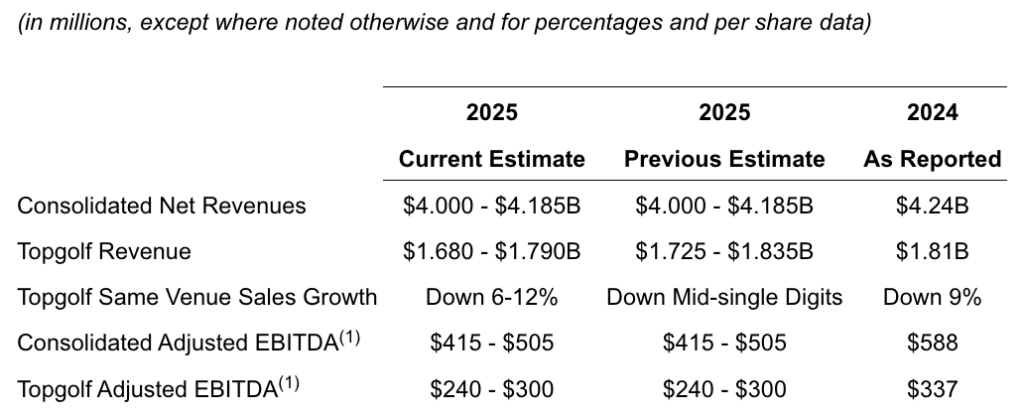

Full-Year 2025 Business Outlook

Despite the current macroeconomic conditions with increased tariffs and a softer consumer environment, and as a result of the company’s strong start to the year, improving foreign currency rates, and actions the company is taking to reduce costs and mitigate the impact of the current tariffs, the company said it is maintaining its prior consolidated full year revenue and adjusted EBITDA guidance (subject to adjustment for the pending sale of its Jack Wolfskin business).

However, due to the softer consumer environment, the company said it is decreasing its estimated same-venue sales guidance for Topgolf and, as a result, the overall revenue guidance for the Topgolf segment. Despite this decrease in forecasted revenue and due to the cost reduction actions and additional improvements in operational efficiencies, the company said it is maintaining the Adjusted EBITDA guidance for Topgolf.

Second Quarter 2025 Business Outlook

The company said the second quarter revenue outlook includes the expectation for a more competitive launch environment in the Golf Equipment business, the continued impact from the rightsizing of the Jack Wolfskin business, the effect from the sale of the WGT gaming business in December 2024 and a projected decline in same venue sales, which the company expects to be in the range of down 7 percent to down 12 percent at Topgolf.

The second quarter EBITDA outlook includes the expectation for an approximately $22 million negative impact related to hedging losses, tariffs and the sale of WGT.

Full Year Outlook

Second Quarter Outlook

The company’s guidance includes its Jack Wolfskin business. The company, however, previously announced that it had agreed to sell its Jack Wolfskin business. Assuming that the sale is completed, which the company expects to occur in late Q2 or early Q3, the guidance will automatically be adjusted to exclude the Jack Wolfskin business results for the balance of the year as of the date the sale is final.

While the company is not providing updated guidance for its Jack Wolfskin business at this time, the company previously disclosed that embedded in its February 24, 2025, full year guidance was an estimate for its Jack Wolfskin business of approximately €325 million in revenue and €12 million of Adjusted EBITDA.

Given the typical seasonality of the Jack Wolfskin business, this full year estimate is comprised of approximately (a) €115 million in revenue and a loss of Euro 18 million of Adjusted EBITDA for the first half of 2025 and (b) €210 million in revenue and €30 million of Adjusted EBITDA in the second half of 2025.

“Looking forward, based upon what we know today, we believe our strong start to the year, improving foreign currency exchange rates, and actions we are taking to both reduce costs and mitigate the impact of the current tariff rates, will allow us to maintain our consolidated full year Revenue and Adjusted EBITDA guidance,” Brewer continued. “This is clearly going to be an interesting year, but we believe we are well positioned to create shareholder value via: building on our core strengths, achieving our consolidated financial goals, and through the sale of our Jack Wolfskin business and the planned separation of Topgolf.”

Image courtesy Callaway Golf