Economic headwinds have impacted retail performance for most of 2023. Could Black Friday and the upcoming holiday season bring relief? Placer.ai dove into its data and, in a recent report, found answers to the question and identified opportunities for retailers.

A More Muted, But Extended Holiday Season

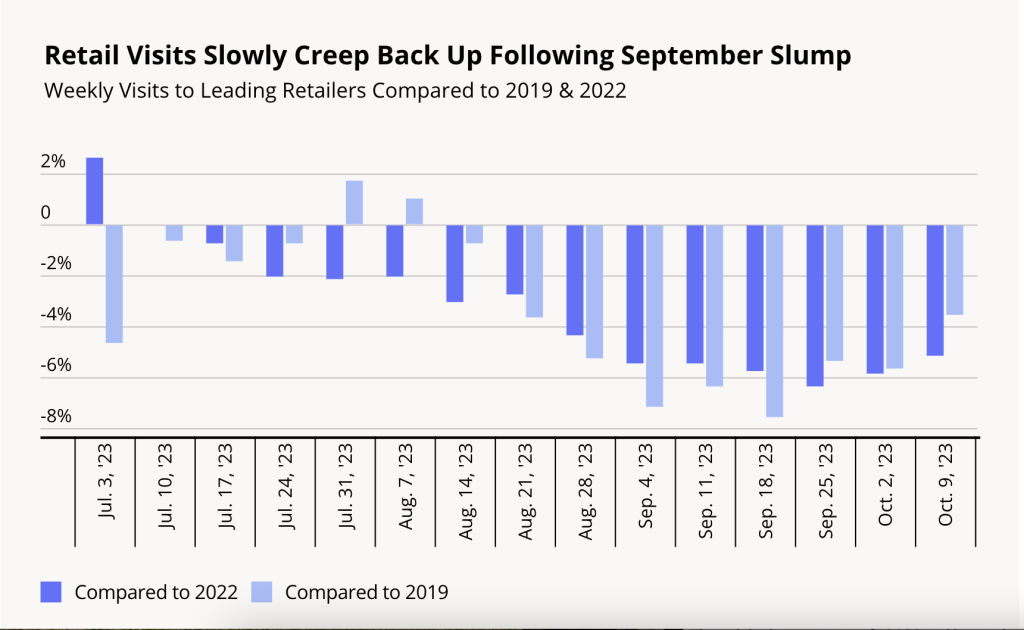

Ongoing inflation and high-interest rates resulting in tighter consumer budgets have kept retail visits below 2022 levels since late July, Placer.ai observed in its Black Friday report.

The research firm noted that visit gaps remained relatively small through August, when the back-to-school selling season gave families and students a reason to shop, but traffic fell in September after the season ended, a reality that SGB Media has seen mentioned as a trend by several retailers reporting their third-quarter results the past two weeks. Placer.ai said that while the year-over-year (YoY) visit gap had narrowed slightly since the beginning of October, perhaps thanks to early promotions, this year’s early holiday season appeared to be off to a slow start.

“Comparing 2023 retail visits to pre-pandemic 2019 numbers revealed the staying power of the extended holiday season that characterized 2021 and 2022,” Placer.ai said in a blog post. “The year-over-four year (Yo4Y) visit gap between mid-August to mid-September was wider than the YoY gap, perhaps due to the different macroeconomic environment in 2023 and 2019.”

The data firm went on to say that since the week of September 25, the Yo4Y visit gap had remained narrower than the YoY visit gap and speculated that it could be because this year’s consumers hae begun buying holiday gifts.

“Still, the impact of this year’s early holiday shopping was more muted than in 2022—so at least some consumers may be waiting for the deeper Black Friday discounts or the urgency of the approaching holidays to begin shelling out for gifts,” the post noted.

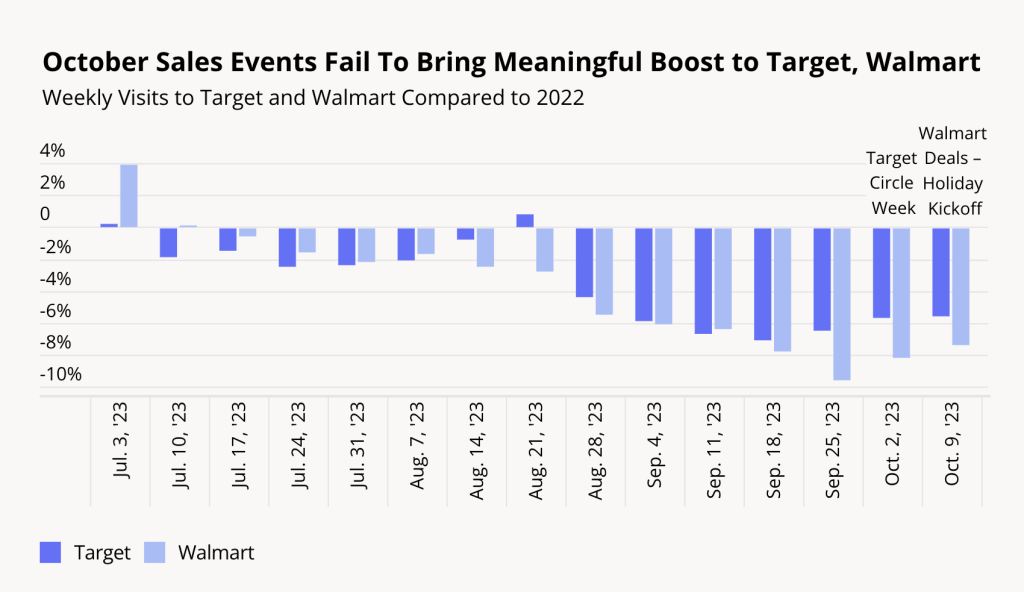

Placer.ai said the weaker extended holiday season in 2023 also comes through when analyzing foot traffic performance during Target and Walmart’s October sale days.

