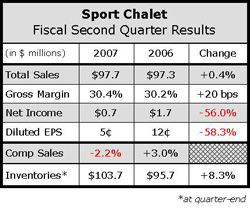

Sport Chalet saw some difficult conditions during their  fiscal second quarter, which ended on September 30, 2007. Sales during the quarter were negatively impacted by softer macroeconomic trends and management said that same-store sales were affected by cannibalization from new stores and competitors' new store openings. While overall sales were soft for the quarter, the retailer did see stronger results from men's apparel and skate lifestyle branded apparel.

fiscal second quarter, which ended on September 30, 2007. Sales during the quarter were negatively impacted by softer macroeconomic trends and management said that same-store sales were affected by cannibalization from new stores and competitors' new store openings. While overall sales were soft for the quarter, the retailer did see stronger results from men's apparel and skate lifestyle branded apparel.

The biggest concern for management is in the snow sports category. During a conference call with analysts, Sport Chalet CEO Craig Levra said, “We're trying to apply as much science to the winter business as we possibly can. We've consulted actively with Dr. Bill Patzert who's the leading climatologist at JPL here in La Canada about short-term and long-term predictions for the weather. We've worked very hard with leveraging all of our technology and systems.”

While a second warm winter is clearly a concern, management pointed out that the company has been able to diversify and become less winter dependent. Winter business for Sport Chalet previously represented 35% of total sales but today, it is 17% and decreasing. Management said that this number is not decreasing because the category is shrinking, rather its other businesses are growing more rapidly.

Gross profit in the second quarter was impacted by increased rent as a percentage of sales in newer stores, as well as increased promotional activity in the second quarter. SG&A improved 30 basis points down to 28.8% of sales for the second quarter compared to 29.1% last year. The improvement resulted from reduced overhead costs.

Looking ahead, management expects the soft consumer trends to continue. In addition, the fires in Southern California caused “a significant decline in store traffic during October at six stores.” Levra said that Sport Chalet operated with reduced staff levels for several days due to road closures, poor air quality due to smoke, and employees who were personally impacted by the fires.

In spite of this set-back, the company is on track to open three additional stores, including two more stores in Arizona and another in Las Vegas, NV. At year-end SPCH will have 52 stores in four states and 71% of its store base will be new or newly remodeled.

Management is taking a cautious approach for the remainder of the fiscal year. SPCH expects full fiscal year sales to increase “only moderately” over fiscal 2007 and comp store sales to be flat to slightly below the prior fiscal year. Net income is expected to be lower than last year as sales growth from new stores is offset by increased costs.