Puma AG continues to see a downturn in the U.S.  business affect its overall plans for achieving the goals set forth in its Phase IV initiative, while other regions continue to see more positive results at least in apparel and accessories. Marketing commitments for a year heavy in key sporting events are expected to have an impact on the bottom line for the year, but those events also likely fueled much of the apparel gains.

business affect its overall plans for achieving the goals set forth in its Phase IV initiative, while other regions continue to see more positive results at least in apparel and accessories. Marketing commitments for a year heavy in key sporting events are expected to have an impact on the bottom line for the year, but those events also likely fueled much of the apparel gains.

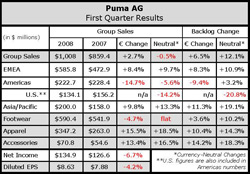

Puma reported that first quarter consolidated sales grew 2.7% to 673.3 million from 655.8 million in Q1 2007, representing a growth rate of 6.6% in currency-neutral terms. Sales in Footwear were down 4.7% (flat c-n) to 394.2 million from 413.5 million in the year-ago period, while Apparel sales increased 15.5% (+18.5% c-n) to 231.8 million from 200.7 million last year and Accessories sales improved 13.4% (+16.5% c-n) to 47.3 million from 41.7 million in the prior-year quarter. PUMAs worldwide branded sales, which include consolidated and license sales, also declined 2.7% (+0.5% c-n) to 741.2 million ($1.11 bn).

The company has stopped reporting owned-retail figures so it is impossible to determine the effect — positive or negative — on the overall numbers.

The EMEA region, which includes Europe, the Middle East, and Africa, saw revenues increase 8.4% to 391.1 million. The currency-neutral sales gain was pegged at 9.7% for the period. EMEA increased its overall contribution to 58.1% of total sales in Q1, compared to 55.0% in the year-ago period, driven in part by the expectations surrounding the Euro 2008 Championships, but also due to the sharp declines in the U.S. business. The sales growth was accompanied by improved margins as well, which rose 100 basis points to 54.7% of sales for the period. The futures look fairly brought here as well, with order backlog for the region up 8.3% at quarter-end to 644.3 million ($1.02 bn), or a 10.9% increase in currency-neutral terms.

The Americas posted a 14.7% sales decline for the quarter to 148.7 million, or down 5.6% when accounting for fluctuations in currency. The Americas region accounted for 22.1% of sales in Q1, compared to 26.6% of sales in the year-ago period.

However, gross margins again improved, expanding 70 basis points to 50.4% of sales. Order backlog at quarter-end was down 9.4% to 236 million ($373 mm), but rose 3.2% in currency-neutral terms.

First quarter sales in the U.S. fell 14.1% when measured in U.S. dollars, coming in at $134.1 million versus $156.2 million for the year-ago quarter, and the order backlog at quarter-end declined 20.8% on top of a 17.6% decline in the prior-year period. Company Chairman and CEO Jochen Zeitz intimated that the business “looks quite okay” excluding the two largest mall players in the mix, and in some areas would actually see some light at the end of the tunnel. He sees the issue in the mall related to a consumer shift to vulcanized footwear and visible technology product in those retailers.

Asia/Pacific region revenues jumped 9.8% (+13.3% c-n) to 133.5 million for the Q1, thanks in large part to the consolidation of the South Korea distributor into the numbers. That move had a reverse effect on worldwide licensed numbers, which declined 35.6% currency-neutral for the quarter. The total region accounts for 19.8% of sales versus 18.4% last year. Gross profit margin was up 160 basis points to 53.0% of sales. The order book at the end of the quarter was up 19.4% to 289.7 million ($458 mm), or a 23.7% increase when accounting for currency.

Total futures backlog was up 6.5% at quarter-end to 1.17 billion ($1.85 bn), but showed a 12.1% increase on a currency-adjusted basis. Footwear backlog rose 3.6% (+10.2% c-n) to 677.9 million ($1.07 bn), while Apparel was up 10.4% (+14.3% c-n) to 418.2 million ($661 mm), and Accessories jumped 14.2% (+18.3% c-n) to 74.3 million ($117 mm).

Puma management reaffirmed sales growth in the low-single-digits for the full year, but was unable to project earnings for the period as the company is committed to initiatives surrounding the Euro 2008 Championships and the Olympics that “could affect 2008s EBIT margin.”

>>> Continued robust growth in the U.S. was a major element in the Phase IV plans. Ni news of any adjustment to those goals