Macy’s, Inc. reported fiscal fourth-quarter earnings and sales that outpaced analysts’ estimates and said that a strategic review has prompted the retailer to accelerate its turnaround plans.

Earnings per share of $2.45, on an adjusted, basis topped Wall Street’s consensus estimate of $2. Revenue of $8.67 billion was ahead of Wall Street’s consensus estimate of $8.47 billion. Macy’s comparable sales, on an owned-plus-licensed basis, were up 6.1 percent versus the company’s guidance calling for gains in the range of 2 percent and 4 percent.

“Our results in the fourth quarter delivered a strong end to a solid year. I am proud that Macy’s, Inc. outperformed expectations on both the top and bottom lines every quarter in 2021, despite COVID-19-related disruptions, supply chain issues, labor shortages, and elevated inflation,” said Jeff Gennette, chairman and chief executive officer, Macy’s, Inc. “Our business has momentum and is serving more customers at more touchpoints in their shopping journey.”

“Our team began the large-scale work of transforming Macy’s, Inc. two years ago when we launched the Polaris strategy, and today we believe the evidence is clear—our business is stronger, more agile and financially healthier. We are more digitally-led and customer-centric and believe we are better positioned for long-term sustainable and profitable growth,” Gennette continued. “Thanks to the hard work of our colleagues, successful execution of Polaris and the strategic allocation of our capital, we believe we are well-positioned to successfully navigate the macro-economic headwinds we expect in 2022.”

Fourth Quarter 2021 Highlights

In addition to prior-year comparisons, Macy’s, Inc. is providing comparisons to 2019 to benchmark its performance given the impact of the pandemic last year.

- Diluted earnings per share of $2.44 and Adjusted diluted earnings per share of $2.45 both exceeded expectations for the quarter.

- This compares to diluted earnings per share of $0.50 and Adjusted diluted earnings per share of $0.80 in the fourth quarter of 2020; and

- this compares to diluted earnings per share of $1.09 and Adjusted diluted earnings per share of $2.12 in the fourth quarter of 2019.

- This compares to diluted earnings per share of $0.50 and Adjusted diluted earnings per share of $0.80 in the fourth quarter of 2020; and

- Comparable sales up 28.3 percent on an owned basis and up 27.8 percent on an owned-plus-licensed basis versus the fourth quarter of 2020, up 6.6 percent and up 6.1 percent, respectively, versus the fourth quarter of 2019.

- Digital sales increased 12 percent versus the fourth quarter of 2020 and increased 36 percent versus the fourth quarter of 2019.

- Digital penetration was 39 percent of net sales, a 5 percentage point decline from the fourth quarter of 2020, but a 9 percentage point improvement over the fourth quarter of 2019.

- Digital penetration was 39 percent of net sales, a 5 percentage point decline from the fourth quarter of 2020, but a 9 percentage point improvement over the fourth quarter of 2019.

Highlights of the company’s nameplates include:

- Macy’s comparable sales were up 27.3 percent on an owned basis and up 26.5 percent on an owned plus licensed basis versus the fourth quarter of 2020 and up 5.9 percent and 5.2 percent, respectively, versus the fourth quarter of 2019.

- Approximately 7.2 million new customers shopped the Macy’s brand during the quarter, an 11 percent increase versus the fourth quarter of 2019. During the fourth quarter of 2021, 58 percent of new customers came through its digital channel.

- During the quarter, Macy’s Star Rewards program members made up approximately 66 percent of its total brand comparable owned plus licensed sales, up approximately 8 percentage points versus fourth quarter 2019.

- Platinum, Gold and Silver members in its Star Rewards Loyalty program continued to engage, with the average customer spend up 9 percent versus the fourth quarter of 2019.

- The Bronze segment of its Star Rewards Loyalty program, its youngest and most diverse loyalty tier, continued to grow with the addition of 3.5 million new members during the quarter.

- Categories that continued to see strong sales performance during the pandemic included home, fragrances, jewelry, watches, and sleepwear.

- For Macy’s omnichannel markets, more than 58 percent of the markets with stores saw omnichannel sales growth over the fourth quarter of 2019 levels, representing 80 percent of comparable owned plus licensed sales and with more than half growing 10 percent or more.

- Approximately 7.2 million new customers shopped the Macy’s brand during the quarter, an 11 percent increase versus the fourth quarter of 2019. During the fourth quarter of 2021, 58 percent of new customers came through its digital channel.

- Bloomingdale’s comparable sales on an owned basis were up 37.8 percent and on an owned plus licensed basis were up 37.6 percent versus the fourth quarter of 2020 and up 13.0 percent and 13.0 percent, respectively, versus the fourth quarter of 2019.

