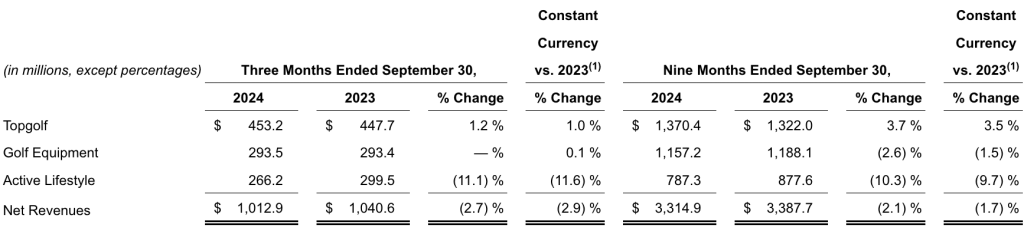

Topgolf Callaway Brands Corp. posted net revenue of $1.01 billion in the third quarter, a 2.7 percent decrease year-over-year, which was said to be primarily driven by an 11.1 percent decrease in Active Lifestyle and partially offset by revenue growth at Topgolf of 1.2 percent. Golf Equipment revenues were flat for the period.

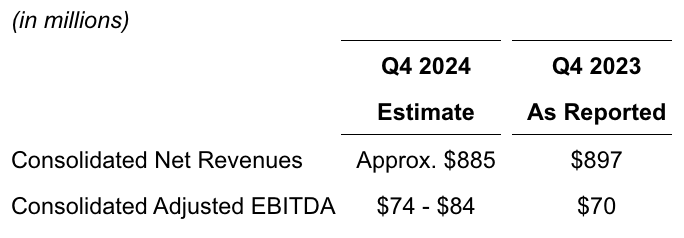

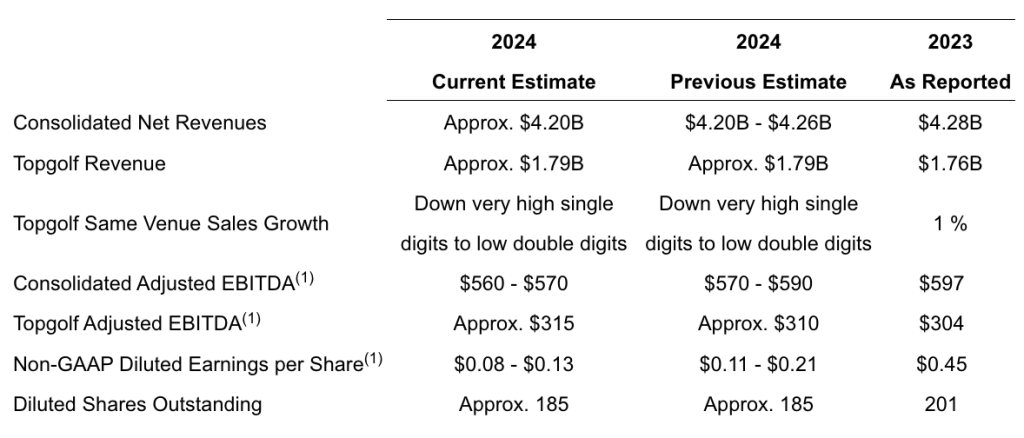

Revenues and non-GAAP profits both came in above estimates, sending MODG shares up over 5 percent in after-hours trading on Tuesday, November 12, but a weaker Q4 outlook may have stymied a bigger jump in share prices.

The results also exceeded the company’s guidance range, primarily due to the timing of shipments in its products businesses.

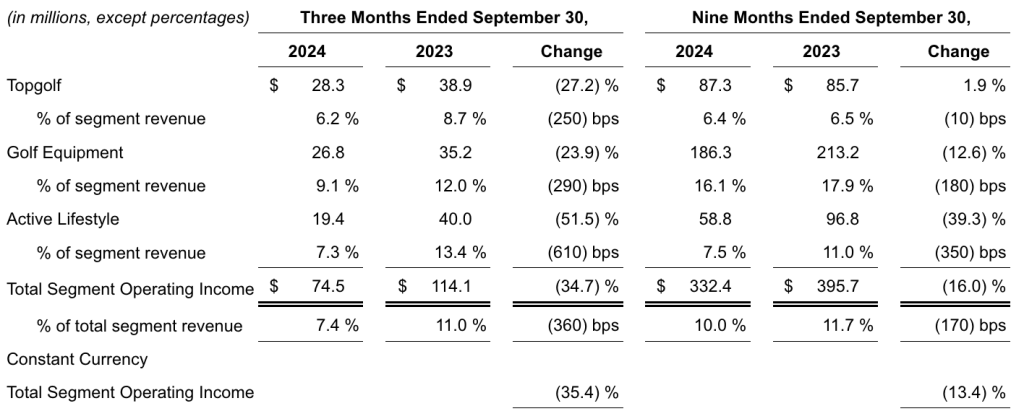

Third Quarter Segment Summary

Topgolf

- Segment revenue increased 1.2 percent, to $453.2 million, driven primarily by new venues.

- Same-venue sales declined 11 percent, which was roughly consistent with expectations.

- Segment operating income decreased 27.2 percent to $28.3 million, reportedly due to increased depreciation related to new venues and lower same venue sales.

- Segment Adjusted EBITDA decreased $6.5 million, or 7.2 percent, to $84.4 million, primarily due to lower same-venue sales.

Golf Equipment

- Segment revenue increased $0.1 million to $293.5 million in Q3, slightly ahead of expectations primarily due to the timing of shipments in the products businesses.

- Segment operating income decreased $8.4 million, which was said to be in line with expectations and primarily due to increased freight costs.

Active Lifestyle

- Segment revenue decreased 11.1 percent to $266.2 million, resulting primarily from lower European wholesale revenue at Jack Wolfskin, as expected.

- Segment operating income decreased $20.6 million due to the lower revenue and increased freight costs.

Income Statement Summary

Net income decreased $33.3 million to a net loss of $3.6 million on a GAAP basis. Net income decreased $31.5 million to $4.3 million on a non-GAAP basis compared to the prior-year Q3 period. This result was due to a decrease in segment operating income.

Adjusted EBITDA of $119.8 million for the third quarter decreased 26.6 percent year-over-year, and was said tp be ahead of expectations due to better-than-expected revenue in the third quarter as well as strong venue profitability at Topgolf.

Balance Sheet Summary

Inventory decreased $70.1 million year-over-year to $666 million at quarter-end, driven by decreases in both the Active Lifestyle and Golf Equipment segments.

Available liquidity, which is comprised of cash on hand plus availability under the Company’s credit facilities, increased $129.0 million, or approximately 18 percent, to $863 million compared to September 30, 2023.

2024 Full Year Outlook

(in millions, except where noted otherwise and for percentages and per share data)

Image courtesy Topgolf