Korea-based Fila Holdings Corp. reported revenues increased 6.0 percent in the third quarter as a 2.8 percent decline at the Fila brand business partially offset a gain of 8.4 percent at Acushnet (Titleist, Footjoy). The Acushnet business is hiding a lot of issues under the surface as Fila USA sales continue to degrade as the company focuses on margin improvement and cost cutting.

Fila Holdings Corp. trades and reports in the Korean won (₩) currency.

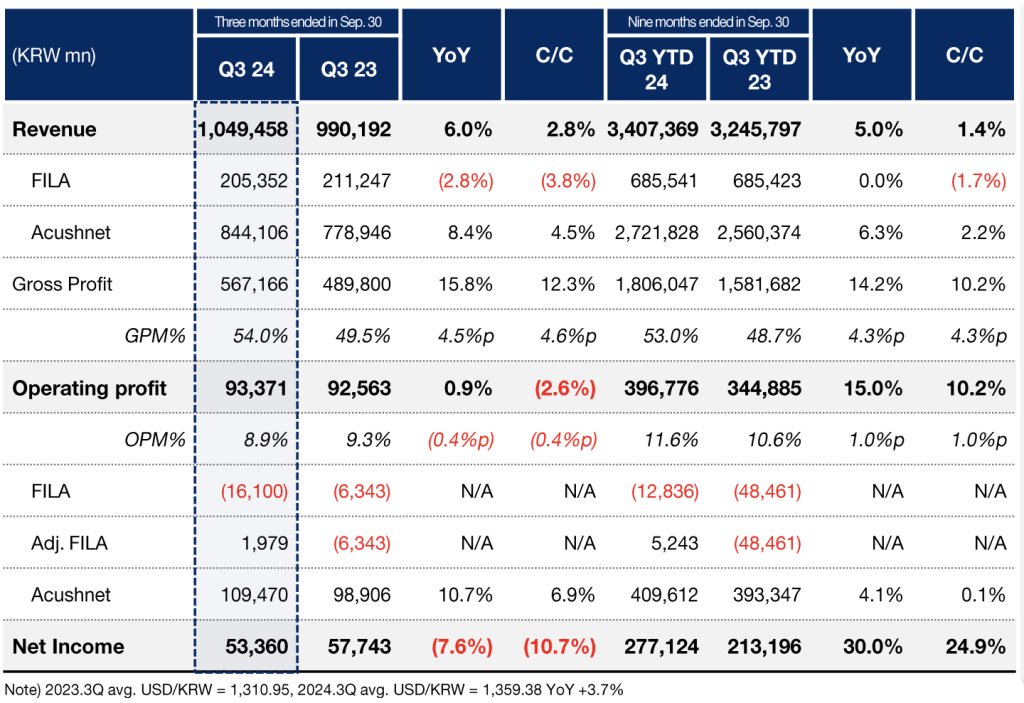

Consolidated revenue reached ₩1,049,458 million ($776.1 mm) against ₩990,192 million in Q3 last year, representing a increase of 6.0 percent on a reported basis and 2.8 percent growth on a currency-neutral basis. The consolidated figures includes the Acushnet business based on Fila Holdings’ 51 percent stake in the company. See Acushnet’s most recent results at bottom.

Net income for the consolidated business in Q3 was ₩53,360 million from ₩57,743 million a year ago.

Fila Holdings Consolidated Q3 Results

Fila Brand

Fila brand revenues were ₩205,352 million ($xxx.x mm) in Q3, compared to ₩211,247 million in the year-ago Q3 period, a decrease of 2.8 percent on a reported basis and a 3.8 percent on a currency-neutral basis. The company said Fila brand’s sales tumbled in the U.S. due to the impact of “ongoing market competitiveness,” offset by continued high demand of key items in Korea, and strong brand performance in China.

The Fila brand segment posted an operating loss of ₩16,100 million against a loss of ₩6,343 million a year ago.

