In the CNBC/NRF Retail Monitor Report released on Tuesday, December 10, the retail sales bounce back in October continued a moderate trend into November even as two of the holiday season’s busiest shopping days rolled over into December and not included in the month’s totals.

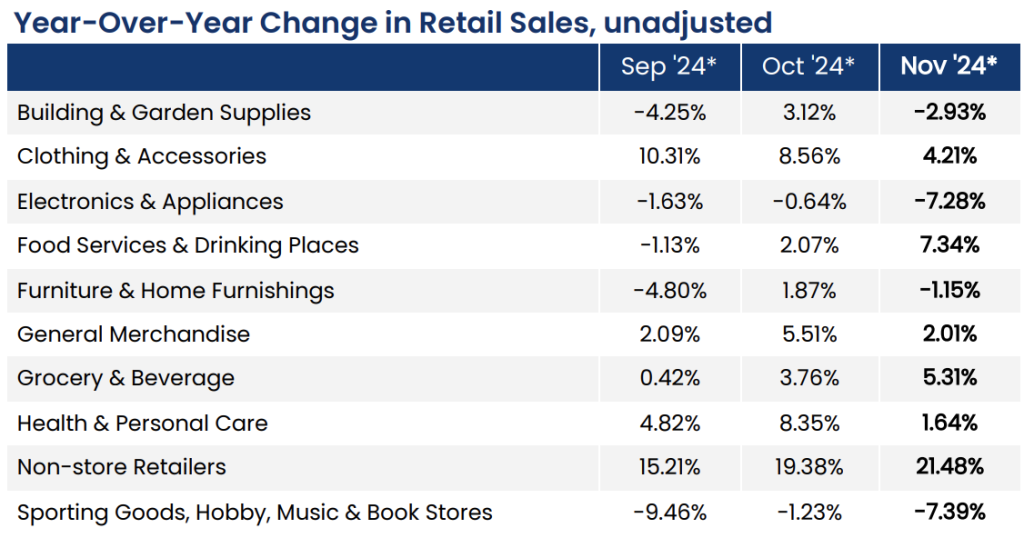

As evidenced by the early pre-Thanksgiving and Thanksgiving weekend sales reports, the Non-Store (Internet & Catalog) channel dominated the channel chart for November, posting growth of nearly 22 percent year-over-year. Other positive sales trends came from Clothing, Footwear and Accessories stores, and General Merchandise stores.

The Sporting Goods sector, which also includes Hobby, Music and Book stores, posted a 7.4 percent decline year-over-year (y/y).

“November sales increased on top of a strong October and would have been even higher if Thanksgiving Sunday and Cyber Monday hadn’t fallen in December,” commented NRF President and CEO Matthew Shay. “Year-over-year gains were solid even as retail prices in many categories are lower this year, showing that consumers are buying more merchandise as the economy continues to grow. We remain confident in our holiday forecast.”

SGB Media rounds all variance percentages under 1 percent to the closest tenth of a percent.

Total retail sales, excluding automobiles and gas, were up 0.15 percent seasonally adjusted month-over-month (m/m) and up 2.4 percent unadjusted y/y in November, according to the CNBC/NRF Retail Monitor Report. That compared with increases of 0.74 percent m/m and 4.1 percent y/y in October.

The Retail Monitor calculation of core retail sales, excluding restaurants in addition to automobile dealers and gasoline stations, was down 0.19 percent m/m in November but up 1.4 percent y/y. That compared with increases of 0.83 percent m/m and 4.6 percent y/y in October.

Total sales were up 2.2 percent y/y for the first 11 months of 2024 and core sales were up 2.3 percent. The numbers come as NRF is forecasting that retail sales during the November to December holiday season will grow between 2.5 percent and 3.5 percent over 2023.

Unlike survey-based numbers collected by the Census Bureau, the CNBC/NRF Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.

The November sales report was up in five out of nine retail categories on a yearly basis, led by Online sales, Grocery and Beverage stores, and Clothing, Footwear and Accessories stores. Sales were up in two categories on a month-over-month basis. Specifics from key sectors include: