S&P Global Ratings revised its outlook on Wolverine World Wide, Inc. due to the footwear company’s recent underperformance and challenging conditions forecasted.

The update follows the company’s recent amendment of its credit agreement. S&P said the amendment temporarily increases its maximum leverage covenant ratio to 4.875x from 4.5x for the next three quarters until the end of 2023.

S&P also said it expects tough industry headwinds to continue to pressure the company’s operating performance and expects Wolverine’s S&P Global Ratings-adjusted leverage to remain above 5x through the end of 2023 before improving to the high-4x area in 2024.

The outlook rating was reduced to negative from stable to reflect the potential for a lower rating if S&P Global Ratings-adjusted leverage sustained above 5x.

S&P affirmed its ratings on the company, including the ‘BB-‘ issuer credit rating, ‘BB’ issue-level rating on the senior secured credit facilities and ‘B+’ issue-level rating on the senior unsecured notes.

The negative outlook reflects the risk that S&P Global Ratings in the next few quarters could be lowered if Wolverine’s operating performance does not improve and a clear path to deleveraging below 5x is not in view.

S&P said in its analysis, “The outlook revision to negative reflects the company’s underperformance and our revised expectation for S&P Global Ratings-adjusted leverage to be above 5x by the end of 2023 before improving to the high-4x area in 2024.

“Wolverine’s operating performance continues to track below our prior expectations due to tough macroeconomic conditions, softness in the wholesale channel, and continued underperformance in its lifestyle group. S&P Global Ratings-adjusted leverage for the last twelve months ended April 1, 2023, was in the low-6x area, and free operating cash flow (FOCF) was negative. We expect ongoing demand pressures and continued softness in the wholesale channel for the balance of 2023 due to retailers continued caution in order patterns after the destocking in 2022. Therefore, we revised down our revenue and EBITDA forecast for 2023 and now expect revenue to decline by a low-single-digit percentage in 2023, excluding Keds, which was sold, and Wolverine Leathers, which is subject to a sale process. We expect EBITDA margins will continue to be under pressure in the first half of the year due to the sale of end-of-life inventory at low price points. However, we expect margins will gradually improve in the second half of the year. We believe lead time is improving but still has not come back to the pre-pandemic levels yet. We expect S&P Global Ratings-adjusted leverage will peak in the second quarter and improve in the second half of 2023 as Wolverine’s inventory levels normalize.

“In addition, the company recently amended its credit agreement to temporarily increase its maximum leverage covenant ratio to 4.875x from 4.5x till the end of 2023. The financial covenant threshold will revert to 4.5x starting the first quarter of 2024. We believe the covenant cushion would have been tight, around 10, if the company had not amended its covenant. The amendment gives the company more flexibility to manage through the back half of the year, and we estimate the cushion will be 30 for 2023 and 2024.

“We anticipate positive FOCF in excess of $100 million in 2023 due to improvement in the company’s working capital position.

“Wolverine’s inventory peaked in the third quarter last year at around $880 million. At the end of the first quarter, net inventory for the ongoing business declined nearly $20 million sequentially from end of 2022. We expect the company’s increased focus on inventory management to lead to positive FOCF generation of around $120 million in 2023, most of which we expect the company to direct towards debt repayment. Wolverine’s maintenance of a sizable dividend of about $33 million while credit metrics are elevated leaves less room for underperformance at the current rating. Furthermore, the company does not have a stated financial policy target and has used debt to fund share repurchases in the past.

“The company is exploring strategic alternatives for Sperry, which could potentially help improve its credit metrics.

“As part of the company’s strategy to reduce organizational complexity and prioritize brands with better growth and profitability prospects, it is exploring strategic alternatives for Sperry, which could include a sale, joint venture, or licensing opportunity. If the company is able to sell the business, we expect the company to use the proceeds to pay down debt, which could help it deleverage faster. However, current market conditions may be tough for the company to get the right valuation. Sperry’s revenue declined by a low-teens percentage year-over-year in the first quarter, and we expect revenue in the Lifestyle group, which includes Sperry and Hush Puppies, to decline by a high-single-digit percentage in 2023.

“The negative outlook reflects that we could lower our ratings in the next few quarters.”

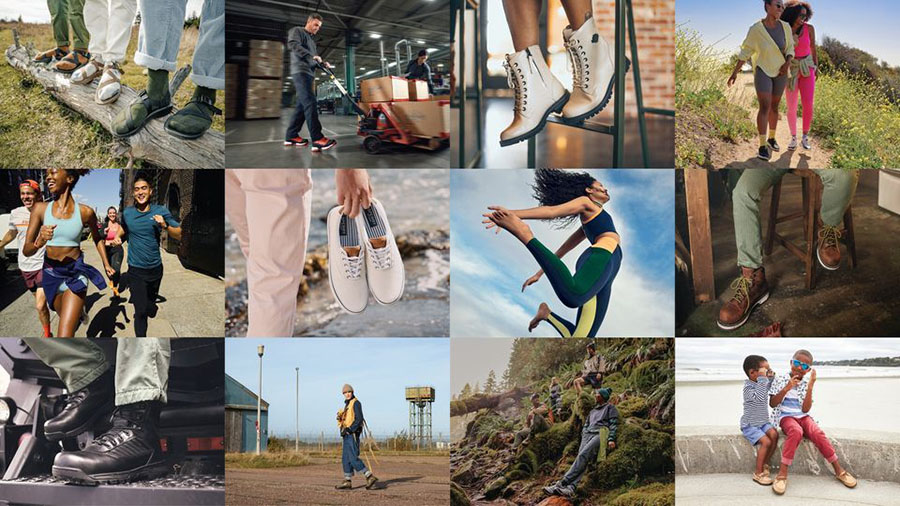

Photo courtesy WWW