The Beachbody Company, Inc., said its third-quarter results demonstrated the continued successful execution of the first phase of its turnaround plan, with significant improvements in adjusted EBITDA and positive free cash flow generation. The company saw revenues fall over 20 percent in the quarter.

“As we enter the next phase of our transformation, we are evolving our distribution model to a modern affiliate network that will broaden our market opportunities and further optimize our cost structure,” said Carl Daikeler, co-founder and CEO of The Beachbody Company, Inc.

“On September 30, 2024, we announced a major change in our business model from a multi-level marketing (MLM) to a single-level affiliate network,” Daikeler explained. “This pivot marks a strategic shift that will fundamentally transform our company and position us well for long-term profitable growth. This change in our distribution strategy, combined with the expansion of our direct-to-consumer and partnership channels, represents a pivotal moment that will remove legacy barriers associated with the former MLM structure and allow us to fully capitalize on the significant market opportunity in health, nutrition, and wellness.”

Daikeler said the company has already seen a strong number of signups from former partners in its network for its new single-level affiliate program since its recent launch. With upcoming initiatives, including the Belle Vitale program and expanded sales channels, Daikeler feels the company is well-positioned to help consumers realize their health and fitness goals.

Third Quarter Revenue Summary

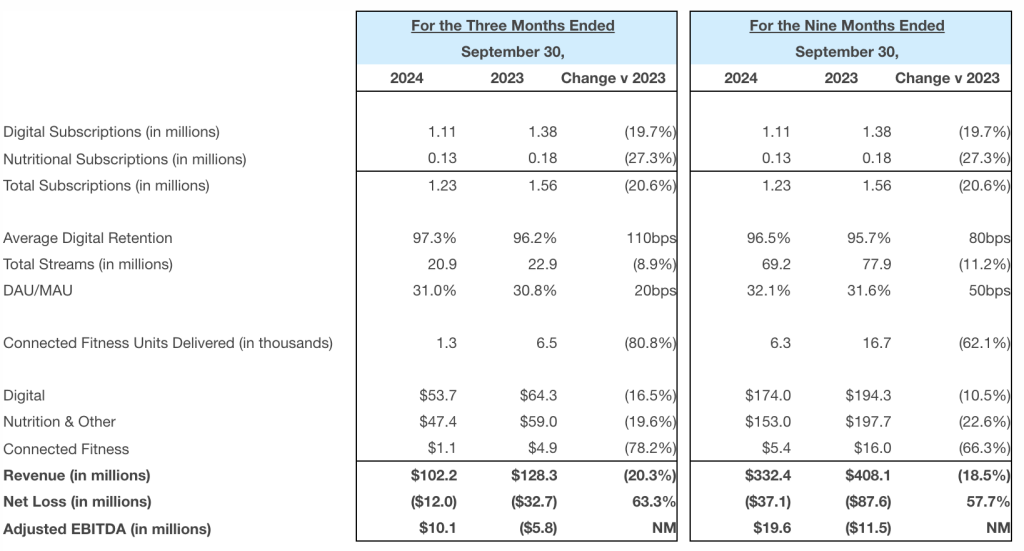

Total revenue was $102.2 million in the third quarter, down 20.3 percent compared to $128.3 million in the prior-year Q3 period.

- Digital revenue declined 19.7 percent to $53.7 million in Q3, compared to $64.3 million in the prior-year Q3 period, and digital subscriptions totaled 1.11 million in the third quarter.

- Nutrition and Other revenue fell 27.3 percent to $47.4 million in Q3, compared to $59.0 million in the prior-year Q3 period, and nutritional subscriptions totaled 0.13 million in the third quarter.

- Connected Fitness revenue was $1.1 million in the quarter, compared to $4.9 million in the prior-year Q3 period, and the company delivered approximately 1,300 bikes in the third quarter.

Income Statement Summary

Total operating expenses were $81.8 million in the third quarter, compared to $104.0 million in the prior-year Q3 period.

Operating loss improved from $16.0 million to $13.0 million in Q3, compared to an operating loss of $29.0 million in the prior-year Q3 period.

Net loss was $12.0 million, which included $9.2 million of restructuring-related costs related to the transition from an MLM model to a single-level affiliate model, compared to a net loss of $32.7 million in the prior-year Q3 period.

Adjusted EBITDA was $10.1 million in the quarter, compared to a loss of $5.8 million in the prior-year period.

Balance Sheet and Cash Flow Summary

Cash provided by operating activities for the nine months ended September 30, 2024, was $9.3 million compared to cash used in operating activities of $14.6 million in the prior-year Q3 period, and cash provided by investing activities was $1.6 million compared to cash used in investing activities of $9.7 million in the prior-year Q3 period.

Free cash flow was $5.3 million in Q3 compared to negative $20.1 million in the prior-year Q3 period.

Key Operational and Business Metrics

Image courtesy The Beachbody Company