Skechers U.S.A., Inc. reported record sales of $2.41 billion in the first quarter, a year-over-year increase of 7.1 percent. Sales were $2.46 billion on a constant-currency (cc) basis, a year-over-year increase of 9.0 percent.

- Wholesale sales growth was 7.8 percent year-over-year (y/y).

- Direct-to-Consumer (DTC) sales increased 6.0 percent y/y.

- International sales increased 7.2 percent y/y.

- Domestic increased 6.9 percent y/y.

“For the first quarter, we delivered record quarterly sales of $2.41 billion, reflecting strong global demand across both our wholesale and direct-to-consumer segments with international sales representing 65 percent of our business,” began David Weinberg, COO of Skechers.

- EMEA sales increased 14 percent y/y;

- Americas sales increased 8 percent y/y;

- APAC sales decreased 3 percent y/y; and

- APAC, when excluding China, increased 12 percent y/y.

“We believe Skechers has significant growth opportunities in China, and we will continue to invest in product, marketing and infrastructure to expand and support our presence. At the core of our success is our diverse offering of comfort technology products available at accessible prices across a variety of distribution channels. We remain focused on innovation within our established and successful lifestyle collections, growing our high-performance footwear offering, and investing in brand demand creation as we continue to drive future growth globally,” concluded David Weinberg.

“For more than thirty years, our focus on comfort, innovation, style and quality at an affordable price has been the cornerstone of our success,” stated Skechers CEO Robert Greenberg, . “Our record first-quarter sales are a testament to the resilience of our brand as we continue to see broad-based global demand. We believe our distinct value proposition will be even more vital as consumers navigate the current economic volatility. With new product developments featuring our Hands Free Slip-ins technology, we have an even stronger and more diverse offering for men, women and kids that meet the needs and interests of consumers.

“Our innovative features are highlighted through fresh global marketing campaigns featuring celebrities like Howie Mandel and Martha Stewart, as well as tailored regional approaches for China, Japan, across Europe, and other key markets. Elite athletes, including Julius Randle, Clayton Kershaw, Brooke Henderson and Harry Kane, are endorsing our technical performance footwear, attesting to its Comfort that Performs on courts, pitches, and beyond. Key opinion leaders and influencers at all levels across continents are advocating for the comfort and convenience of Skechers footwear. With the flexibility and determination of the entire Skechers organization, we will continue to innovate and deliver best-in-class footwear around the world,” offered Robert Greenberg.

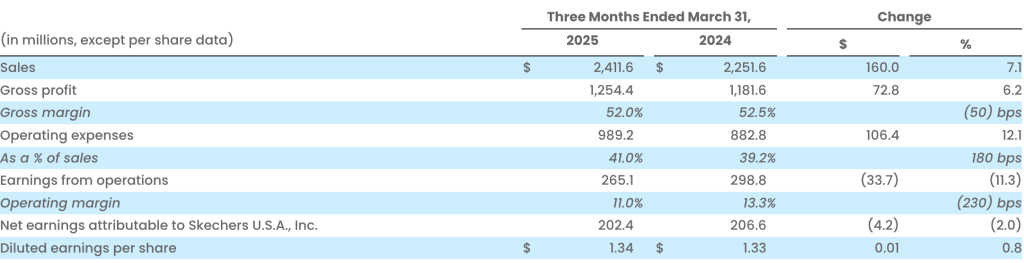

First Quarter 2025 Financial Results

Wholesale sales grew $110.5 million, or 7.8 percent, including increases in EMEA of 13.0 percent and AMER of 7.3 percent, partially offset by a decrease in APAC of 0.6 percent. Wholesale volume increased by 9.1 percent, and the average selling price declined by 1.3 percent.

DTC sales grew $49.5 million, or 6.0 percent, including increases in AMER of 9.8 percent and EMEA of 21.7 percent, partially offset by a decrease in APAC of 4.4 percent. DTC volume increased 6.3 percent and average selling price declined 0.3 percent.

Gross margin was 52.0 percent, a decrease of 50 basis points, due to lower average selling prices.

Operating expenses increased $106.4 million, or 12.1 percent, and, as a percentage of sales, increased 180 basis points to 41.0 percent. Selling expenses increased by $28.6 million or 18.3 percent, and, as a percentage of sales, increased by 70 basis points to 7.7 percent, primarily due to higher global demand creation expenditures. General and administrative expenses increased $77.8 million or 10.7 percent, and, as a percentage of sales, increased 110 basis points to 33.3 percent, primarily driven by labor and facility costs, including rent and depreciation.

Earnings from operations decreased $33.7 million, or 11.3 percent, to $265.1 million.

Net earnings attributable to Skechers were $202.4 million, and diluted earnings per share were $1.34, compared with the prior year’s net earnings of $206.6 million and diluted earnings per share of $1.33. The current quarter included a favorable impact due to foreign currency exchange rates of 17 cents per share.

Balance Sheet

Cash, cash equivalents, and investments totaled $1.24 billion, a decrease of $143.5 million, or 10.4 percent, from December 31, 2024, due to working capital changes and $147.1 million of capital expenditures, partially offset by earnings.

Inventory was $1.77 billion at quarter-end, a decrease of $145.6 million, or 7.6 percent, from December 31, 2024.

Outlook

Due to macroeconomic uncertainty stemming from global trade policies, the company is not providing financial guidance and is withdrawing its annual 2025 guidance provided in the company’s earnings release reported on February 6, 2025.

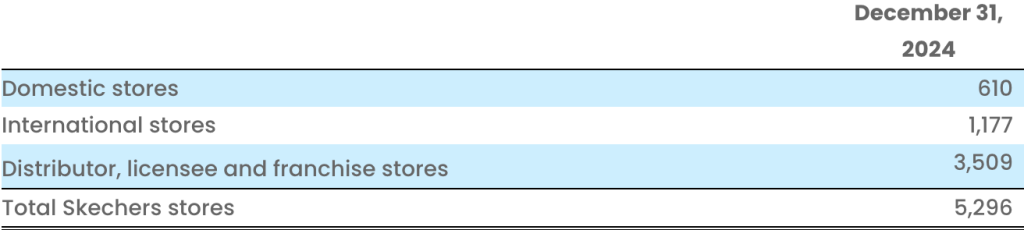

Store Count

Image courtesy Skechers