Ahead of World Anti-Counterfeiting Day on June 8, StockX released its Third Annual Big Facts Report for 2024, outlining key findings that StockX reported “offers unique transparency around today’s most sought-after brands, StockX’s proprietary review process and how the company prevents substandard products from entering the market.”

The StockX report includes data from June 1, 2023 to May 31, 2024.

According to the U.S. Chamber of Commerce, counterfeit products now cost the global economy over $500 billion annually. StockX’s “Big Facts: The Verification Report 2024” report provides a view into what is happening on the secondary market across sneakers, apparel, accessories, and collectibles—all categories that remain top targets for today’s largest counterfeiting operations.

StockX said in a media release that the report “also provides data on which product category is most susceptible to counterfeits” (it ain’t sneakers) and related topics, including quality control metrics like the top reasons products get rejected during the StockX verification process.

In the last year alone, StockX reported that it rejected over 400,000 products, collectively valued at nearly $85 million, because they did not meet the company’s verification standards.

“This represents an increase of around 100,000 products compared to the same period last year when StockX rejected around 300,000 items,” the company wrote in an overview of the statistics.

StockX was quick to note that there are several reasons why products fail to pass the StockX verification process, including sizing inconsistencies, missing accessories, box damage, signs of previous wear, and if the company suspects the item is fake.

During the same period, StockX said its experts blocked over 100,000 suspected fake products from getting into the hands of unsuspecting consumers, more than 40,000 of which were sneakers.

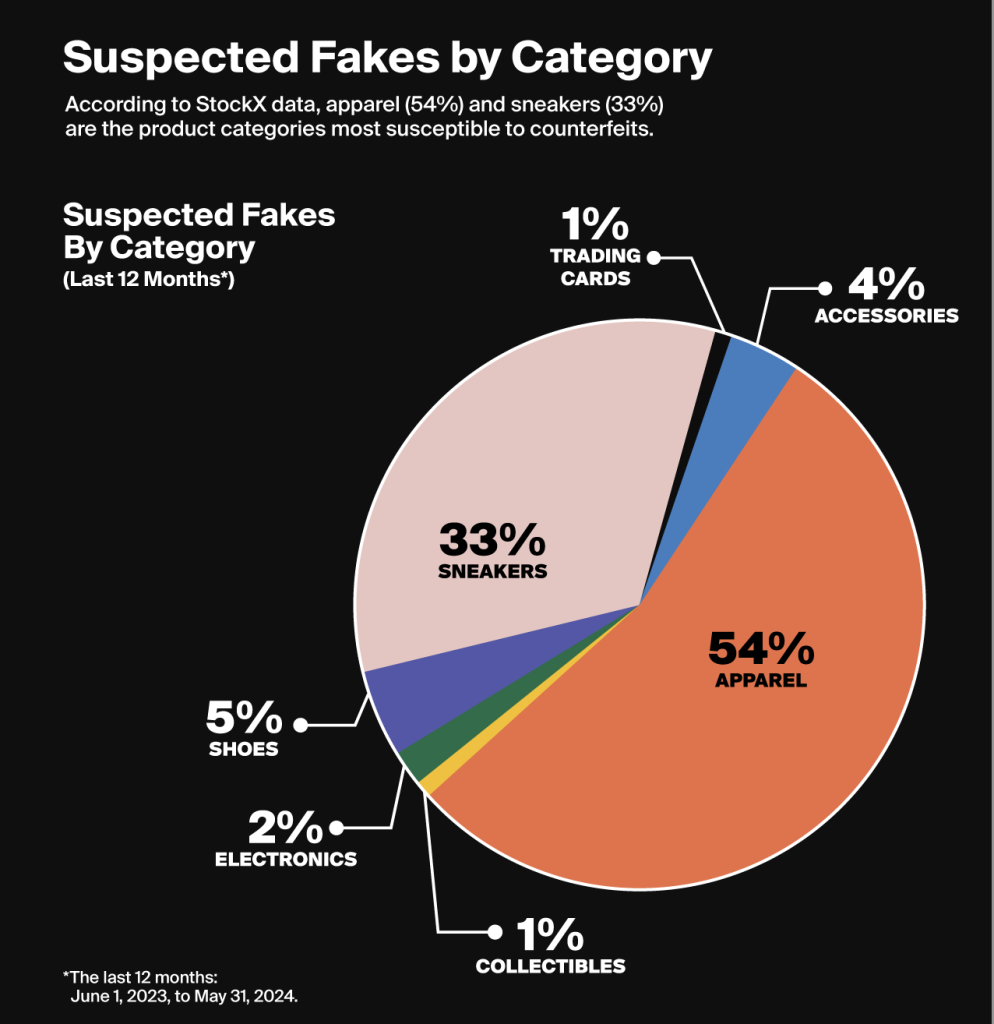

For the first time, StockX is offering in its 2024 report a breakdown of the product categories most susceptible to counterfeits. According to its data, apparel and sneakers top the list, with apparel accounting for 54 percent of suspected fake verification failures in the last year and sneakers accounting for 33 percent of suspected fake verification failures.

StockX also noted that its verification process goes beyond catching counterfeits, a point made clear by the quality control metrics in the 2024 report.

According to StockX data, the No. 1 reason its verification process rejects products is signs of previous wear (29 percent), with suspected fakes (19 percent) being the second most cited reason, consistent with StockX’s 2023 report, which found that fake products accounted for 20 percent of verification failures.

Top Fakes

The suspected fake products the StockX verification experts have seen most frequently in the last year include both high price-point items and more affordable options, which the company said proves that no product or brand is safe from counterfeiting.

In the Sneakers category, the No. 1 product was the Adidas Yeezy Boost 350 V2 Zebra, followed by the Adidas Campus 00s Core Black (No. 2) and the Jordan 4 Retro Black Cat (2020) (No. 3).

In Apparel, Fear of God hoodies dominated the category for the second year, with the Fear of God Essentials Hoodie Light Oatmeal taking the top spot. Classic and popular staples topped the list for handbags, including black colorways of the Jacquemus Le Grand Bambino and Telfar Shopping Bag Medium, as well as the Louis Vuitton Mini Bumbag Monogram.

Fake Accessories?

It wasn’t all footwear, apparel and bags that StockX flagged in its verification process. While it may be somewhat surprising to see a Stanley Tumbler on the list, perhaps it should not be given the cult status of the product the last year or two. The Stanley x Starbucks Quencher 40 oz Tumbler in Winter Pink was the No. 1 product flagged in Accessories. No.2 was the Supreme New Era Box Logo Beanie (FW22) in Black.

StockX said it has a robust network with verification centers that stretch across three continents — North America, Europe, and Asia — and hundreds of team members dedicated to this critical function. International markets are also a key source of platform growth. The business now operates across 5,000 different trade lanes, and in 2023 nearly half of all StockX trades were fulfilled by international sellers.

Images, data and charts courtesy StockX