Fila USA

Fila USA sales, which covers the U.S., Canada and Mexico, fell 18.8 percent year-over-year in the third quarter to ₩52,983 million ($38.9 mm), compared to ₩65,216 million ($49.6 mm) in Q3 last year.

Revenues were down even more in local currencies as revenue fell 21.7 percent in U.S. dollar terms. The quarter’s decline represented a continuation and expansion on the brand’s decline in the region following a 16.7 percent decline in the second quarter. Even more troubling than the year-over-year and sequential trends is the brand’s decline in the region over a two-year period, with revenues totaling just $38.9 million in the most recent quarter after posting revenue of $90.7 million in Q3 2022.

The company said the decline in the most recent quarter was mainly due to the competitive market environment in the sports fashion category caused by “excessive discounting.” The company is now focusing on margin improvement and brand-centric strategies to enhance brand equity.

Fila USA’s gross margin expanded again to 32.5 percent of sales, a sharp improvement from the 9.2 percent GM posted last year and a negative 47.8 percent margin in the 2022 second quarter. The shift was said to be due to less promotional activities and target margin management under the reduced inventory levels. Gross profit jumped 167 percent and gross margin increased nearly 23 full percentage points.

Fila USA posted an operating loss of ₩25,471 million (-$18.8 mm) in the quarter, compared to a loss of ₩23,445 million (-$18.0 mm) in the year-ago period.

Adjusted operating loss for the region was ₩7,480 million (-$5.5 mm) in the quarter, compared to a loss of ₩23,445 million (-$18.0 mm) in the year-ago period, due to one-ff severance cost of ₩18 billion from business restructuring. The company said the strong U.S. dollar against the Korean won further exacerbated the negative impact on Fila USA earnings..

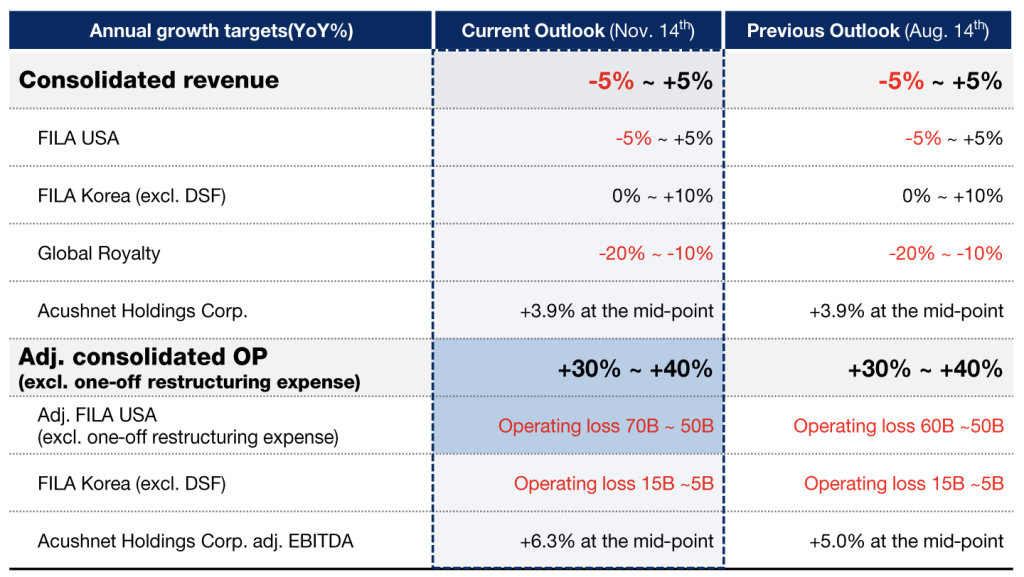

Outlook

Fila maintained its outlook for the year after reducing sales and earnings guidance earlier in the year.

Images, data and tables courtesy Fila Holdings Corp.

Titleist Golf Club Sales Strength Offsets Softer Ball Sales in Q3 at Acushnet Holdings