The RealReal, which claims to be the world’s largest online marketplace for authenticated, resale luxury goods, reported total first quarter 2023 revenue was $142 million, a decrease of 3 percent compared to the comparable period in 2022. The Gross Merchandise Value, or GMV, was $444 million in the period, an increase of 4 percent compared to Q1 2022.

Top-line-related Metrics:

- Active buyers reached 1,014,000, an increase of 22 percent compared to the 2022 comp period;

- Orders reached 891,000, an increase of 1 percent compared to the comp period in 2022;

- Average order value (AOV) was $499, an increase of 2 percent compared to Q1 2022;

- Higher AOV was driven by a year-over-year increase in average selling prices (ASPs), partially offset by decreased units per transaction (UPT); and

- GMV from repeat buyers was 86 percent compared to 85 percent in the first quarter of 2022.

Gross Profit was $90 million, an increase of $11 million compared to the 2022 comp period. Gross margins came in at 63.4 percent of revenues in Q1, a 12.1 percentage point improvement versus the year-ago period.

The company reported a net loss of $82.5 million, or 83 cents a share in the quarter, including a restructuring charge of $36.4 million, compared to a loss of $57.4 million, or 61 cents a share in the year-ago quarter. The adjusted non-GAAP net loss attributable to common shareholders was 36 cents a share in Q1 compared to a loss of 47 cents a share in the prior-year period. The Wall Street consensus estimate was a loss of 40 cents a share.

Adjusted EBITDA loss was $27.3 million or negative 19.2 percent of total revenue in Q1, compared to an adjusted EBITDA loss $35.3 million, or negative 24.1) percent of total revenue, in the first quarter of 2022.

“During the first quarter of 2023, we made progress on our financial and operating results,” said John Koryl, CEO of The RealReal. “For the quarter, revenue exceeded the mid-point of our guidance, and Adjusted EBITDA exceeded the high-end of our guidance range. We believe our strategy of re-focusing efforts on the higher-margin consignment business is starting to deliver results. During the first quarter, consignment revenue grew 22 percent, and direct revenue declined 49 percent year-over-year. Additionally, we made progress on minimizing lower-value consigned items. As a result of these actions, we expanded our gross margin in the first quarter, and we were able to deliver a higher take rate, more gross profit dollars, and improved profitability.”

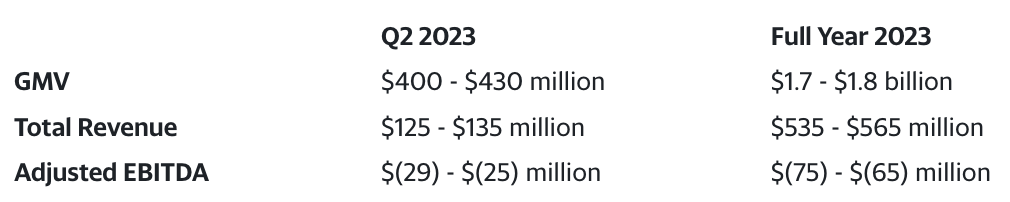

Based on market conditions as of May 9, 2023, REAL provided guidance for the second quarter and full year 2023 GMV, total revenue and Adjusted EBITDA, which is a Non-GAAP financial measure:

Photo courtesy The Real Real