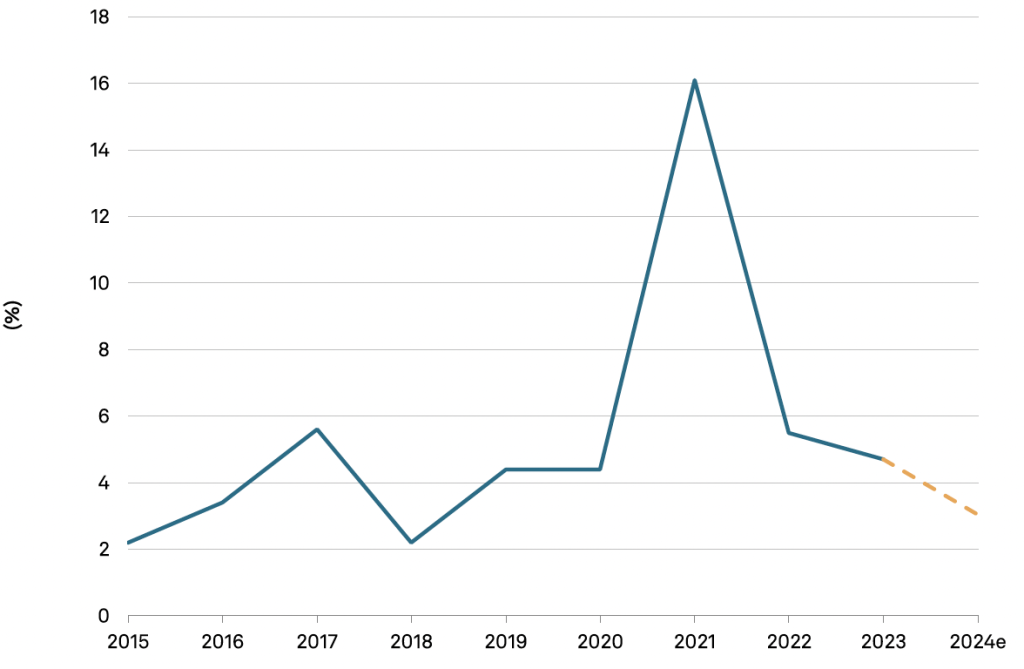

S&P Global Ratings is forecasting that holiday sales growth will slow to about 3 percent in 2024 from 4.7 percent last year, remaining below the 10-year average of 5.3 percent. Price actions, as well as modest volume gains given the firm’s expectation for a cautious but resilient middle to higher income consumer, is said to support its growth forecast.

“Our outlook is influenced by waning–but persistent–inflation that has pressured household budgets. Additionally, the late Thanksgiving holiday will result in five fewer shopping days than last year, which may weigh on sales,” S&P wrote in its 2024 Sales Outlook. “However, a loosening but resilient labor market and further anticipated interest rate cuts support consumer confidence levels. Moreover, many retailers have pulled ahead inventory orders, positioning themselves well for any potential supply-chain disruptions.”

Total Retail Sales for November and December

Seasonally Adjusted, Year-Over-Year Percent Change

Value Perception Will Separate Retailers This Holiday Season

S&P said that given expectations for a softer holiday season than in recent years, it anticipates retailers that will lean on deals to stimulate holiday cheer.

“We also believe retailers will need to spend more on advertising to offset lower traffic trends and compete for attention,” the company wrote.

“However, not all sectors will perform equally well. We expect value retailers (such as TJX Cos. Inc.) that cater to the more resilient middle and higher income consumer will fare better due to increased foot traffic from value-conscious consumers,” the company added. “Similarly, Big Box retailers like Walmart Inc. and Target Corp., with their ability to effectively communicate and deliver value to consumers, will also likely perform well as consumers seek ways to stretch their budgets. We expect other sectors, such as department stores and apparel retailers, will rely on higher discounts to increase traffic and manage inventory. Furthermore, soft demand in specialty categories like consumer electronics and home furnishings will also necessitate promotional activity to spark demand. Ultimately, issuers that have the financial flexibility to compete on price and convenience will continue to fare better in our view.”

S&P referred to the September retail sales data, which they said served as an early indicator of holiday shopping trends and suggests that the 2024 holiday season may be successful if retailers focus on improving their value propositions. Total retail and food services sales were up 1.7 percent year-over-year, with e-commerce leading the way as consumers continue to seek convenience and price transparency.