“Both chains launched promotional events intended to compete with Amazon’s Prime Day—Target Circle Week on October 1-7 and Walmart Deals Holiday Kickoff on October 9-12,” the report said. “Neither chain received a significant foot traffic boost from these promotions—though there were declines in visit gaps and the impact may have been more pronounced online—which also indicates that many consumers are potentially still holding off on major holiday shopping.”

How Are Key Categories Performing Ahead of Black Friday?

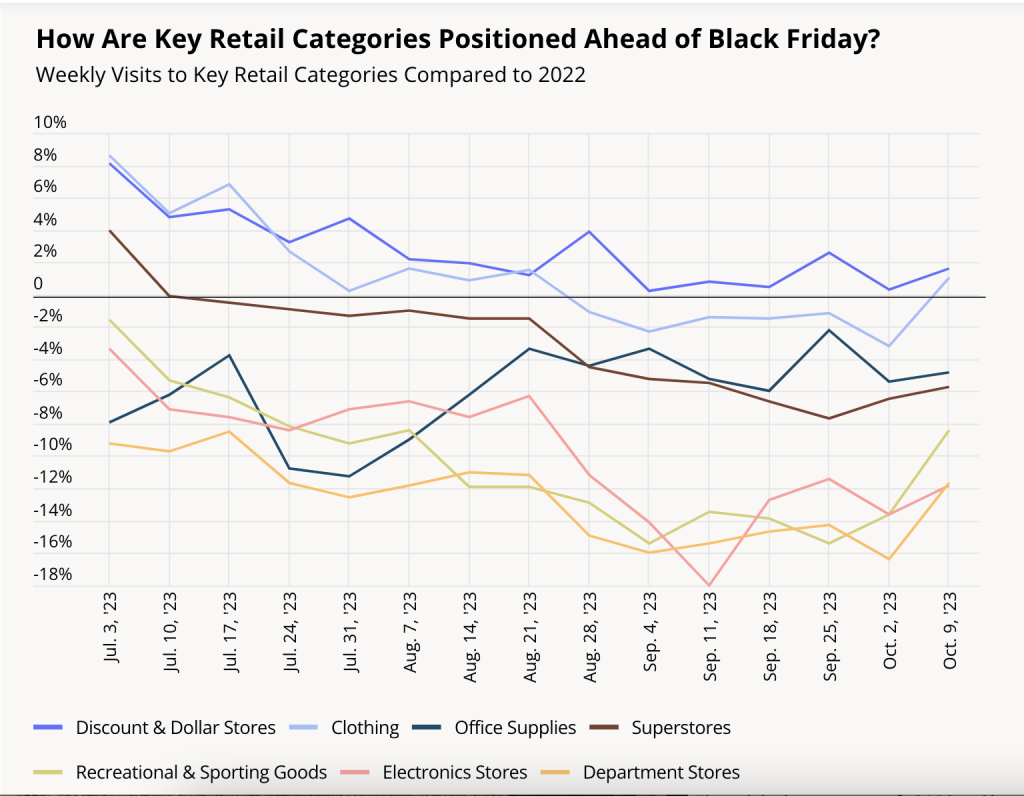

With holiday shopping underway, analyzing recent foot traffic numbers in key retail categories could reveal which will likely come out ahead in the fourth quarter.

Placer.ai said Discount and Dollar Stores have consistently outperformed other retailers through the summer and into the fall and are likely to continue drawing customers looking to save on essential and discretionary products.

“Clothing chains—boosted by the ongoing strength of off-price brands—have also stayed ahead of other sectors and may well see an influx of visits as the end of the year draws near, and shoppers look to purchase festive holiday attire,” Placer.ai said. “Superstores have also seen smaller YoY visit gaps than some other categories, although visits have slowed down in recent weeks.”

Meanwhile, the research firm noted that year-over-year visit gaps at Recreational & Sporting Goods chains, Electronics Stores and Department Stores had widened significantly since the end of August, but also noted that its recent data showed more promising, with all three categories seeing their visit gaps beginning to shrink.

“If this trend continues, a variety of categories may well receive a much-needed Black Friday boost,” said Placer.ai.

Unknowns Abound Ahead Of A Key Holiday Season

Early October foot traffic data compiled by Placer.ai does not offer much information about the fate of the holiday shopping season. Although the year-over-year visit gaps do appear to be shrinking— a sign that the retail space is moving in the right direction—the lack of significant traffic spikes during major retailer promotional events also indicates that most consumers have yet to get into the holiday spending spirit.

“The wider macroeconomic uncertainty—including the impact of the reinstatement of student loan payments—also makes it difficult to predict the upcoming months,” Placer.ai suggested. “Still, one thing does appear likely: consumers are remaining cautious, and retailers that want to benefit from the traditional holiday retail boost might need to get creative to convince shoppers to walk through their doors.”

For more data-driven retail insights from Placer.ai, go here.