- Approximately 391,000 new customers shopped the Bloomingdale brand during the quarter, a 26 percent increase versus the fourth quarter of 2019, and spent 41 percent more.

- The company continued to see strong performance from luxury during the fourth quarter. Results were driven by strong sales of luxury handbags, fine jewelry, men’s shoes and contemporary, fragrances, and home.

- Approximately 391,000 new customers shopped the Bloomingdale brand during the quarter, a 26 percent increase versus the fourth quarter of 2019, and spent 41 percent more.

- Bluemercury comparable sales were up 30.9 percent on an owned and owned plus licensed basis versus the fourth quarter of 2020 and up 3.1 percent on an owned and owned plus licensed basis versus the fourth quarter of 2019.

- The activation and return of customers to stores, coupled with the continued growth in digital, drove its strong sales performance during the quarter.

- The activation and return of customers to stores, coupled with the continued growth in digital, drove its strong sales performance during the quarter.

- Gross margin for the quarter was 36.5 percent, up from 33.7 percent in the fourth quarter of 2020 and down 30 basis points from the fourth quarter of 2019.

- The improvement, as a result of merchandise margin, was largely due to benefits from pricing, promotion and inventory productivity enhanced by the Polaris strategy.

- Delivery expense as a percent of net sales increased 190 basis points from the fourth quarter of 2019, due to increased digital penetration and holiday delivery expense surcharges.

- The improvement, as a result of merchandise margin, was largely due to benefits from pricing, promotion and inventory productivity enhanced by the Polaris strategy.

- Selling, general and administrative (SG&A) expense of $2.4 billion, a $384 million increase from the fourth quarter of 2020, and an $80 million decline from the fourth quarter of 2019.

- SG&A expense, as a percent of sales, was 28.0 percent, an improvement of 220 basis points from the fourth quarter of 2020 and 210 basis points from the fourth quarter of 2019.

- The quarter benefited from strong expense leverage in conjunction with growing sales driven by disciplined expense management and improved productivity resulting from the company’s Polaris strategy, including the permanent cost savings realized in 2020.

- SG&A expense, as a percent of sales, was 28.0 percent, an improvement of 220 basis points from the fourth quarter of 2020 and 210 basis points from the fourth quarter of 2019.

- Net credit card revenue of $264 million, up $6 million from the fourth quarter of 2020, and up $25 million from the fourth quarter of 2019.

- Represented 3.0 percent of sales, 80 basis points lower than the fourth quarter of 2020 and 10 basis points higher than the fourth quarter of 2019.

- Performance continued to be driven by improved bad debt levels due to strong customer credit health.

- Represented 3.0 percent of sales, 80 basis points lower than the fourth quarter of 2020 and 10 basis points higher than the fourth quarter of 2019.

Full-Year 2021 Highlights

- Diluted earnings per share of $4.55 and Adjusted diluted earnings per share of $5.31 both exceeded expectations for the year.

- This compares to a diluted loss per share of $(12.68) and an Adjusted diluted loss per share of $(2.21) in 2020; and

- This compares to diluted earnings per share of $1.81 and Adjusted diluted earnings per share of $2.91 in 2019.

- This compares to a diluted loss per share of $(12.68) and an Adjusted diluted loss per share of $(2.21) in 2020; and

- Comparable sales up 43.0 percent on an owned basis and up 42.9 percent on an owned-plus-licensed basis versus 2020, up 3.1 percent and up 3.0 percent, respectively, versus 2019.

- Macy’s brand active customer count increased 18 percent over 2020 and 1 percent over 2019 to 44 million.

- For the full year, after eliminating repeat visits between quarters, Macy’s new customers increased 40 percent over 2020 and 26 percent over 2019 to 19.4 million.

- For the full year, after eliminating repeat visits between quarters, Macy’s new customers increased 40 percent over 2020 and 26 percent over 2019 to 19.4 million.

- Digital sales increased 13 percent versus 2020 and increased 39 percent versus 2019.

- Digital penetration was 35 percent of net sales, a 9-percentage point decline from 2020, but a 10-percentage point improvement over 2019.

- Digital penetration was 35 percent of net sales, a 9-percentage point decline from 2020, but a 10-percentage point improvement over 2019.

- Gross margin for the year was 38.9 percent, up from 29.2 percent in 2020 and up 70 basis points from 2019.

- Improvement, as a result of merchandise margin, was largely due to benefits from pricing, promotion and inventory productivity enhanced by the Polaris strategy.

- Delivery expense, as a percent of net sales, increased 200 basis points from 2019, due to increased digital penetration.