However, other retailers with exposure to discretionary categories–such as department stores, furniture and home furnishing stores, and sporting goods stores–continue to struggle; sales decreased year over year,” S&P wrote. “As a result, we expect retailers with heavy exposure to discretionary products will rely on promotions to generate demand. Otherwise, they risk a disappointing holiday season.

These observations and assessments were made before the first report on October retail sales were released by CNBC and the National Retail Federation Retail Monitor report that saw retail sales returning to growth, led by some clearly discretionary categories and channels. See SGB Media coverage at bottom.

Companies Pull Forward Promotional

Sales S&P noted that in October 2024, Amazon.com Inc., Wayfair LLC, Target Corp., and other large retailers launched holiday-themed promotions, dangling discounts on narrow selections of merchandise more than six weeks before Black Friday–one of the biggest shopping days of the year. Amazon reported that its Prime Big Deals Day was the company’s biggest early holiday kickoff event ever.

“In our view, consumers can expect more deal events before Black Friday and Cyber Monday,” the company’s analysts shared.

The S&P team said that retailers may be trying to pull forward sales as consumers grow more cautious during the weeks leading up to the holiday, particularly during an election year and a shortened holiday shopping window. These steep discounts and big deals also reflect the highly promotional environment this season as value remains front of mind for consumers. This may also explain the stronger retail sales bounce in October.

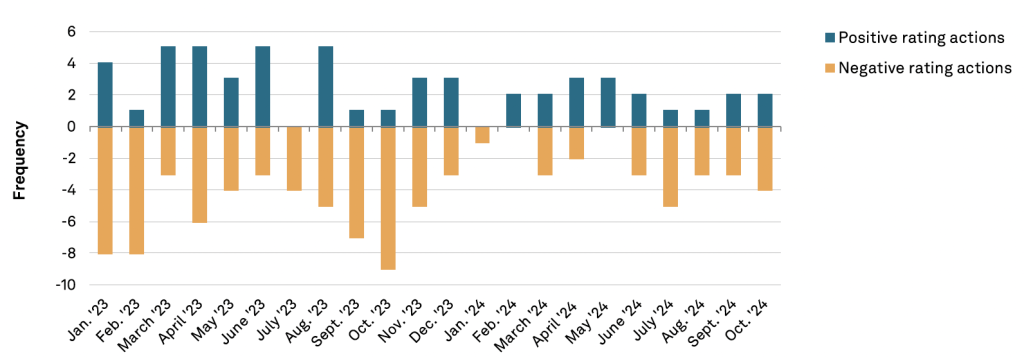

Recent Rating Actions Reflect Weakness In Discretionary Spending

S&P said slowing consumer spending due to tighter household budgets has softened companies’ top-line growth. This, coupled with the difficulty of absorbing fixed costs, has increased negative rating actions across the U.S. retail portfolio, they suggest.

“Additionally, high debt burdens and onerous debt servicing costs for retailers that were part of private-equity buyouts during the pandemic have resulted in constrained operational and financial flexibility,” the report noted. “The bulk of the negative rating actions over the last 12 months have been in the apparel, accessories, and specialty sub-sectors, where exposure to discretionary spending is high.” (see chart below).

U.S. Retail and Restaurant Rating Actions

“This holiday season, a more price-sensitive consumer will prompt retailers to promote and discount, further pressuring their profit margins. In the hopes of offsetting the highly promotional retail environment, many retailers announced formal cost-savings initiatives over the last year,” the report noted.

The company said retailers have also adopted a conservative approach to inventory management to support margins.

“We expect these initiatives and tight inventory management will mostly offset promotional pressures and lead to flat margins for retailers year-over-year,” the report noted.

Currently, the company said the negative bias in rating outlooks is about 21 percent in the retail and restaurants portfolio, reflecting 28 percent of ratings with a negative outlook or on CreditWatch with negative implications, and 7 percent of ratings with positive outlooks or on CreditWatch with positive implications.

“The negative bias is typical for the sector due to intense secular pressures,” S&P said. “These include competition for consumer spending with technology, health care, auto, housing, and experiences; the costs of shifting business models to meet consumers where and how they want to shop; and price transparency pressuring margins.”

However, if restaurants are removed from the portfolio and the analysts split the remaining retailers between discretionary and non-discretionary, they said the pressure on credit quality in discretionary sub-sectors such as apparel, specialty, and department stores, is even higher.

“The negative bias in ratings on retailers with exposure to discretionary spending is nearly 1.5 times the negative bias of ratings on retailers exposed to more stable non-discretionary spending,” S&P noted.