Brunswick Corporation, owner of the Boston Whaler, Lund, Sea Ray, Bayliner, Harris Pontoons, Princecraft, and Quicksilver boat brands, and the Mercury Marine, Mercury Racing, MerCruiser, and Flite marine propulsion brands, reported consolidated net sales of $1.22 billion in the first quarter of 2025, down from $1.37 billion in the first quarter of 2024.

The company reported its first quarter sales decline due to the impact of continued lower wholesale ordering by dealers and OEMs and prudent pipeline management, which was only partially offset by modest annual price increases and benefits from well-received new products.

Operating earnings were down year-over-year due to the impact of lower sales, lower absorption from decreased production levels and the negative impact of changes in foreign currency exchange rates, partially offset by new product momentum, annual price increases and ongoing cost control measures throughout the enterprise.

Diluted EPS for the quarter was 30 cents on a GAAP basis and 56 cents on an adjusted basis.

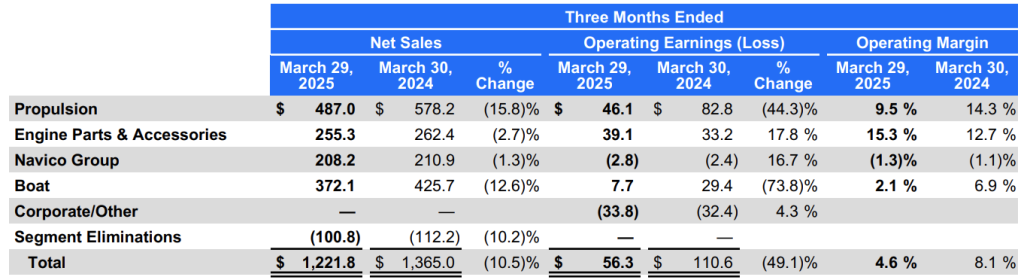

GAAP Sales and Operating Earnings by Segment

Propulsion Segment reported a 16 percent decrease in sales resulting from the enterprise factors, while operating earnings were below the prior year primarily due to lower sales and the impact of lower absorption from decreased production levels, partially offset by cost control measures. Sales and operating earnings grew sequentially versus the fourth quarter of 2024 as OEMs continue to balance inventory ahead of the primary season.

Engine Parts and Accessories Segment reported a 3 percent decrease in sales versus the same period last year due to slightly lower shipments. Sales from the Products business were down 9 percent, while the Distribution business sales were up 2 percent compared to the prior year. Segment operating margin was seasonally strong at 15 percent, up more than 100 basis points versus the prior year, resulting from the efficient operation of the business and slightly lower cost inflation.

Navico Group Segment reported sequentially stronger sales versus the fourth quarter of 2024 and a sales decrease of 1 percent versus Q1 2024, primarily driven by reduced sales to marine OEMs resulting from lower customer boat OEM production levels, offset mainly by strong aftermarket sales and new product momentum. Segment operating earnings decreased due to the lower sales.

Boat Segment reported a 13 percent decrease in sales year-over-year resulting from anticipated cautious wholesale ordering patterns by dealers, which was only partially offset by the favorable impact of modest model-year price increases. Freedom Boat Club had another strong quarter, contributing approximately 11 percent of segment sales, including the benefits from recent acquisitions. Segment operating earnings were within expectations as the impact of net sales declines and lower absorption from the reduced production was partially offset by pricing and continued cost control.

Balance Sheet and Cash Flow Summary

Cash and marketable securities totaled $305.5 million at the end of the first quarter, up $18.8 million from 2024 year-end levels.

Net cash used for operating activities of continuing operations during the first three months of the year was $13.4 million, including net earnings net of non-cash items and the impact of working capital.

Investing and financing activities resulted in net cash provided of $42.9 million during the first three months of 2025, including $266.2 million of proceeds from the issuance of short-term debt, net of $126.1 million of repayments of long-term debt, $37.7 million of capital expenditures, $28.2 million of dividend payments, and $25.6 million of share repurchases.

2025 Outlook

“As we enter the prime retail season in the U.S., we are keenly aware of the direct impact of tariffs on our business and the new uncertainties faced by our wholesale customers, channel partners and the end-consumers who buy our products at retail around the world,” the company said in a media release. “Although we cannot control the ever-changing conditions in which we do business, we can control our response and continue to push forward our strategic initiatives. In this regard, we plan to continue to invest in new products and technologies, including many to be launched this year; drive differentiation and market share gains for our brands; work closely and dynamically with our channel partners to maintain healthy and appropriate boat, engine and parts pipelines and support them with appropriate incentive programs to stimulate demand; mitigate the direct tariff impact on our business; and maintain optionality through supply chain actions, including targeted onshoring.”

BC reported that it was also evaluating opportunities to improve profitability and cash flow by rationalizing its manufacturing footprint, incremental COGS and operating expense reductions and ongoing capital management.

“In these challenging conditions, our resilient, recurring revenue businesses and channels continue demonstrating their earnings and cash flow power, which is helping to mitigate the impacts of market conditions,” the company continued. “That said, there remains significant uncertainty related to our 2025 performance and guidance, primarily due to the uncertainties of trade policy, the direct and indirect impact of these uncertainties on our consumers, fluctuations in foreign exchange rates, and the interest rate environment.”

The company said it was using its best estimates to report the following updated full-year guidance:

- Net sales between $5.0 billion and $5.4 billion;

- Adjusted diluted EPS in the range of $2.50 to $4.00 per share;

- Free Cash Flow over $350 million; and

- Second quarter 2025 revenue between $1.1 billion and $1.3 billion, and adjusted diluted EPS between 80 cents and $1.10 per share.

Image courtesy Boston Whaler/Brunswick Corporation