Foot Locker had a strong second quarter as sales increased slightly and the retailer swung to a net profit after a year-ago loss with help from a leap in gross margins. Even more promising was a 3.5% decline in inventory at quarter-end versus the same time last year. The sales increase was boosted approximately 2% to 3% by the effects of currency exchange rates.

On a conference call with analysts, CEO Matt Serra commented that “August is off to a good start. The U.S. is about even, as of today. We expect it to be ahead by Sunday, after this weekend’s launch. There is a big Jordan package and a Pippin package, and some strong Air Force One programs this weekend.” The Internet business was also said to be strong for the third quarter-to-date.

By month, Q2 comp store sales increased very low-single-digits in May and June and decreased low- to mid-single-digits in July. Management said that sales by week were very uneven, fluctuating in line with the level of last year’s promotional activity when FL was aggressively liquidating slower selling goods, especially in late June and July.

Second-quarter comparable store sales for the companys combined U.S. store operations increased low-single-digits with a “meaningful profit increase.” Compared to the second quarter of last year, footwear sales increased in the mid-single-digits, while apparel sales continued on a negative trend. Sales in both the men’s and kid’s footwear businesses increased mid-single-digits, while women’s sales decreased mid-single-digits. Compared to the second quarter of 2006, since the 2007 quarter was adversely affected by liquidation sales, average selling price for footwear was up approximately 10% with units relatively flat on a comp store basis.

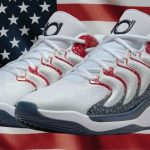

Men’s basketball and running shoes sales in the higher-priced marquee styles remain the highlight though sales in the lower-priced canvas category – led by various Converse Chuck Taylor assortments – as well as various assortments of sandals, also remained very strong. Marquee footwear now accounts for “well over 33%” of FLs footwear sales with margins that are “very rich.” The launch of Kobes Hyperdunk in August was described as a “barn burner.”

U.S. apparel sales continue to be weak across most categories, but TapouT and MMA as a whole were called out as big opportunities. “This mixed martial arts apparel is a very hot category,” said Serra. “We have exclusively in the mall TapouT, which is a very fast growing business. It started at Champs almost a year ago… It is now in Foot Locker and it’s being rolled out I believe to all the Foot Locker doors.”

The company also recently added Under Armour apparel to the mix, which is planned to expand to 800 stores by the end of the year. Track suits were said to be coming back, but the retailer is implementing a program to get out of the promotional T-shirts that worked extremely well for about six or seven years. As a result, average unit retail was up significantly in apparel this year versus last year.

The international business was mixed with strong results at the Asia-Pacific and Canadian divisions, but the business in Europe remained challenging. Asia-Pacific saw a high-single-digit comp store sales increase and division profit above plan, while Canada saw a mid-single-digit comp store sales gain and a double-digit division profit increase.

In Europe, footwear generated solid gains in higher-priced technical running footwear in the men’s segment, but was impacted negatively by weak sales in the men’s and women’s fashion categories.

The apparel and accessories business in Europe showed signs of improvement with second-quarter sales nearly flat with last year on solid gains in men’s branded outerwear, hats, and bags.

Sales at FootLocker.com/East Bay increased 10%, while division profit increased 33%.

For the first half, FL opened 40 new stores and remodeled or relocated 162. The company closed 97 stores during the first half of the year, of which 17 stores were part of a program initiated last year to accelerate the closing of unproductive stores.

For the full year, net income – excluding the 10 cents per share impairment charge recorded during the first fiscal quarter-will be in a range of 70 cents to 85 cents per share. In addition, management expects to reduce year-end inventory levels by approximately $100 million compared to the year-ago date on a constant-currency basis, resulting in a 5% reduction in inventory per square foot.

Foot Locker focused its fall purchasing on unique, exclusive, and limited distribution marquee footwear with planned reductions in styles in other categories that are currently out to fashion. In addition, management said they have a meaningful opportunity to rebuild the branded apparel business with both existing suppliers, Nike and Adidas, while expanding recently tested apparel from Under Armour, TapouT and other emerging brands.