- Improvement, as a result of merchandise margin, was largely due to benefits from pricing, promotion and inventory productivity enhanced by the Polaris strategy.

- Inventory turnover for the year increased 21 percent over 2020 and 22 percent over 2019.

- Inventory was up 16 percent from 2020 and down 16 percent versus 2019.

- Inventory productivity was driven by further evolving and scaling our data science and maintaining disciplined buying behavior.

- Inventory was up 16 percent from 2020 and down 16 percent versus 2019.

- SG&A expense of $8.0 billion, a $1.3 billion increase from 2020, and a $951 million decline from 2019.

- SG&A expense, as a percent of sales, was 32.9 percent, an improvement of 610 basis points from 2020 and 370 basis points from 2019.

- The year benefited from strong expense leverage driven by disciplined expense management, improved productivity resulting from the company’s Polaris strategy, including the permanent cost savings realized in 2020, and the number of open job positions during the year.

- SG&A expense, as a percent of sales, was 32.9 percent, an improvement of 610 basis points from 2020 and 370 basis points from 2019.

- Net credit card revenue of $832 million, up $81 million from 2020 and up $61 million from 2019.

- Represented 3.4 percent of sales, 90 basis points lower than 2020, and 30 basis points higher than 2019.

- Performance-driven by improved bad debt levels from strong customer credit health.

- Represented 3.4 percent of sales, 90 basis points lower than 2020, and 30 basis points higher than 2019.

Enhancing Shareholder Value

“We generated $2.3 billion in free cash flow this year—a significant amount that allowed us to return capital to shareholders through our measured capital allocation plan while meaningfully improving the health of our balance sheet,” said Adrian Mitchell, chief financial officer, Macy’s, Inc. “The strength of our financial position offers the flexibility in 2022 to continue investing in growth opportunities, navigate the dynamic macro environment with agility, and further deliver on our commitment to enhancing shareholder value.”

During 2021, Macy’s, Inc.’s strong performance allowed it to take significant actions to strengthen its financial position and return capital to shareholders. And today, coupling 2021 performance with the long-term outlook, the company is announcing further actions to enhance shareholder value:

- The company voluntarily retired debt early in 2021, driving its year-end Adjusted Debt-to-Adjusted EBITDAR leverage ratio well below the company’s 2021 target of no more than 2.5x.

- The company reinstated its regular quarterly dividend in 2021 and, today, reported its board of directors declared a regular quarterly dividend of 15.75 cents per share on Macy’s, Inc.’s common stock, an increase of approximately 5 percent. The dividend is payable on April 1, 2022 to shareholders of record at the close of business on March 15, 2022.

- The company successfully completed its $500 million share repurchase program in the fourth quarter of 2021, and in total repurchased approximately 20.5 million shares during the year. The company’s board of directors has authorized a new, open-ended $2 billion share repurchase program.

Results of Comprehensive Business Review

The company’s Board of Directors, with the assistance of independent financial, legal and third-party advisors and the company’s management team, completed a lengthy comprehensive review of the company’s e-commerce and brick-and-mortar operations to consider the best path forward for Macy’s, Inc. to enhance value for shareholders. The review included the evaluation of a variety of alternatives for the company’s e-commerce business. Ultimately, based on the work completed, its Board determined that an integrated, omnichannel Macy’s, Inc. with an acceleration of certain Polaris initiatives, will deliver greater value to its shareholders than a separation of digital and physical assets at either the enterprise or brand levels. Key to the Board’s decision was the high separation costs and ongoing costs from operating separated businesses and the high execution risk for the business and the company’s customers. As a result of the review, the company is accelerating Polaris initiatives that span digital, brand partners, private label, marketing and loyalty, and the expansion of off-mall, small-format Market by Macy’s and Bloomie stores.

“We are more confident in our path forward as one integrated company. The Board’s review reaffirmed our conviction that we are pursuing a robust strategy, and it provided us with greater clarity on several initiatives that could be further accelerated to unlock additional value for our shareholders, which we are pursuing,” said Gennette. “Our team will continue our work to deliver an even bolder and brighter future for Macy’s, Inc. and all its stakeholders, including our shareholders, our colleagues and our customers.”

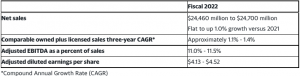

2022 Guidance

Macy’s, Inc. anticipates positive momentum in 2022 supported by the Polaris initiatives and strong consumer demand. At the same time, the company expects macro environment challenges, such as inflation, supply chain pressures, labor shortages, and potential COVID-19 variants. The company’s annual guidance reflects a measured plan based on these assumptions.

Photo and chart courtesy Macy’s