Life Time Group Holdings, Inc. closed out a record 2024 with its highest level of member engagement coupled with the company’s highest level of visits per membership and record membership retention. The strong performance drove the highest revenue per membership the company has recorded in its 32-year history, delivering $796 in average revenue per center membership in 2024, compared to $711 in revenue per membership in 2023.

“We remain well-positioned to continue to execute on the significant growth opportunities ahead while maintaining the strength of our margin profile and balance sheet,” commented Bahram Akradi, founder, chairman and CEO of Life Time Group Holdings, Inc. “We delivered strong double-digit revenue and Adjusted EBITDA growth, reduced our leverage and generated positive free cash flow. We exceeded every single financial objective the company had set forth.”

Akradi said that, more importantly, the strength and desirability of Life Time resulted in:

- Record levels of member engagement coupled with the company’s highest level of visits per membership and

- Record membership retention, driving the highest revenue per membership in the company’s 32-year history.

“We remain well-positioned to continue to execute on the significant growth opportunities ahead while maintaining the strength of our margin profile and balance sheet,” he suggested.

Fourth Quarter 2024 Summary

- Revenue increased 18.7 percent to $663.3 million in the fourth quarter, reportedly due to continued strong growth in membership dues and in-center revenue, driven by an increase in average dues, membership growth in new and ramping centers, and higher member utilization of in-center offerings.

- Center memberships increased by 48,846, or 6.4 percent, compared to December 31, 2023, and decreased, consistent with seasonality expectations, by 14,440 from the third quarter 2024 to 812,062.

- Total subscriptions, including center memberships and digital on-hold memberships, increased 6.3 percent to 866,085 compared to December 31, 2023.

- Center operations expenses increased 19.3 percent to $343.9 million, said to be primarily due to operating costs related to new and ramping centers as well as costs to support growth in memberships and in-center business revenue.

- General, administrative and marketing expenses increased 13.1 percent to $61.2 million, said to be primarily due to increases in share-based compensation and benefit-related expenses, information technology costs, and center support overhead to enhance and broaden member services and experiences.

- Net income increased $13.5 million to $37.2 million in Q4, reportedly due primarily to improved business performance, partially offset by a tax-effected write-off of $7.7 million of unamortized debt discounts and issuance costs associated with the extinguishment of the company’s former Term Loan Facility and Construction Loan and the loss on the satisfaction and discharge of its 5.75 percent Senior Secured Notes and 8.00 percent Senior Unsecured Notes.

- Adjusted net income increased $22.3 million to $60.3 million, and Adjusted EBITDA increased $39.3 million to $177.0 million as the company said it experienced greater flow-through of its increased revenue and benefited from the structural improvements to the business that have improved margins.

Full-Year 2024 Summary

- Revenue increased 18.2 percent to $2,621.0 million due to continued strong growth in membership dues and in-center revenue, driven by an increase in average dues, membership growth in new and ramping centers, and higher member utilization of the company’s in-center offerings.

- Center operations expenses increased 17.6 percent to $1,392.4 million, primarily due to operating costs related to the new and ramping centers, costs to support membership growth and in-center business revenue.

- General, administrative and marketing expenses increased 9.9 percent to $221.0 million primarily due to increases in information technology costs, center support overhead to enhance and broaden member services and experiences and share-based compensation and benefit-related expenses.

- Net income increased $80.1 million to $156.2 million, primarily due to improved business performance and, to a lesser extent, tax-effected one-time net gains of $3.7 million on sale of land and $2.0 million on sale-leaseback transactions in the current year as compared to tax-effected one-time net losses of $10.9 million on sale-leaseback transactions and $4.6 million on the sale of land in the prior year, partially offset by a tax-effected write-off of $10.4 million of unamortized debt discounts and issuance costs associated with the extinguishment of the former Term Loan Facility and Construction Loan and the loss on the satisfaction and discharge of the company’s 5.75 percent Senior Secured Notes and 8.00 percent Senior Unsecured Notes in the current year. Net income in the prior year also included a $3.9 million tax-effected one-time gain on the sale of two triathlon events.

- Adjusted net income increased $70.8 million to $200.5 million in 2024. Adjusted EBITDA increased $140.0 million to $676.8 million as the company experienced greater flow-through of its increased revenue and benefited from the structural improvements to its business that improved margins.

New Center Openings

The company opened two new centers during the fourth quarter and a total of eight centers for the year. As of December 31, 2024, the company operated a total of 179 centers.

