Xponential Fitness reported sales in the second quarter ended June 30 rose 67 percent to $35.8 million. The increase included a corresponding system-wide same-store sales increase of 129 percent year-over-year.

The second-quarter net loss was $8.0 million, compared to a loss of $4.8 million in the prior-year period. Net loss in the second quarter of 2021 was positively impacted by a one-time $3.7 million forgiveness of a Payment Protection Program (PPP) loan.

On a per-share basis for the second quarter, net loss totaled 33 cents per diluted share on a pro forma basis based on a share count of 21,694,000 shares.

Adjusted EBITDA, is defined as net income before interest, taxes, depreciation, and amortization, adjusted for equity-based compensation, acquisition and transaction expenses, management fees, litigation expenses, and a change in fair value of contingencies, increased significantly to $8.3 million, up from a loss of $3.1 million in the prior-year period.

Q2 2021 Operating Highlights

- Opened 59 new studios. Nearly 100 percent of the 1,824 North American studios were open and operational during the quarter.

- Sold 197 North American franchise licenses, compared to 46 in Q2 2020.

- Increased total North American studio count to 1,824 at June 30, up from 1,765 total studios at March 31.

- Reported fourth consecutive quarter of sequential system-wide sales improvement represented consistent system recovery since the second quarter of 2020.

- Recovery of nearly 90 percent run-rate AUVs4 compared to January 31, 2020, placing the company on track to reach pre-pandemic run-rate AUVs by early 2022.

“I’m extremely pleased with our second quarter 2021 financial results,” said Anthony Geisler, CEO, Xponential Fitness, Inc. “As is evident from our solid year-over-year revenue growth and the sale of 197 North American franchisee licenses in Q2, our business has rapidly rebounded to pre-pandemic levels and, importantly, as of today’s date, is showing no signs of slowing down in the third quarter. When comparing the end of the second quarter of 2021 to January 31, 2020, even without considering our newest brand, Rumble, our business had recovered to 103 percent of actively paying members, 98 percent of total visits and nearly 90 percent run-rate AUV. Thus far in Q3, this positive trajectory has continued. In July, we recorded our highest-ever monthly system-wide sales, and our August results to date remain solid. So far in August, compared to the end of Q2, we’ve seen an increase in our total memberships and our actively paying members, overall and at a per studio level.”

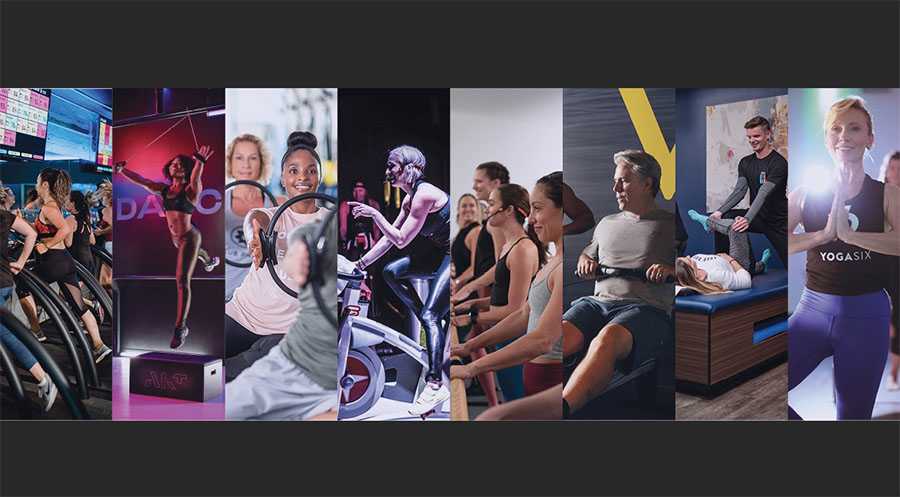

Geisler continued, “Since Xponential Fitness’ founding in 2017, our mission has been to make boutique fitness accessible to everyone. Today, we are the largest boutique fitness franchisor in the United States and have over 1,850 studios operating globally across nine leading boutique fitness brands. In July, we reached an important milestone in our history by completing our IPO, which positions us well to continue successfully executing our mission and differentiated business strategy for years to come. Looking ahead, we are confident in our ability to continue expanding our market share in the large and growing boutique fitness industry as we unlock the incredible power of the Xponential platform.”

Liquidity and Capital Resources

- As of June 30, 2021, the company had approximately $20.2 million of cash and cash equivalents and $206.8 million in total debt. Net cash provided by operating activities was $0.8 million during the second quarter of 2021.

- In June, the company was notified that it received forgiveness for a PPP loan in April 2020 as part of the Coronavirus Aid, Relief and Economic Security Act. Including accrued interest, this PPP loan forgiveness resulted in a gain on debt extinguishment of $3.7 million for the six months ended June 30, 2021.

Initial Public Offering

- In July 2021, the company sold 10.0 million shares of its common stock in its initial public offering and received net proceeds of $120 million. Xponential also raised $200 million through the sale of convertible preferred stock. In addition to the payment of transaction fees related to the IPO and the convertible preferred stock, the proceeds from the IPO and convertible preferred were used to pay down $116.1 million of the Company’s Term Loan, which includes a prepayment penalty and interest aggregating $1.1 million, reducing the Company’s commitments for payment of debt principal to $96.5 million.

- In August 2021, the company sold 904,000 shares of Class A common stock to the underwriters of its initial public offering according to the underwriter’s option to purchase additional shares. After underwriter discounts and commissions, net proceeds of approximately $10.1 million were received on August 24, 2021. Xponential intends to use $9.0 million of such net proceeds to purchase 750,000 LLC Units from the company’s CEOOfficer and the remaining proceeds will be used for working capital.

2021 Outlook

Based on current business conditions and future expectations as of this release, the company is initiating its outlook for the full fiscal year ending December 31, 2021. It anticipates the following:

- Studio openings in the range of 215 to 235;

- North America system-wide sales in the range of $690 million to $700 million, or an increase of 57 percent at the midpoint as compared to full-year 2020;

- Revenue in the range of $135.5 million to $137.0 million, or an increase of 28 percent at the midpoint as compared to full-year 2020; and

- Adjusted EBITDA in the range of $22.0 million to $23.0 million, or an increase of 129 percent at the midpoint as compared to full-year 2020.

Photo courtesy Xponential Fitness