GBG USA Inc., a subsidiary of Global Brands Group Holding Ltd., filed for Chapter 11 bankruptcy protection in New York Thursday. It will use Chapter 11 to auction its U.S. assets, including the Aquatalia brand, according to a regulatory disclosure.

The Group’s Global Brand Management and Europe wholesale businesses are separate legal entities from GBG USA, not included in this filing, and continue to maintain ongoing operations.

In conjunction with the filing, GBG USA said in a press release that it “has entered into an asset purchase agreement (APA) with WH AQ Holdings LLC (as purchaser) and Hilco Brands LLC (as guarantor), pursuant to which both will serve as the stalking horse bidder in a court-supervised sale process for GBG USA’s Aquatalia brand and business. The stalking horse bid provides a purchase price of $17.3 million and the APA is subject to higher or otherwise better offers, among other conditions.”

GBG USA is also pursuing the sale of a substantial portion of its remaining assets, including Ely & Walker, Airband, MagnaReady, Yarrow, b New York and Juniperunltd, in accordance with Section 363 of the U.S. Bankruptcy Code and court-approved bidding procedures.

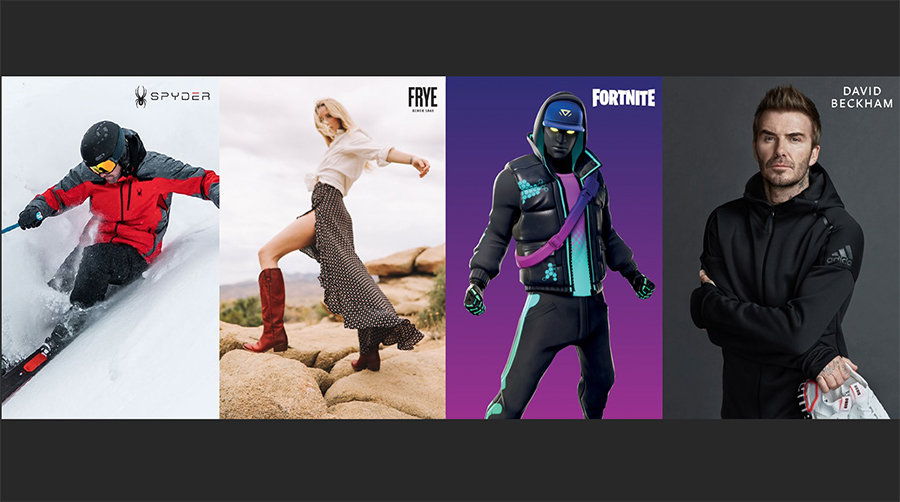

These actions follow the recent sale of the Group’s South Korean Spyder business to Alpha Vista Investment Co., Ltd., the sale of Spyder USA’s inventory and related assets to Liberated-Spyder LLC, and the sale of Frye’s inventory and related assets to ABG Frye LLC.

“Over the past eighteen months, the retail landscape has been greatly impacted by COVID-19, creating hardships for us and many others across our industry. Our business has also been impacted by ongoing structural shifts in the retail industry, as well as persistent geopolitical tensions that have disrupted supply chains. These factors have been especially detrimental to GBG USA,” said Rick Darling, CEO, Global Brands Group. “We have taken significant steps over the last year to strengthen GBG USA’s financial position while also conducting a thorough review of all strategic options for GBG USA and its brands. This process resulted in the successful sales of our South Korean Spyder retail operation, the inventory and related assets for two of our brands, Spyder and Frye, and an APA for our Aquatalia brand and business. As for GBG USA’s remaining assets, we determined that a Court-supervised process to facilitate a sale is the best course of action to maximize value for all stakeholders and address the financial position of GBG USA and the Group in a fair and transparent manner. GBG USA has compelling brands and products and a highly talented team, and we believe this process represents the best opportunity for GBG USA’s employees and business.”

Darling continued, “The U.S. proceedings do not involve the Group’s separate European wholesale and Brand Management businesses, which are continuing to maintain ongoing operations. We have taken and continue to take measures to help improve performance, reduce the cost base and improve the working capital of the European wholesale business. The Brand Management business remains robust and profitable. I am extremely grateful to our employees across the globe who have demonstrated agility and dedication while continuing to serve our customers and supply chain partners in this period of uncertainty.”

The recent sales of Spyder and Frye’s inventory and related assets provided GBG USA with cash collateral to meet its immediate liquidity needs. This has also reduced the need for supplemental debtor-in-possession (“DIP”) financing for the Chapter 11 process. GBG USA has further received $16 million in DIP financing from ReStore Capital, LLC to support its additional liquidity needs during the Chapter 11 cases. The DIP facility, coupled with the consensual use of cash collateral, should provide GBG USA with sufficient funding to implement its sale strategy in an orderly manner and to maximize value for all stakeholders.

GBG USA has also filed customary motions with the Court seeking authorization to support its operations, including the authority to continue payment of employee wages and maintain healthcare benefits and other relief measures customary in these circumstances.

The bankruptcy case was filed in the U.S. Bankruptcy Court for the Southern District of New York under case number: 1:21-bk-11369.

Photo courtesy GBG USA Inc.