Collectable announced it is raising an additional $5.5 million as part of a Series A funding round led by Amplo, Bain Capital Ventures and Fifth Down Capital. Other investors include Rose Park Advisors, Evolution VC Partners, Anthony and Joseph Pompliano, Colin Anderson, Friends and Family Capital, former CFO of Palantir, and Jeff Pearlman, partner, LNK Partners.

The funds will go towards expanding the platform’s user base, supporting product expansion, marketplace data and analytics, content creation, and various marketing initiatives. The valuation is not being disclosed.

“Since we launched last year, we’ve been thrilled to see the response from sports fans, investors and collectors. Through our category focus and deep relationships, we’ve been able to offer unrivaled quality and quantity of iconic, blue-chip sports collectibles to the fractional community,” said Collectable CEO and Co-founder Ezra Levine.

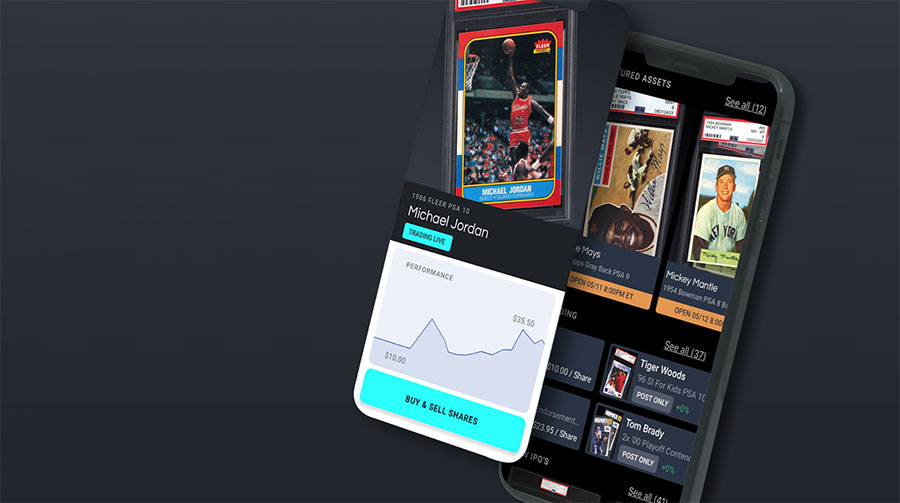

Collectable is a “fractionalized ownership platform dedicated to sports memorabilia. Since its launch in September 2020, Collectable has attracted well over 35,000 users while completing nearly 100 sports collectible asset IPO’s. The company released its first Collectable Index, showing investors have received over a 40 percent return since launch had they invested $100 in each offering equally,” said the brand.

Photo courtesy Collectable