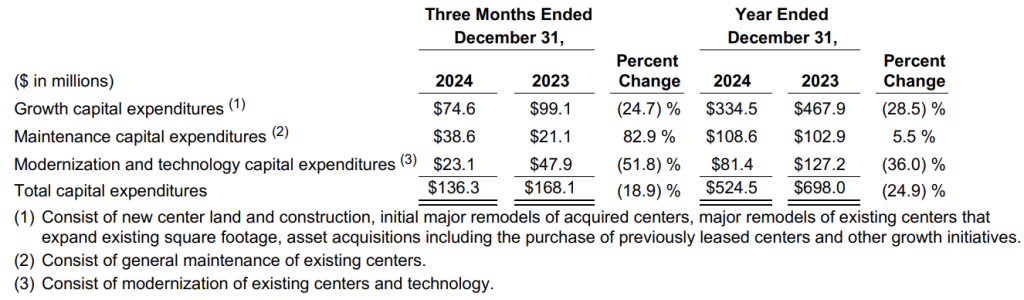

Cash Flow Highlights

Net cash provided by operating activities increased 23.5 percent to $163.1 million for the fourth quarter and 24.2 percent to $575.1 million for the year.

The company achieved a positive free cash flow of $26.5 million for the fourth quarter and $273.6 million for the year, including $207.4 million of net proceeds from sale-leaseback transactions for the year.

Liquidity and Capital Resources

Life Time’s net debt leverage ratio improved to 2.28x as of December 31, 2024, from 3.61x as of December 31, 2023. As of December 31, 2024, the total available liquidity was $619.7 million, which included availability on the $650.0 million revolving credit facility and cash and cash equivalents.

The company said it consummated several transactions in 2024 that strengthened its balance sheet and financial position, including:

- Completed an equity offering of 13.8 million shares, which included 6.0 million primary shares, resulting in net proceeds of $124.0 million to the company. The company used some of these net proceeds to pay down an aggregate principal amount of $110.0 million of our former Term Loan Facility.

- Upsized and extended its revolving credit facility to $650.0 million. After delivery of fourth-quarter results, interest will be at Secured Overnight Financing Rate (SOFR) plus an applicable margin of 2.25 percent (subject to a certain 25 basis points ratings-based step-down).

- Incurred new term loans maturing in 2031 in an aggregate principal amount of $1.0 billion. The term loans bear interest at a rate per annum equal to SOFR plus an applicable margin of 2.50 percent (subject to a certain 25 basis points ratings-based step-down).

- Issued $500.0 million in aggregate principal amount of 6.00 percent Senior Secured Notes due 2031.

- Satisfied and discharged in full the aggregate principal balance and unpaid accrued interest of the 5.75 percent Senior Secured Notes and 8.00 percent Senior Unsecured Notes.

- Completed sale-leaseback transactions for six properties, generating $207.4 million of net proceeds.

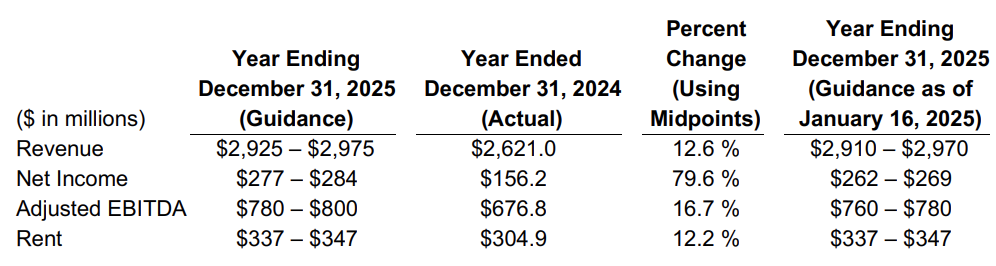

Full-Year 2025 Guidance

The company also expects to achieve the following operational and financial results for full-year fiscal 2025:

- Open 10 to 12 new centers.

- Manage net debt leverage ratio to maintain at or below 2.25x.

- Comparable center revenue growth of 7 percent to 8 percent.

- Adjusted EBITDA growth to be driven primarily by dues revenue growth and expanded operating leverage.

- Rent will include non-cash rent expenses of $35 million to $38 million.

- Interest expense, net of interest income and capitalized interest, of approximately $90 million to $94 million, reflecting the company’s reduced debt levels in 2024 and the debt refinancing completed in the fourth quarter of fiscal 2024.

- Provision for income tax rate estimate of 27 percent.

- Cash income tax expense of $58 million to $62 million.

Image courtesy Life Time Group Holdings, Inc.