Nordstrom, Inc. reported first quarter net sales increased 5.1 percent compared to the Q1 period in fiscal 2023, and total company comparable sales increased by 3.8 percent. Gross merchandise value (GMV) increased 4.9 percent. First-quarter net sales include a 75 basis point negative impact from the wind-down of Canadian operations.

During the quarter, Nordstrom banner net sales increased 0.6 percent, and comparable sales increased 1.8 percent. Net sales for Nordstrom Rack increased 13.8 percent and comparable sales increased 7.9 percent.

“The positive sales growth we saw across the company in the first quarter is very encouraging, and we’re particularly excited about the progress that our Rack banner is making,” said Erik Nordstrom, chief executive officer of Nordstrom, Inc. “While we’re pleased with our topline growth, profitability fell short of our expectations. Looking ahead, our strong sales performance gives us momentum heading into the rest of the year and the confidence to reaffirm our 2024 guidance.”

In the first quarter, active, women’s and kid’s apparel had strong double-digit growth versus 2023, and the beauty category increased by high-single-digits.

“We’re set up well going forward in regards to the health of our inventory, both in managing levels and providing compelling content with good sell-through,” said Pete Nordstrom, president of Nordstrom, Inc. “As we reflect on the legacy that our dad left behind, we’ve been reminded of his firmly held and consistent values—especially his commitment to serving our customers. Those values have been integral to Nordstrom’s growth, and they remain at the core of the decisions we make as a company. We want to thank our teams for bringing our values to life as we stay focused on our priorities for 2024.”

The retailer posted a first-quarter net loss of $39 million, or a loss of 24 cents per share, in the first quarter, compared to a net loss of $205 million, or a loss of $1.27 per diluted share, in Q1 last year.

As previously announced, on May 22, 2024, Nordstom’s Board of Directors declared a quarterly cash dividend of $0.19 per share, payable on June 19, 2024, to shareholders of record at the close of business on June 4, 2024.

First Quarter 2024 Summary

- Total company net sales increased 5.1 percent, and comparable sales increased 3.8 percent compared with the same period in fiscal 2023. GMV increased 4.9 percent. The wind-down of Canadian operations negatively impacted total company net sales of 75 basis points, as the first quarter of 2023 included one month of Canadian sales.

- Nordstrom banner net sales increased 0.6 percent, and comparable sales increased 1.8 percent compared with the same period in fiscal 2023. GMV increased 0.3 percent. The wind-down of Canadian operations negatively impacted Nordstrom’s banner net sales of 110 basis points.

- Nordstrom Rack banner net sales increased 13.8 percent and comparable sales increased 7.9 percent compared to the same period in fiscal 2023.

- Digital sales decreased 0.2 percent compared with the same period in fiscal 2023. Digital sales represented 34 percent of total sales during the quarter.

- Gross profit, as a percentage of net sales, of 31.6 percent, decreased 225 basis points compared with the same period in fiscal 2023. The strength in first-quarter sales reportedly drove strong gross profit and leverage, which were more than offset primarily by timing matters related to higher loyalty activity and reserves, as well as external theft in the company’s transportation network and inventory cleanup in the retailer’s supply chain as it consolidated facilities.

- Ending inventory decreased 6.3 percent compared with the same period in fiscal 2023 versus a 5.1 percent increase in sales.

- SG&A expenses, as a percentage of net sales, of 35.8 percent, decreased 20 basis points compared with the same period in fiscal 2023, primarily due to leverage on higher sales and improvements in variable costs in the supply chain and across the business, partially offset by higher labor costs.

- Loss before interest and taxes was $21 million in the first quarter of 2024, compared with a loss before interest and taxes of $259 million during the same period in fiscal 2023. Adjusted earnings before interest and taxes (EBIT) of $50 million in the first quarter of 2023 excluded one-time charges of $309 million related to the wind-down of Canadian operations.

- Interest expense, net of $27 million, decreased from $28 million during the same period in fiscal 2023.

- Income tax benefit was $9 million, or 17.5 percent of pretax loss, compared with income tax benefit of $82 million, or 28.6 percent of pretax loss, in the same period in fiscal 2023. The effective tax rate decreased in the first quarter of 2024, compared with the same period in fiscal 2023, primarily due to nonrecurring tax benefits related to the wind-down of Canadian operations in 2023. Excluding the impacts of the Canadian wind-down, the rate decrease was due to the impact of unfavorable stock-based compensation on pretax loss in 2024, compared with pretax earnings in 2023.

