The National Retail Federation (NRF) reports that U.S. retail sales spending grew in March after two consecutive months of declines. Still, the trade association said gains remained moderate as consumers continued to be concerned by rising tariffs.

Growth in the Clothing, Footwear and Accessories Stores sector softened from the January and February trends, while the sector that includes Sporting Goods stores accelerated versus January and February periods, according to the CNBC/NRF Retail Monitor for March.

“Retail sales increased in March but only moderately, and the spending came before the president’s ‘Liberation Day’ tariff announcement,“ offered NRF President and CEO Matthew Shay. “The pullback we’ve seen the past few months comes despite strong economic fundamentals. A major factor appears to be driven by the uncertainty caused by tariffs. March’s increase is partly the result of stocking up to get ahead of tariffs. With the economic outlook unclear and the situation fluid, consumer sentiment is weakening, and many consumers are shifting disposable income into savings.”

The NRF offered evidence to the contrary, citing a survey in its February report that consumers plan to stock up ahead of the U.S.-imposed tariffs.

A survey conducted for the NRF by Prosper Insights & Analytics found that 46 percent of consumers said they were stocking up on household appliances, clothing and other items in early March because they were worried they would become more expensive due to the tariffs. Still, the market has seen concerns at the vendor and retail level in financial reporting over the last 30 days.

The CNBC/NRF Retail Monitor forecasted that total retail sales, excluding autos and gas, were up 0.60 percent seasonally-adjusted month-over-month (m/m) in March and up 4.8 percent unadjusted year-over-year (y/y). That compared with a decrease of 0.22 percent m/m and an increase of 3.4 percent y/y in February.

SGB Media rounds all variance percentages under 1 percent to the closest hundredth of a percent and any variances 1 percent or higher to the closest tenth of a percent.

The CNBC/NRF report’s calculation of Core Retail Sales, excluding restaurants, auto dealers and gas stations, was up 0.40 percent m/m in March and up 5.1 percent y/y. That compared with a decrease of 0.22 percent m/m and an increase of 4.1 percent y/y in February 2025.

Total sales were up 4.5 percent y/y for the calendar first quarter, and core sales were up 5.0 percent. Each metric was up 100 basis points points from the two-month YTD trend line.

The NRF said its March results reflected consumer spending after President Donald Trump announced tariffs on China, Canada and Mexico in February but before he announced a minimum 10 percent tariff on all U.S trading partners on April 2 along with sweeping “reciprocal“ tariffs on dozens of countries.

“The reciprocal tariffs have been suspended for 90 days, but additional tariffs on China have resulted in back-and-forth escalation between China and the U.S,“ the NRF observed.

The CNBC/NRF Retail Monitor reportedly uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions to tabulate the report results, which do not need to be revised monthly or annually.

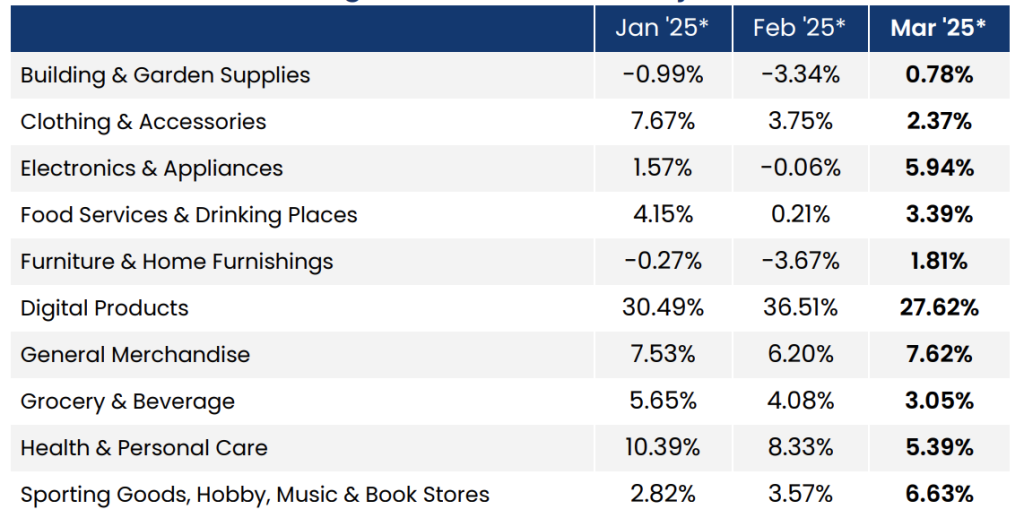

March sales were up in five out of nine categories on a year-over-year basis, led by Digital Retailers, General Merchandise, and the Sporting Goods, Hobby, Music, and Bookstores segment.

The Sporting Goods, Hobby, Music, and Bookstores segment was up 6.6 percent y/y unadjusted after a strong 3.6 percent y/y gain in February.

Year-Over-Year Change in Retail Sales, Unadjusted

To download the CNBC/NRF Retail Monitor Report for March 2025, go here.

Data and chart courtesy CNBC/NRF Retail Monitor

Image courtesy Costco