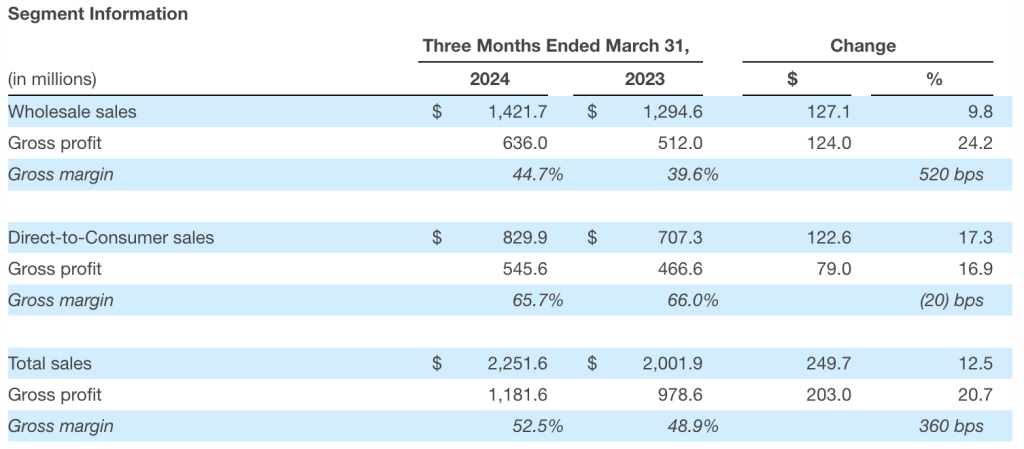

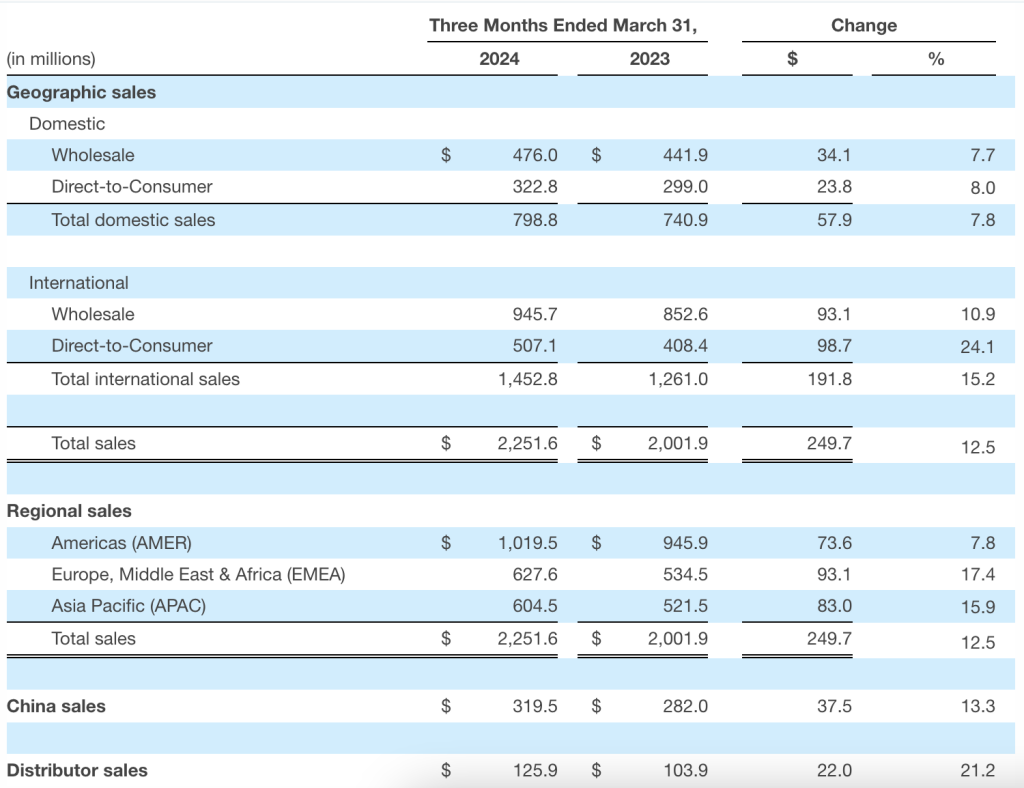

Skechers USA, Inc. reported that first quarter sales increased 12.5 percent (+13.4 percent constant-currency) to $2.25 billion, due to a 15.2 percent increase in the international business and a 7.8 percent increase domestically. Wholesale increased 9.8 percent and direct-to-consumer (DTC) increased 17.3 percent.

Wholesale sales grew 9.8 percent to $1.42 billion, including increases in EMEA of 11.5 percent, APAC of 15.3 percent, and AMER of 5.9 percent. Wholesale volume increased 9.9 percent and average selling price was flat.

DTC sales grew 17.3 percent to $829.8 million for the quarter, including increases in APAC of 16.5 percent, AMER of 10.5 percent, and EMEA of 62.4 percent. Direct-to-Consumer volume increased 15.5 percent and average selling price increased 1.6 percent.

Gross margin was 52.5 percent of net sales, an increase of 360 basis points, said to be primarily due to lower costs per unit, driven by lower freight costs and higher average selling prices.

Operating expenses increased $127.8 million, or 16.9 percent, and as a percentage of sales increased 150 basis points to 39.2 percent. Selling expenses increased $27.9 million, or 21.7 percent, and as a percentage of sales increased 50 basis points to 7.0 percent. The increase was due to higher demand creation expenditures. General and administrative expenses increased $99.9 million, or 15.9 percent, and as a percentage of sales increased 100 basis points to 32.3 percent. Increased expenses were primarily driven by increased labor and facility costs, including rent and depreciation.

Earnings from operations increased $75.2 million, or 33.6 percent, to $298.8 million, resulting in an operating margin of 13.3 percent.

Net earnings were $206.6 million, or $1.33 per diluted share, compared with prior year net earnings of $160.4 million and diluted earnings per share of $1.02.

In the first quarter, the Company’s effective income tax rate was 19.0 percent.

“Skechers continues to reach new milestones in expanding our global footprint. Achieving another sales record and exceptional earnings is a testament to the strength of our brand and our ability to meet consumers’ needs,” stated John Vandemore, CFO, Skechers USA. “We remain committed to our growth strategy, further expanding our global reach and helping shoppers around the world enjoy the comfort and value of our Skechers products, and we have continued confidence in our goal of achieving $10 billion in sales by 2026.”

Balance Sheet

Cash, cash equivalents and investments totaled $1.25 billion, a decrease of $134.0 million, or 9.7 percent from December 31, 2023, due to working capital changes as well as $60.0 million of share repurchases and capital expenditures of $57.1 million. Decreases were partially offset by increased earnings.

Inventory was $1.36 billion, a decrease of $164.8 million or 10.8 percent from December 31, 2023.

Share Repurchase

During the first quarter, the Company repurchased 1.0 million shares of its Class A common stock at a cost of $60.0 million. As of March 31, 2024, $205.7 million remained available under the Company’s share repurchase program.

Outlook

For the second quarter of 2024, the company believes it will achieve sales between $2.175 and $2.225 billion and diluted earnings per share of between 85 cents and 90 cents. Further, the company said it believes that for the fiscal year 2024, it will achieve sales between $8.725 and $8.875 billion and diluted earnings per share of between $3.95 and $4.10.

Image courtesy Skechers