- The company ended the first quarter with $1.2 billion in available liquidity, including $428 million in cash. The company strengthened its financial position in April by retiring the $250 million notes due using cash-on-hand.

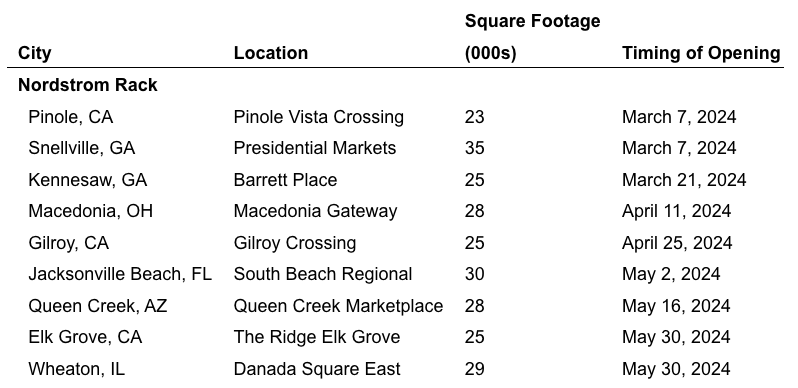

Stores Update

During and subsequent to the first quarter of 2024, the company opened nine stores:

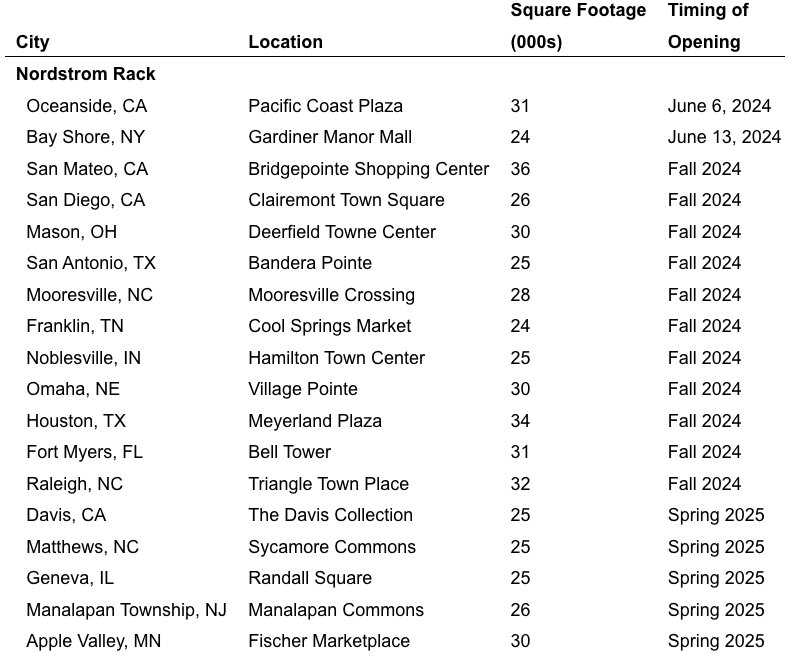

Nordstrom also announced plans to open the following stores:

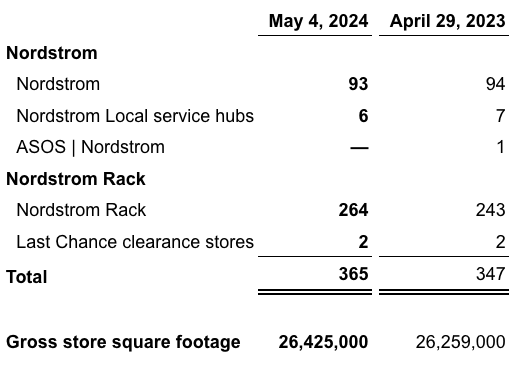

Nordstom had the following store counts as of quarter-end:

Fiscal Year 2024 Outlook

Nordstrom reaffirmed its financial outlook for fiscal 2024 as follows:

- Revenue range, including retail sales and credit card revenues, of 2.0 percent decline to 1.0 percent growth versus the 53-week fiscal 2023, which includes an approximately 135 basis point unfavorable impact from the 53rd week;

- Comparable sales range of 1.0 percent decline to 2.0 percent growth versus 52 weeks in fiscal 2023;

- EBIT margin of 3.5 to 4.0 percent of sales; and

- Income tax rate of approximately 27 percent.

Image courtesy Nordstrom