The National Retail Federation (NRF) reported that U.S. retail sales spending slowed from the December holiday season but still posted strong year-over-year gains.

“Consumers pulled back in January, taking a breather after a stronger-than-expected holiday season,” noted NRF President and CEO Matthew Shay. “Despite the monthly decline, the year-over-year increases reflect overall consumer strength as a strong job market and wage gains above the rate of inflation continue to support spending. We’re seeing a ‘choiceful’ and value-conscious consumer who is rotating spending across goods and services and essentials and non-essentials, boosting some sectors while causing challenges in others.”

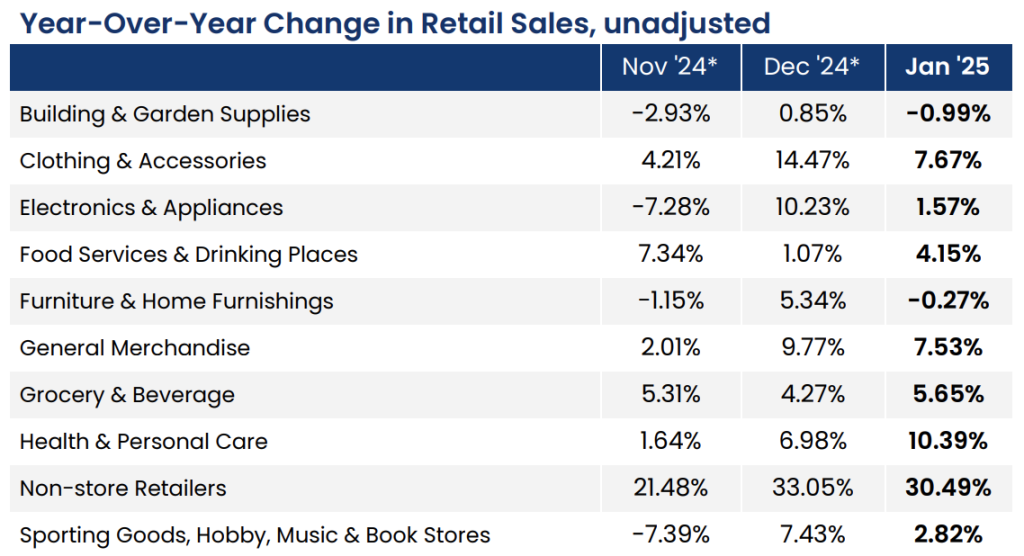

The Retail Monitor projected that total January retail sales, excluding autos and gas, were down 1.1 percent seasonally-adjusted month-over-month (m/m) versus December 2024, but were up 5.4 percent unadjusted year-over-year (y/y) versus January 2024. That compared with increases of 1.7 percent m/m and 7.2 percent y/y in December.

SGB Media rounds all variance percentages under 1 percent to the closest hundredth of a percent and any variances 1 percent or higher to the closes tenth of a percent.

The report’s calculation of Core Retail Sales, excluding restaurants, auto dealers and gas stations, was down 1.3 percent m/m in January but up 5.7 percent y/y from January 2024. That compared with increases of 2.2 percent m/m and 8.4 percent y/y in December.

The results come after the NRF reported that the holiday selling season was successful as core retail sales grew 4 percent y/y during the 2024 holiday period and 3.6 percent for the full year.

The CNBC/NRF Retail Monitor reportedly uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions to tabulate the report results, which do not need to be revised monthly or annually.

January sales were up in seven out of nine categories on a yearly basis, led by Non-Store Retailers, which includes E-Commerce and Catalog businesses, Health and Personal Care Stores and Clothing and Accessories Stores, which includes Footwear Stores.

The Sporting Goods, Hobby, Music, and Bookstores segment was down 1.9 percent m/m, seasonally-adjusted, but up 2.82 percent y/y, unadjusted, after a very strong December trend.

Go here to download a PDF of the full January Retail Monitor report.

Image courtesy Dick’s Sporting Goods